How does a family office manage wealth and investments?

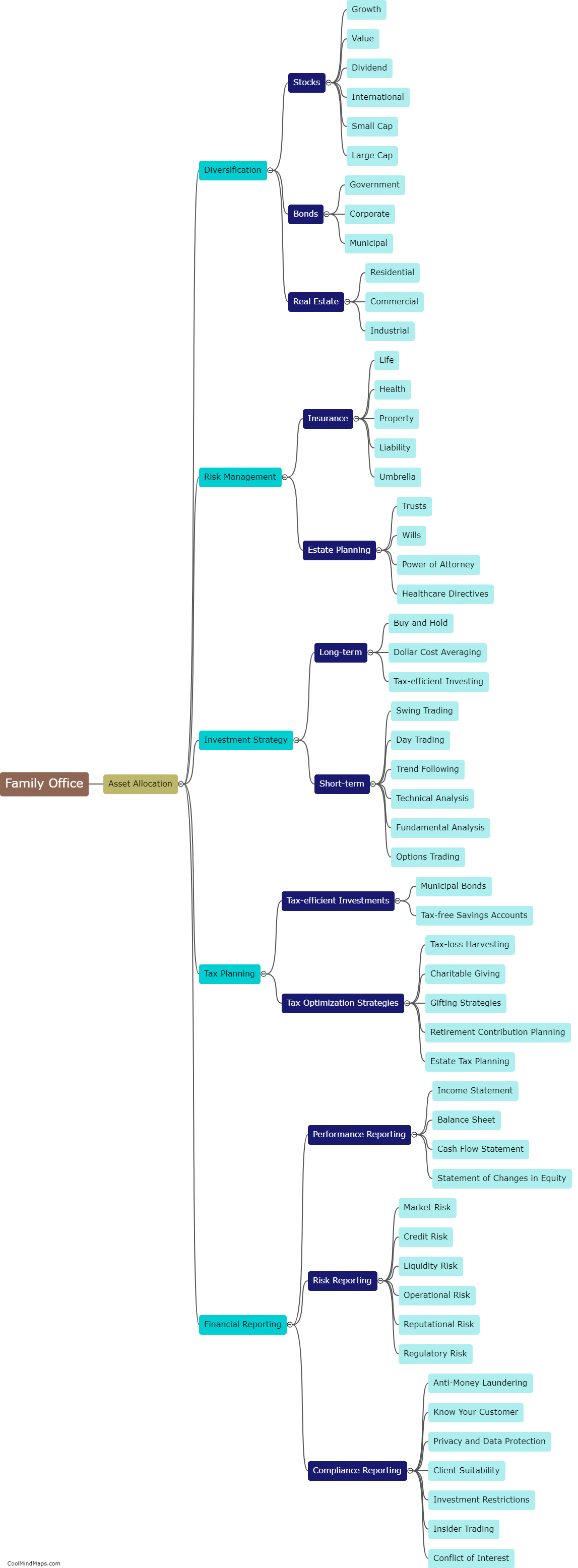

A family office is a specialized and comprehensive wealth management entity that serves ultra-high-net-worth individuals and families. It acts as a centralized hub to manage, preserve, and grow family wealth across generations. One of the core functions of a family office is to effectively manage investments. This involves creating a tailored investment strategy that aligns with the family's goals, risk tolerance, and investment horizon. Family offices typically employ a team of experienced professionals, including investment managers and financial advisors, who conduct thorough research, due diligence, and analysis. They explore various asset classes, such as stocks, bonds, real estate, private equity, and alternative investments, to construct a diversified portfolio. Additionally, family offices establish robust risk management frameworks and perform regular performance monitoring to ensure the optimal allocation of capital and strive for long-term growth and wealth preservation. Their expertise, combined with a deep understanding of the family's unique circumstances and objectives, helps them navigate complex financial markets and deliver comprehensive wealth and investment management services.

This mind map was published on 16 August 2023 and has been viewed 100 times.