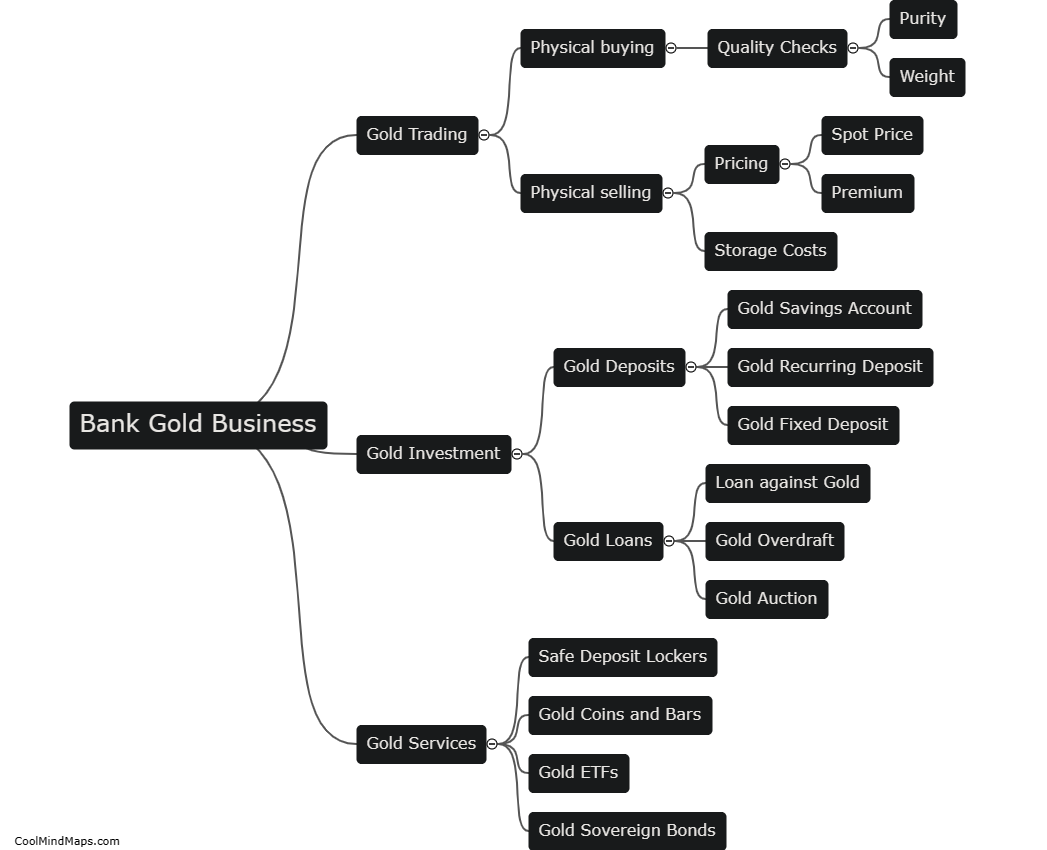

What is bank gold business?

Bank gold business refers to the practice of banks buying, selling and storing physical gold that is held as a financial asset or investment. Banks can offer gold transactions to their customers in different forms such as gold bars, coins, bullions or certificates of deposit. In a bank gold business, the banks work as intermediaries between customers who want to trade or invest in gold. This business can provide banks with a source of additional revenue and can help diversify their investment portfolios. However, it also exposes banks to market volatility and liquidity risk that may negatively impact their financial position.

This mind map was published on 17 May 2023 and has been viewed 111 times.