What are the main types of taxes in the United States?

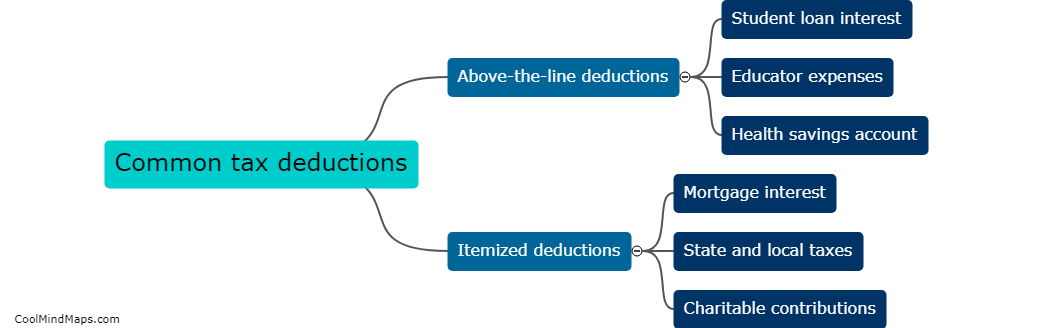

The main types of taxes in the United States include federal income tax, which is levied on individuals and corporations based on their earnings and profits respectively. Another important tax is the state income tax, which varies by state and is based on the income of individuals and businesses within that state. Sales tax is another common type of tax that is imposed on the purchase of goods and services at the point of sale. Property tax is assessed on the value of real estate properties, while payroll taxes are collected to fund social security and Medicare. Lastly, there are excise taxes which are levied on specific goods like alcohol, tobacco, and gasoline.

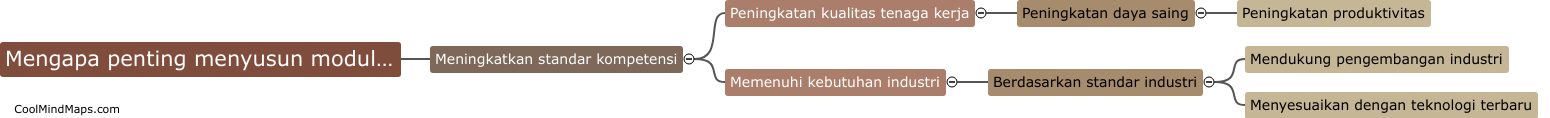

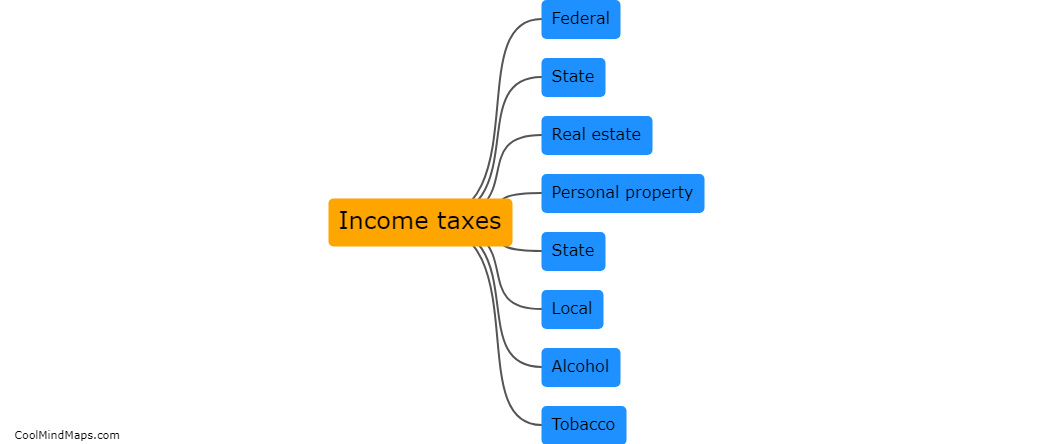

This mind map was published on 26 August 2024 and has been viewed 64 times.