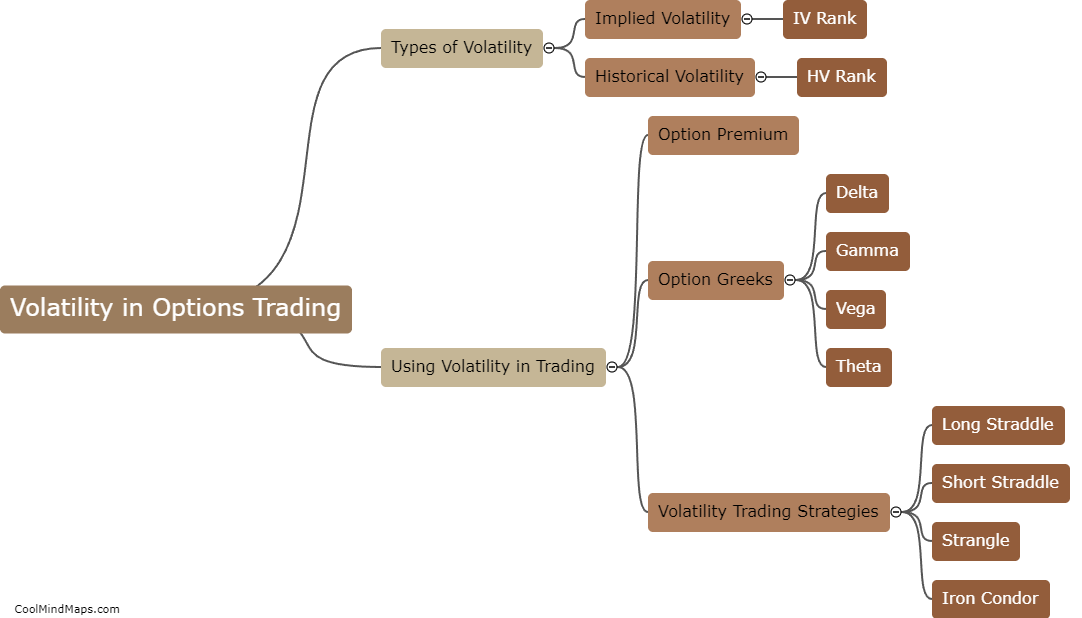

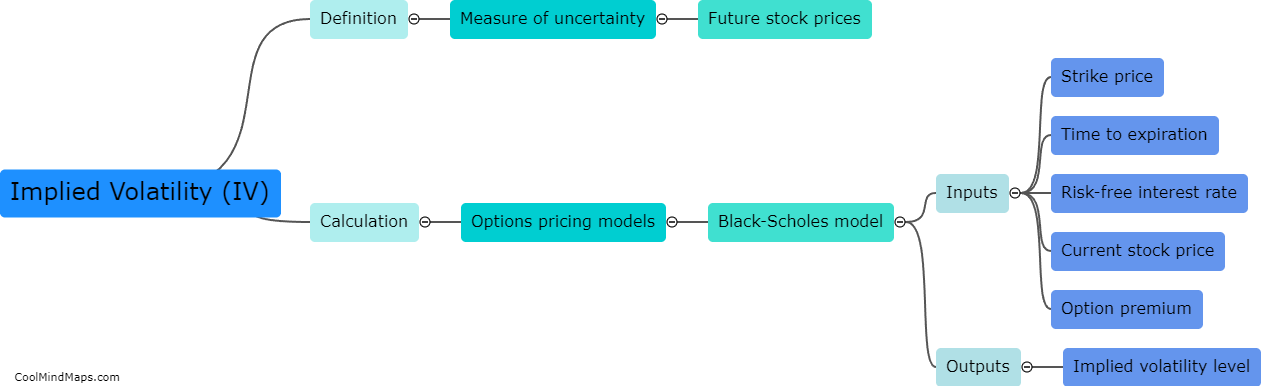

What is Implied Volatility (IV)?

Implied Volatility (IV) is a measure of the market's expectation for the magnitude of price changes in an underlying asset. It is derived from an options pricing model and reflects the level of uncertainty or risk about the future direction of the underlying asset's price. High implied volatility suggests that market participants expect significant price movements, while low implied volatility implies that the market anticipates relatively stable prices. In summary, IV is a key metric for options traders to determine the potential profitability and risk of an options trade.

This mind map was published on 28 May 2023 and has been viewed 96 times.