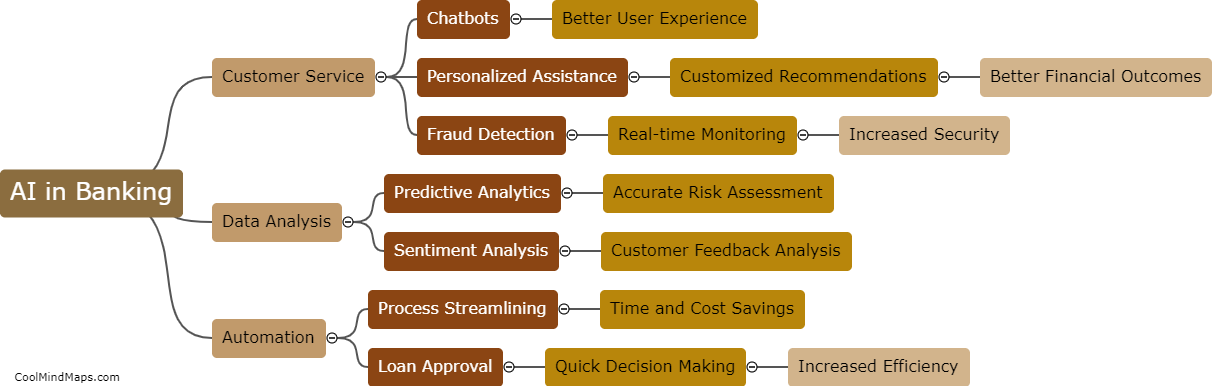

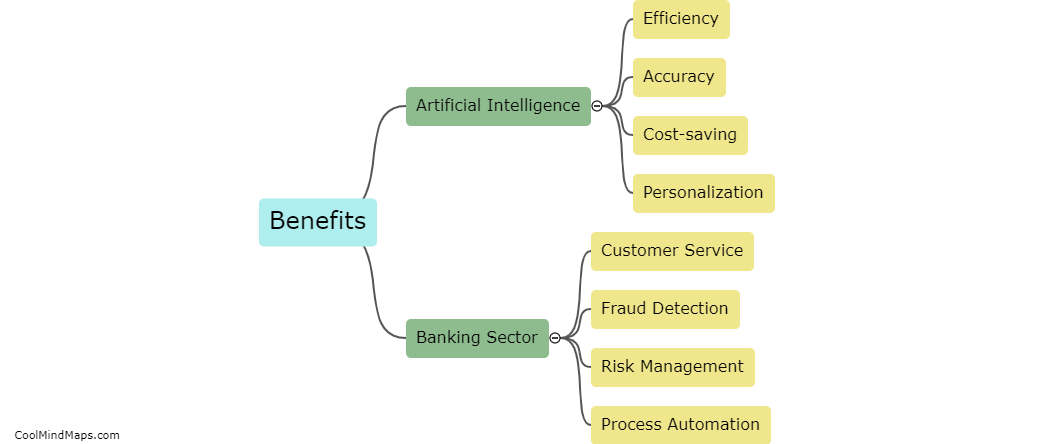

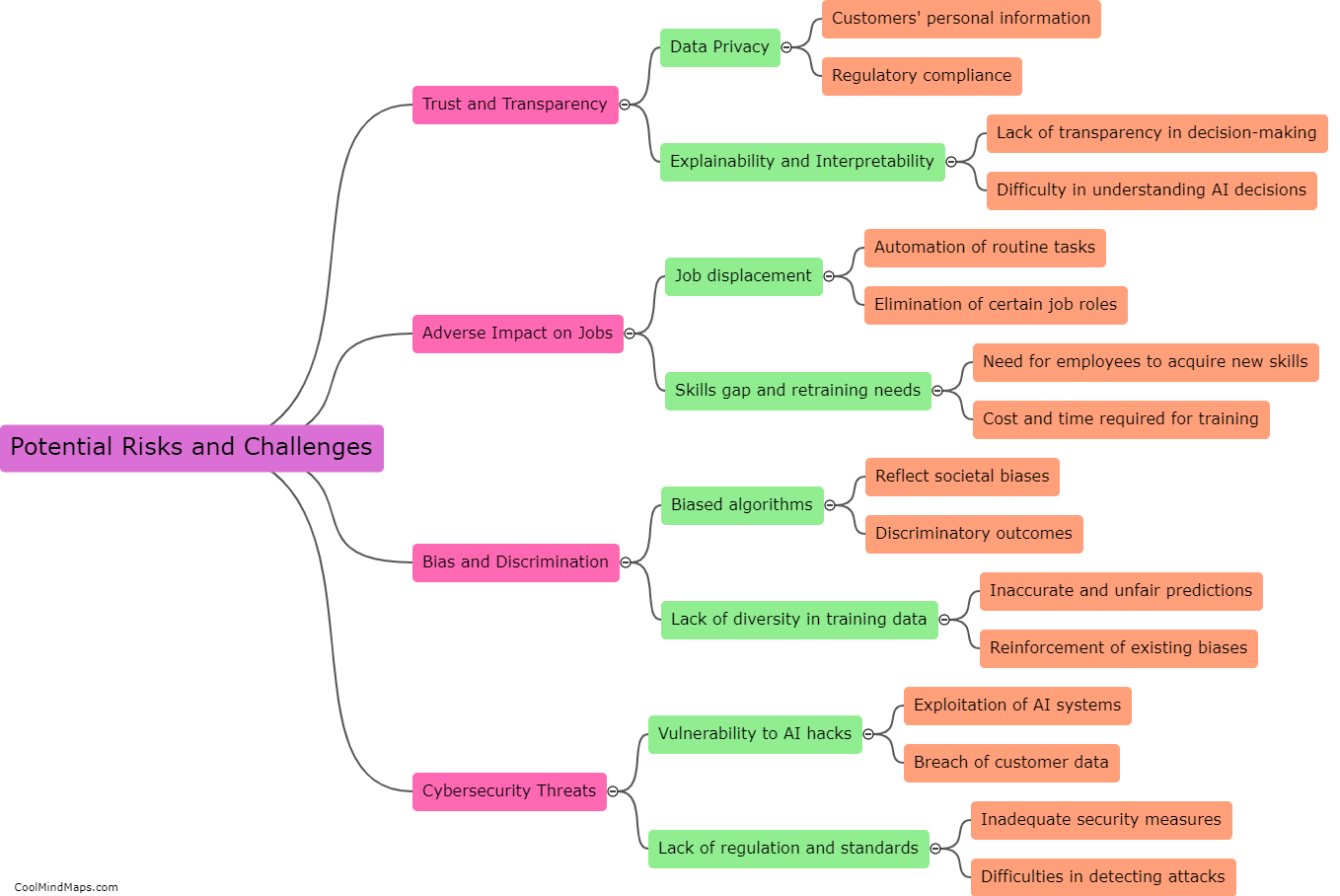

What are the potential risks and challenges of implementing artificial intelligence in banking?

