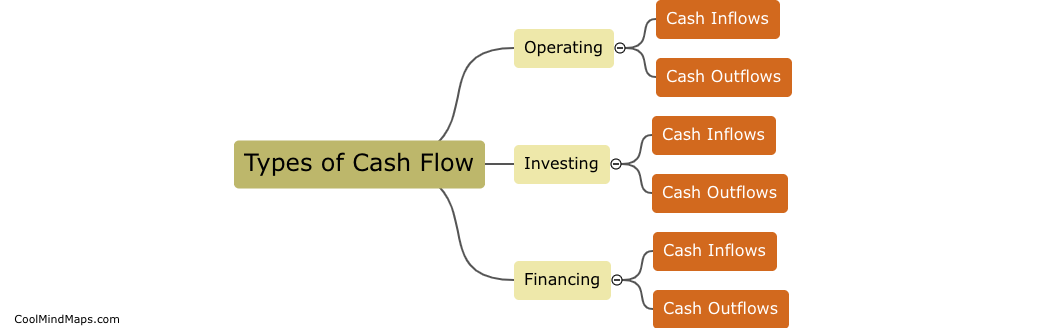

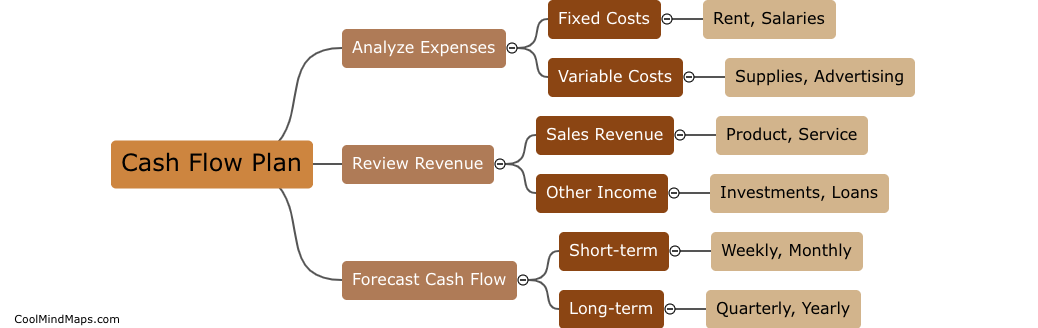

What are the benefits of cash flow planning?

Cash flow planning is the process of tracking, analyzing and forecasting the movement of money within a business or individual. The benefits of implementing cash flow planning are numerous, including being able to identify potential cash shortages in advance, improving the ability to manage and prioritize expenses, making informed decisions about investments and identifying growth opportunities. Cash flow planning can also provide a sense of financial stability and help in creating a clear financial roadmap for achieving long-term goals. By consistently monitoring cash flow, it can help a business or individual to maintain financial balance, avoid unnecessary debt, and ultimately reach financial success.

This mind map was published on 24 April 2023 and has been viewed 100 times.