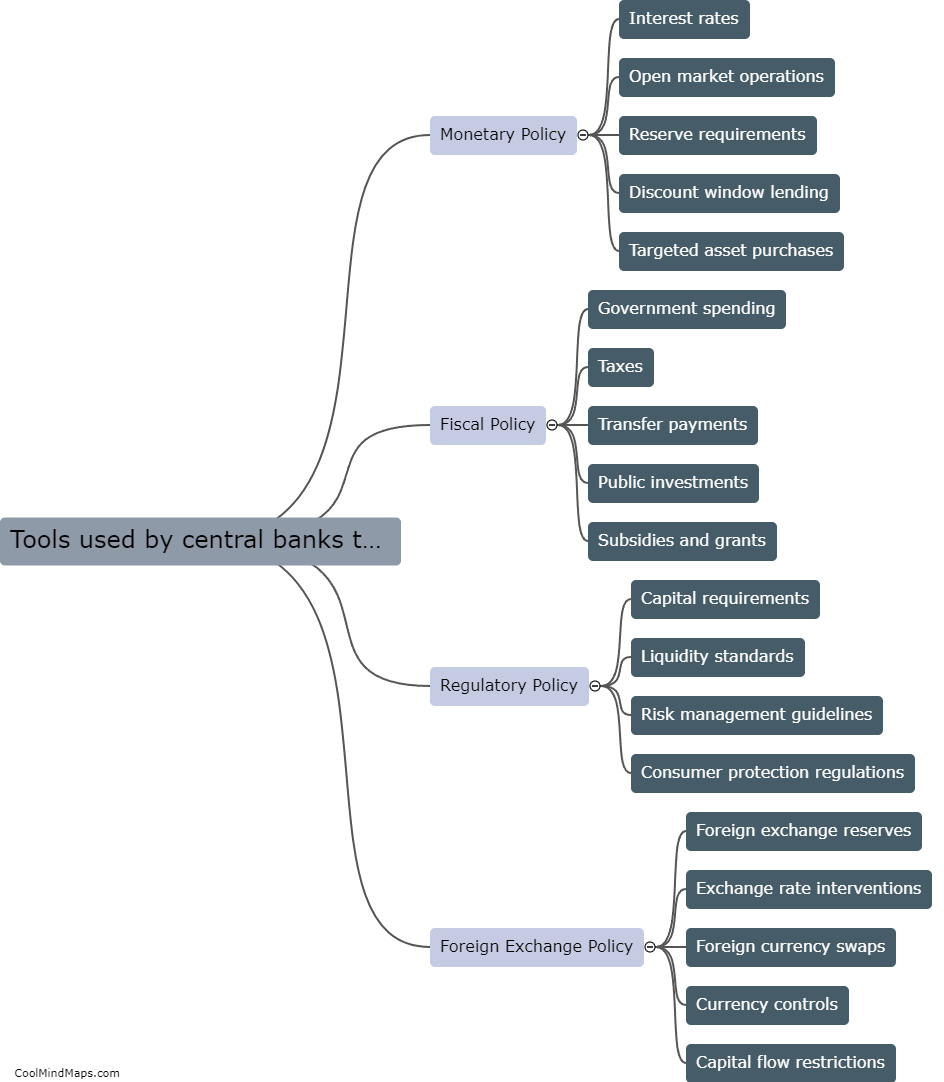

What are the tools used by central banks to regulate the economy?

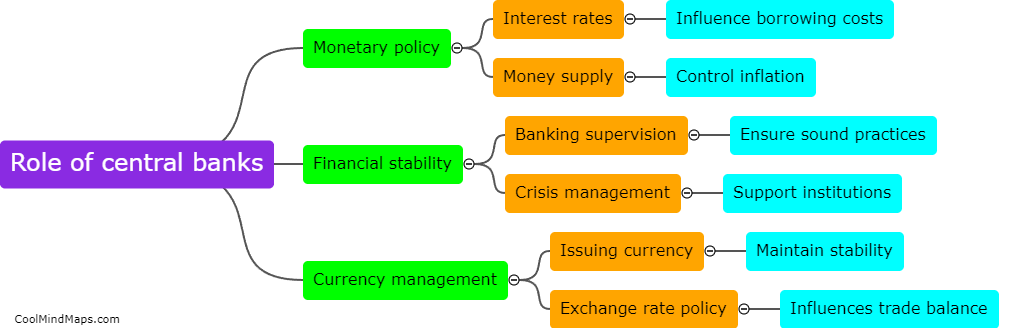

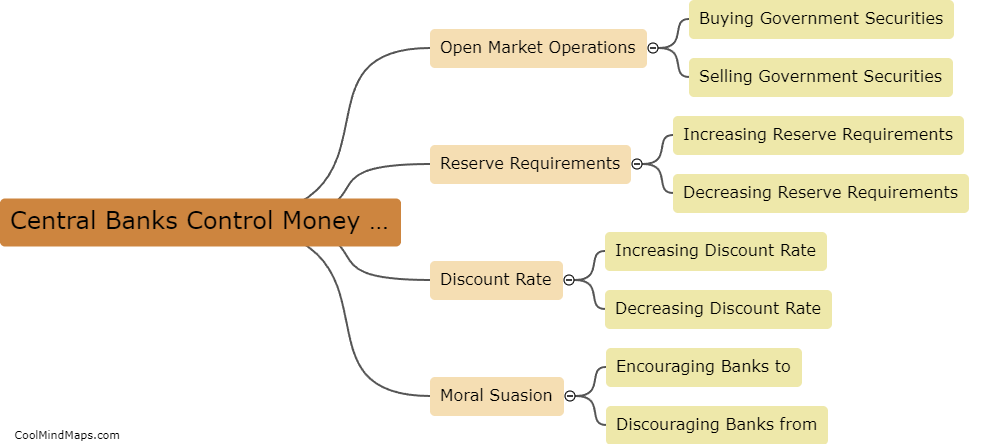

Central banks have a variety of tools at their disposal to regulate the economy. One of the primary tools is open market operations, where central banks buy or sell government bonds to influence the money supply and interest rates. Another tool is reserve requirements, where central banks mandate that commercial banks hold a certain percentage of their deposits as reserves, thus controlling the amount of money that can be loaned out. Additionally, central banks can use discount rates to influence the cost of borrowing for commercial banks. They can also communicate their monetary policy stance through forward guidance, signaling their future intentions to the market. Lastly, central banks can intervene directly in currency markets to stabilize exchange rates. These tools, used collectively, allow central banks to regulate and steer the economy towards desired objectives such as price stability, economic growth, and financial stability.

This mind map was published on 19 September 2023 and has been viewed 100 times.