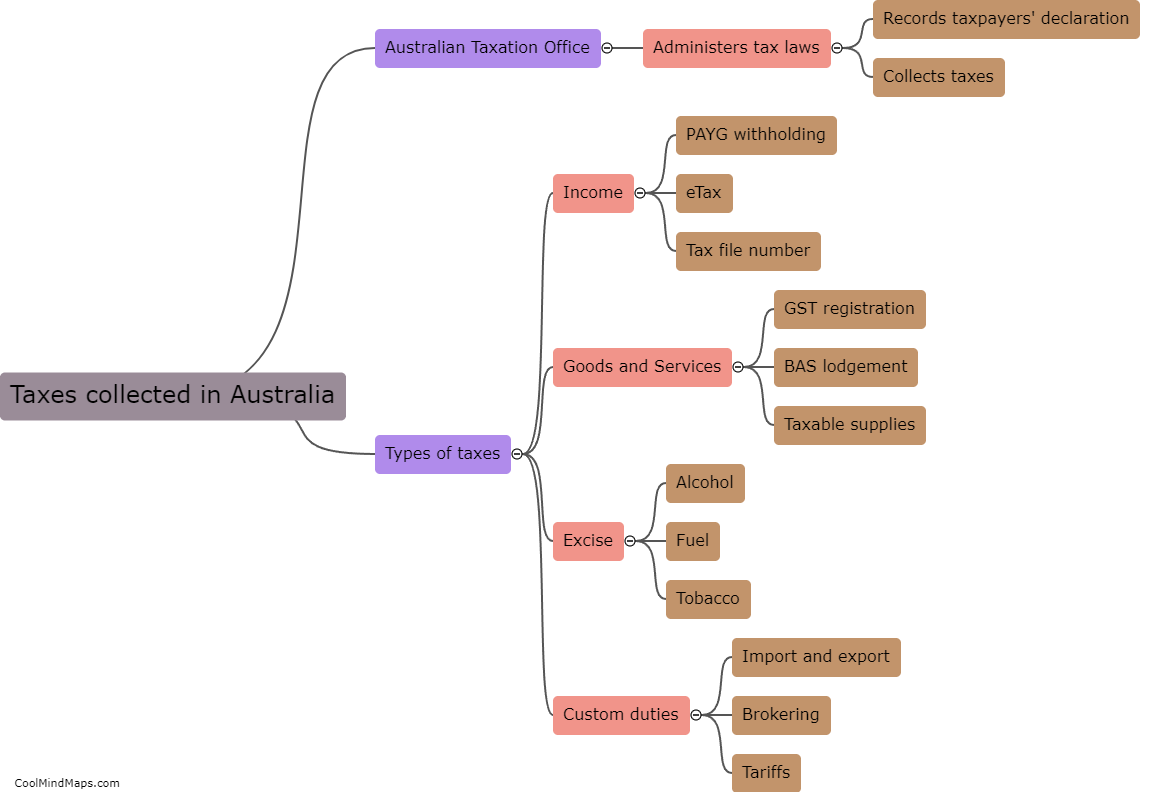

How are taxes collected in Australia?

