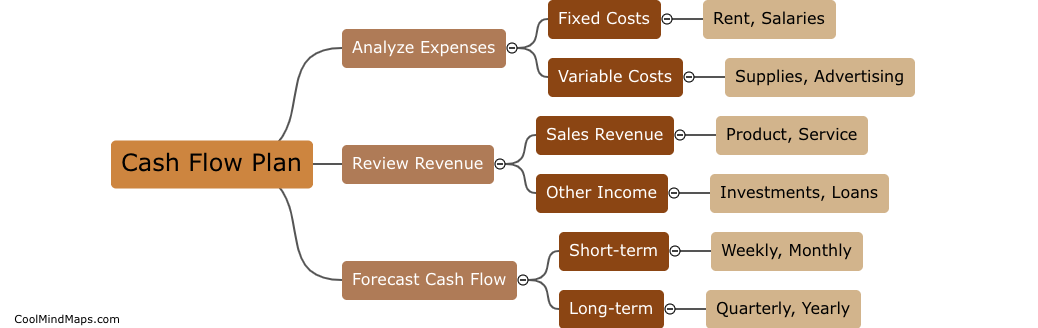

How can businesses create a cash flow plan?

Businesses can create a cash flow plan by analyzing their current expenses and revenue streams. They should create a budget that includes all of their fixed and variable costs, along with the amount of money they expect to bring in each month. By doing this, they can identify potential cash flow problems early on and take steps to address them before they become too severe. Additionally, businesses should consider strategies like stretching out their payables, accelerating their receivables, and investing in new revenue streams to improve their cash flow over time. Ultimately, proactive planning and smart financial management can help businesses maintain a healthy cash flow and achieve long-term success.

This mind map was published on 24 April 2023 and has been viewed 97 times.