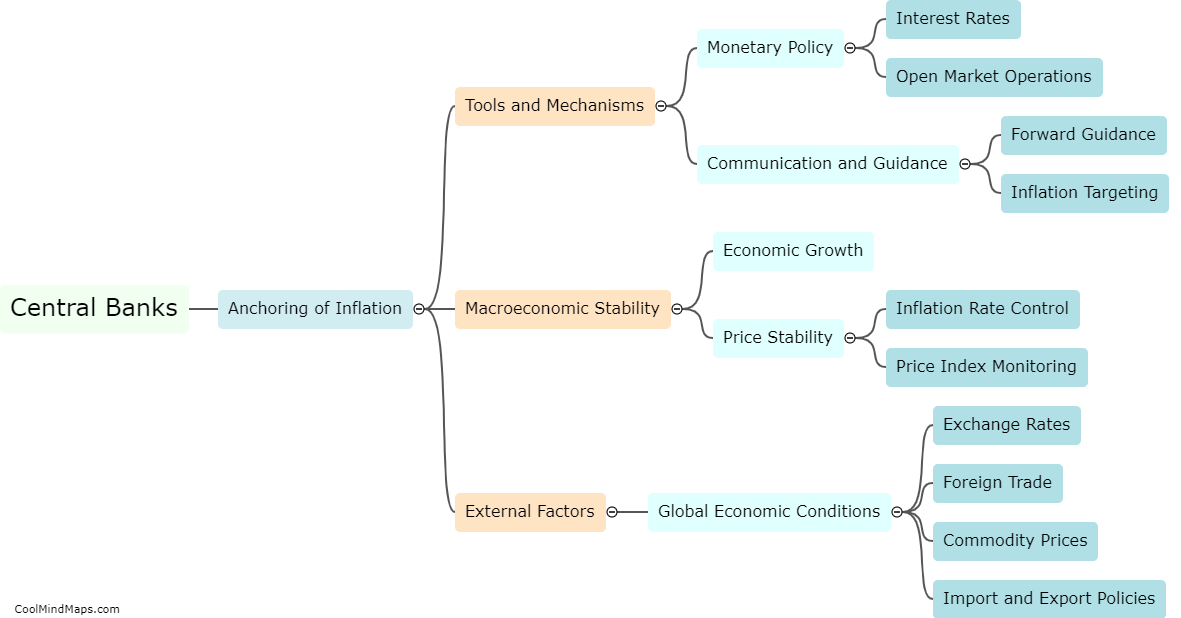

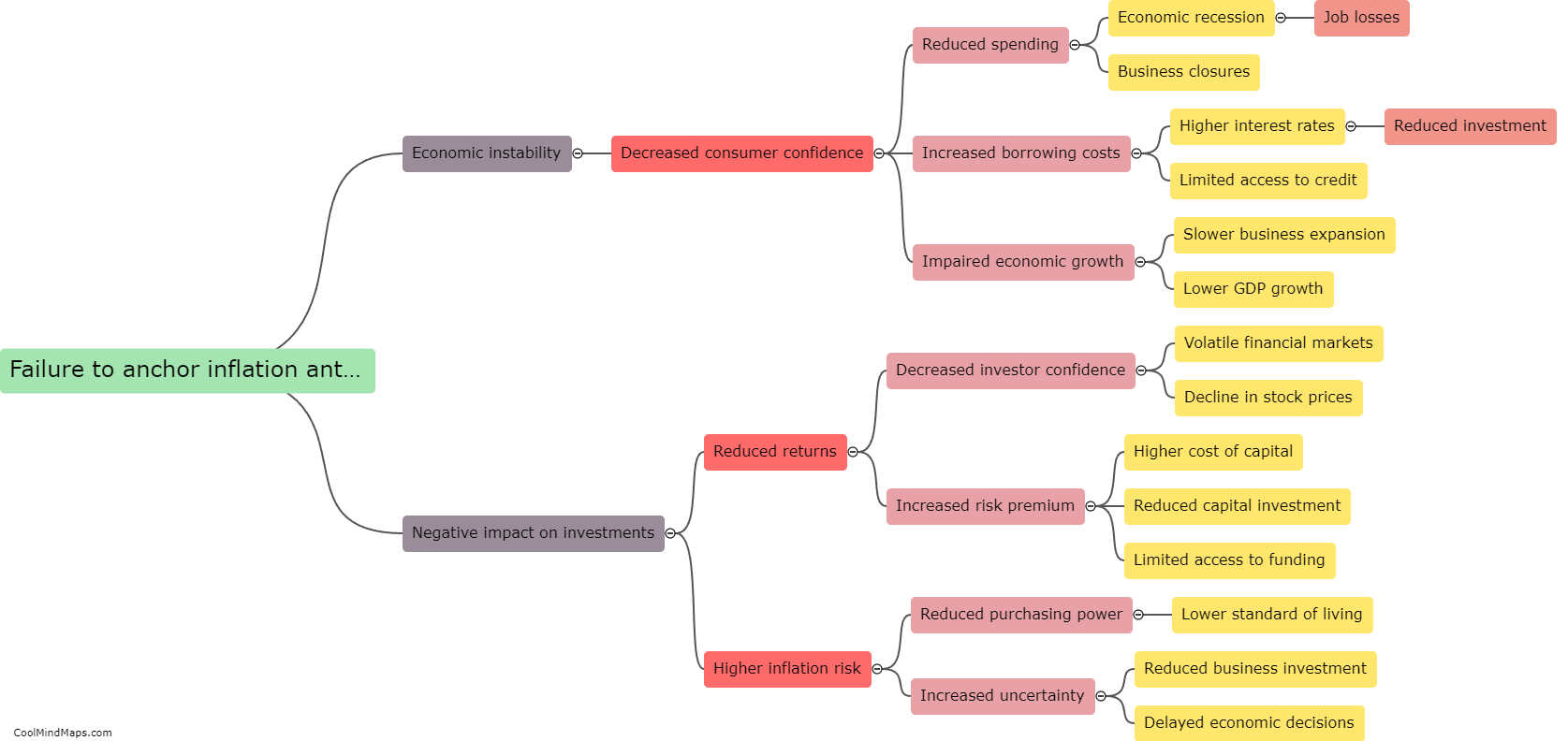

What are the consequences of a failure to anchor inflation anticipation?

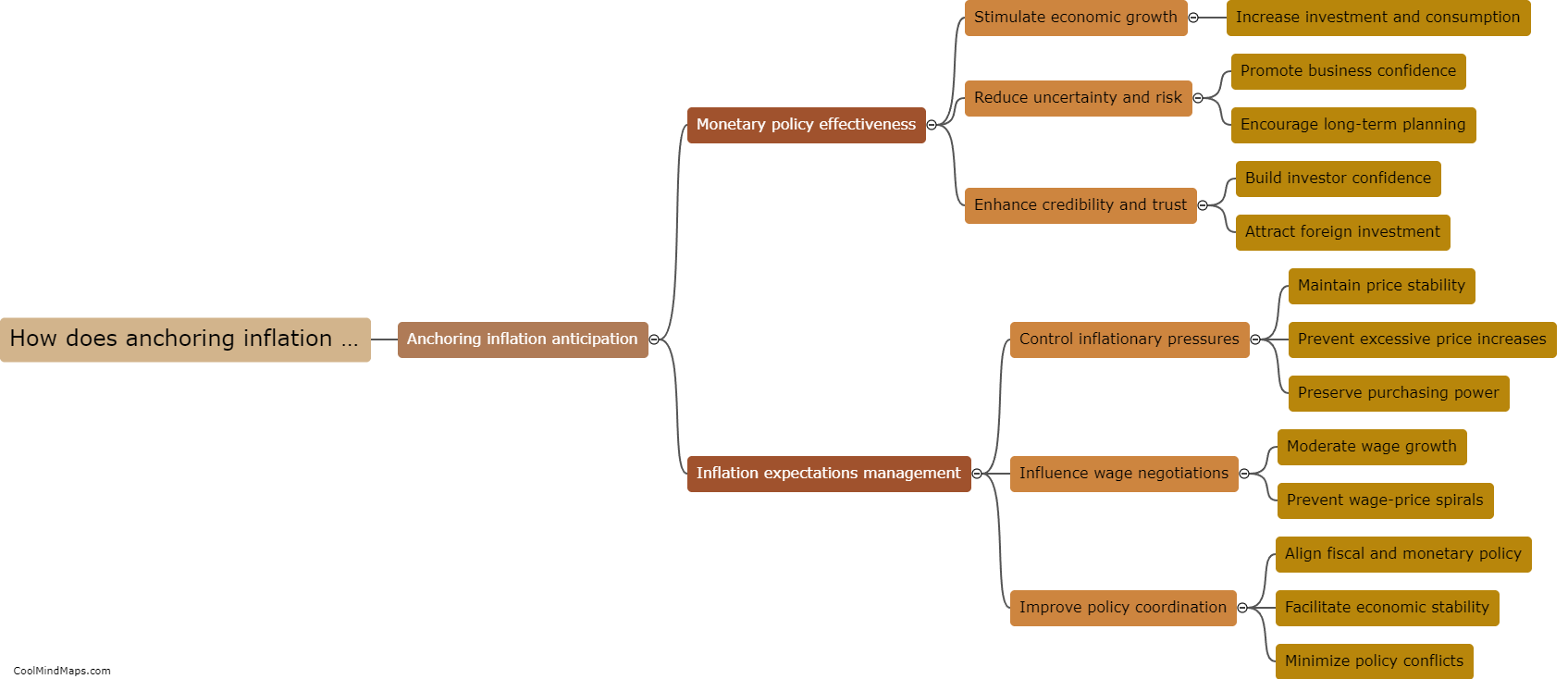

A failure to anchor inflation anticipation can have several negative consequences on an economy. Firstly, it can lead to increased uncertainty and volatility in financial markets. Without a clear expectation of future inflation, investors and businesses may struggle to make sound decisions regarding investments, lending, and pricing. This can hamper economic growth and stability. Secondly, a lack of anchored inflation anticipation can erode the purchasing power of individuals and households. When inflation expectations are not well-anchored, people may expect higher prices in the future and adjust their behavior accordingly, leading to reduced consumer spending and saving. Additionally, failure to anchor inflation anticipation can undermine central banks' credibility and their ability to effectively conduct monetary policy. Without a clear inflation target, central banks may struggle to communicate and implement appropriate policies, potentially leading to destabilizing macroeconomic outcomes. In summary, the consequences of failing to anchor inflation anticipation can include financial market volatility, decreased consumer spending, and diminished central bank effectiveness.

This mind map was published on 26 September 2023 and has been viewed 84 times.