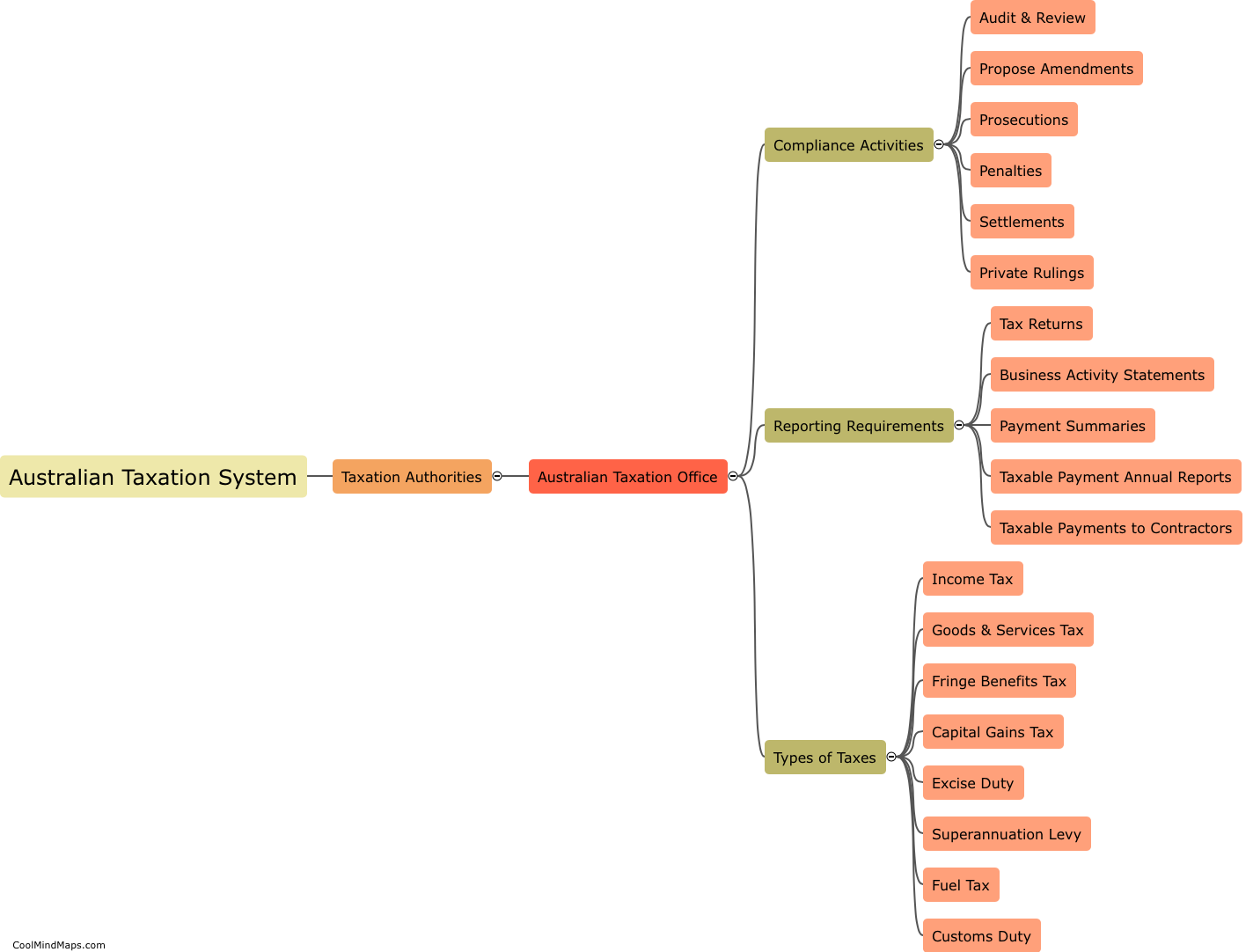

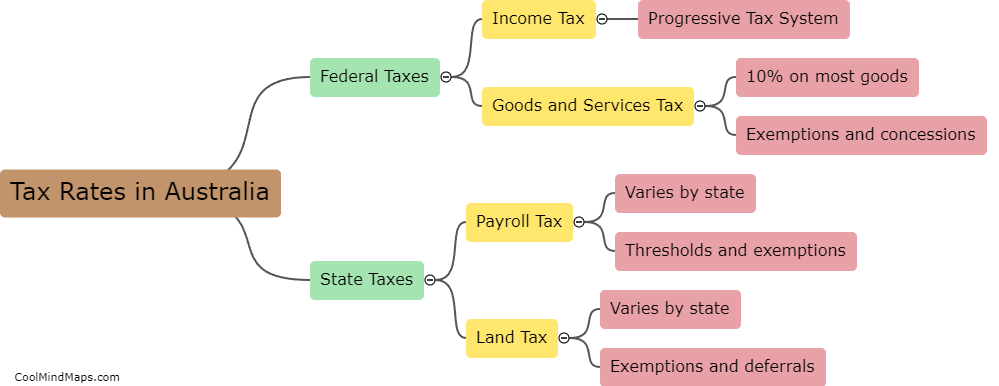

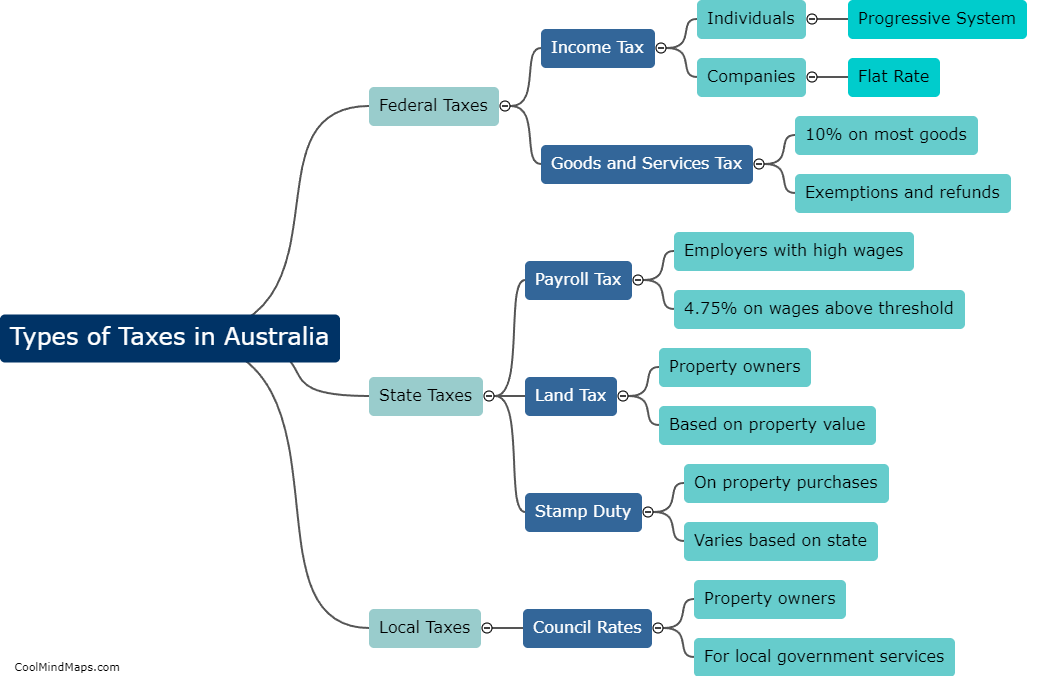

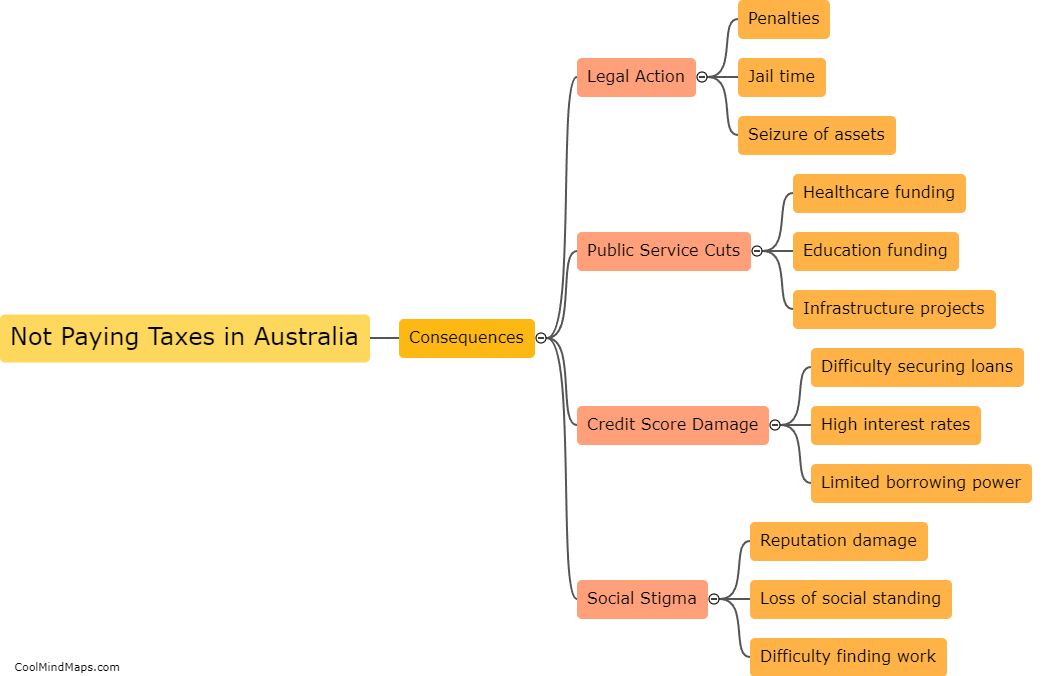

In Australia, taxes are collected by the Australian Taxation Office through a system of self-assessment, where taxpayers are responsible for correctly reporting their income and deductions. This includes income tax, goods and services tax, excise duties, and other taxes and levies. The tax system is administered by the Australian Government and includes various exemptions and deductions aimed at supporting low-income earners and businesses. Taxes are paid to the government through various payment methods, including online payments and direct debit, and penalties apply for late or incorrect payments. Overall, the tax system is an important source of revenue for the Australian Government, enabling it to fund essential services and infrastructure projects.

This mind map was published on 22 May 2023 and has been viewed 92 times.