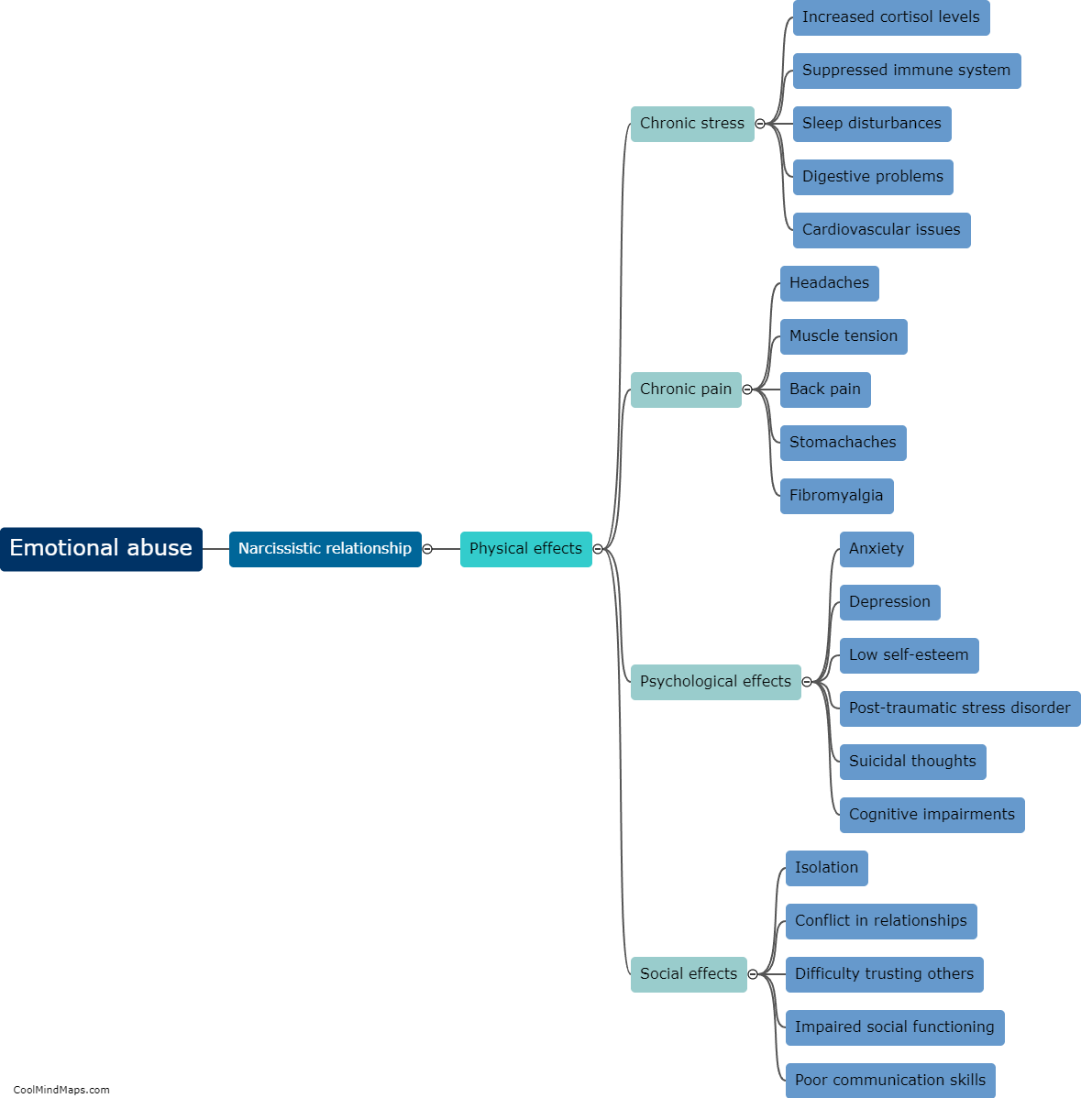

Implementing artificial intelligence (AI) in banking comes with potential risks and challenges that need thoughtful consideration. One significant risk is the potential for cyber threats and data breaches. AI systems may handle sensitive customer data, making them attractive targets for hackers. Banks must prioritize robust cybersecurity measures to protect against unauthorized access. Another challenge is the risk of algorithmic biases that may lead to discriminatory practices and unfair treatment of customers. Banks must ensure that their AI models are trained on unbiased and diverse data to mitigate this risk. Additionally, the lack of regulatory frameworks and standards for AI in banking presents a challenge. Clear guidelines and regulations are needed to govern the use of AI and address any legal and ethical concerns that may arise. Finally, there is the challenge of trust among customers who may be wary of AI-driven banking services and concerned about privacy. Banks must address these concerns and educate customers about the benefits and safeguards in place to gain their confidence. Overall, implementing AI in banking requires careful consideration of these risks and challenges to ensure its responsible and effective deployment.

This mind map was published on 24 September 2023 and has been viewed 118 times.