What are the components of a financial structure?

The components of a financial structure refer to the various elements that make up an organization's financial setup. These components typically include capital structure, capital adequacy, financial resources allocation, risk management, and financial governance. The capital structure involves the mix of debt and equity financing used by a company to fund its operations, and it determines the organization's financial leverage. Capital adequacy refers to the organization's ability to meet its financial obligations and regulatory requirements. Financial resources allocation involves the allocation of funds to different areas within the organization to optimize financial performance. Risk management entails identifying and managing financial risks that could impact the organization's financial stability. Lastly, financial governance involves the frameworks, policies, and procedures that guide financial decision-making and ensure accountability and transparency within the organization. Overall, these components work together to shape an organization's financial structure and ultimately impact its financial success and stability.

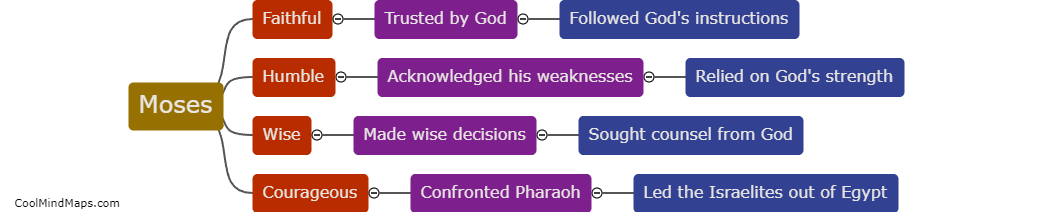

This mind map was published on 23 January 2024 and has been viewed 99 times.