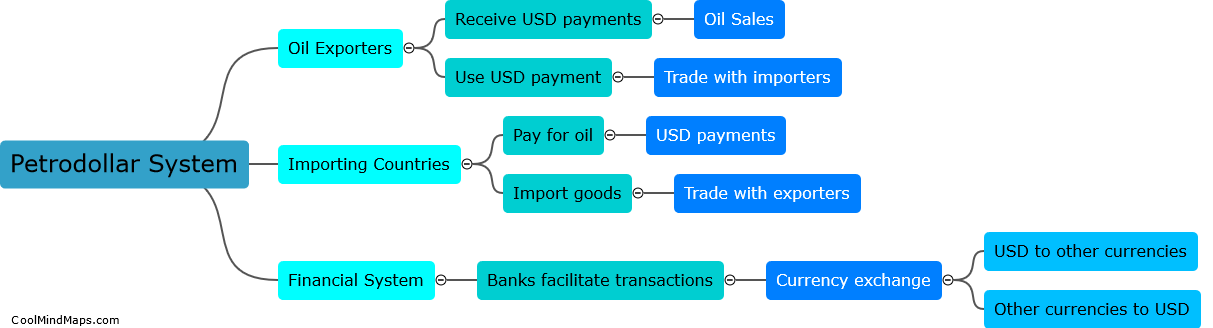

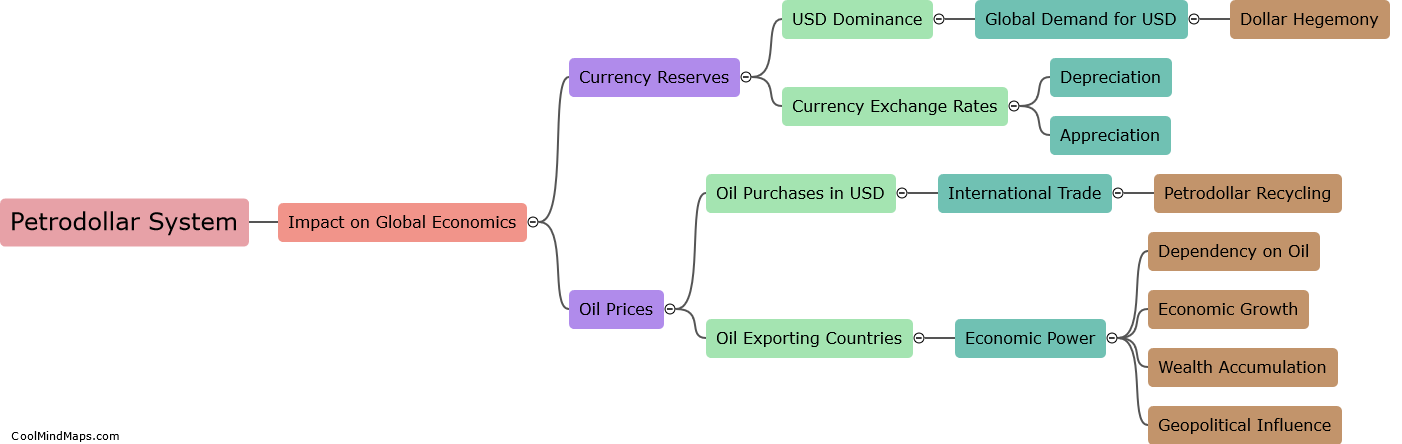

How does the petrodollar system impact global economics?

The petrodollar system is a term used to describe the international practice of buying and selling oil in US dollars. This system arose after the agreement between the US and Saudi Arabia in the 1970s, whereby oil-producing countries agreed to price and trade oil exclusively in US dollars. The impact of the petrodollar system on global economics is significant. Firstly, it strengthens the position of the US dollar as the dominant global currency, as countries need to acquire dollars to purchase oil. This creates a demand for dollars, which supports its value and makes it a preferred reserve currency for many central banks. Additionally, the petrodollar system allows the US to finance its current account deficit by effectively exporting inflation. As oil-importing countries need to hold large amounts of dollars for energy purchases, they are indirectly funding the US deficit. Furthermore, the petrodollar system influences the global balance of power, as the US has more influence over oil-producing countries and their policies. Overall, the petrodollar system has a wide-ranging impact on global economics, affecting currency markets, trade flows, and geopolitical dynamics.

This mind map was published on 1 January 2024 and has been viewed 90 times.