How does the Fiscal Procedures & Financial Accountability Act promote financial accountability?

The Fiscal Procedures & Financial Accountability Act (FPFAA) promotes financial accountability by establishing clear guidelines and procedures for the management of public finances. The act outlines specific requirements for budget preparation, fiscal reporting, and internal financial control systems. It also emphasizes the need for transparency and accountability by mandating timely and accurate financial reporting, including the submission of audited financial statements. Additionally, the act promotes responsible fiscal decision-making and expenditure control by setting standards for budget execution and procurement processes. By enforcing these provisions, the FPFAA ensures that government institutions are held accountable for their financial actions, thus fostering a culture of financial responsibility and transparency within the public sector.

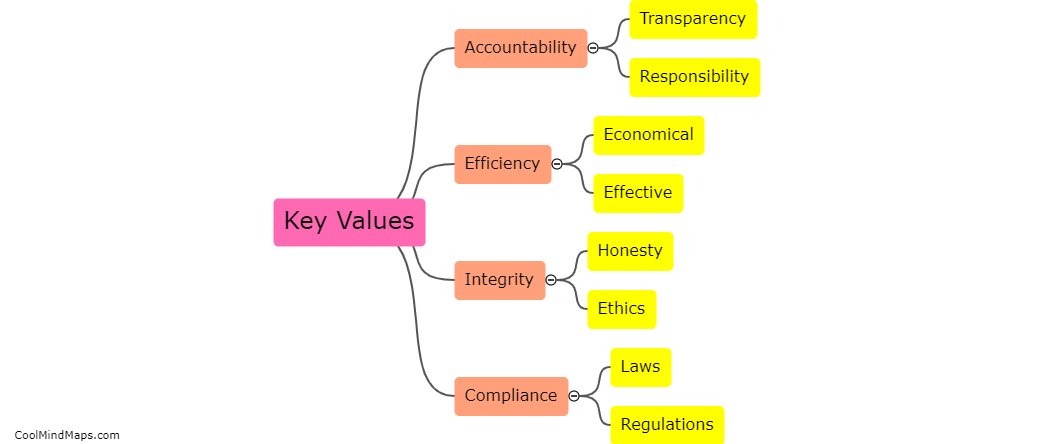

This mind map was published on 28 November 2023 and has been viewed 91 times.