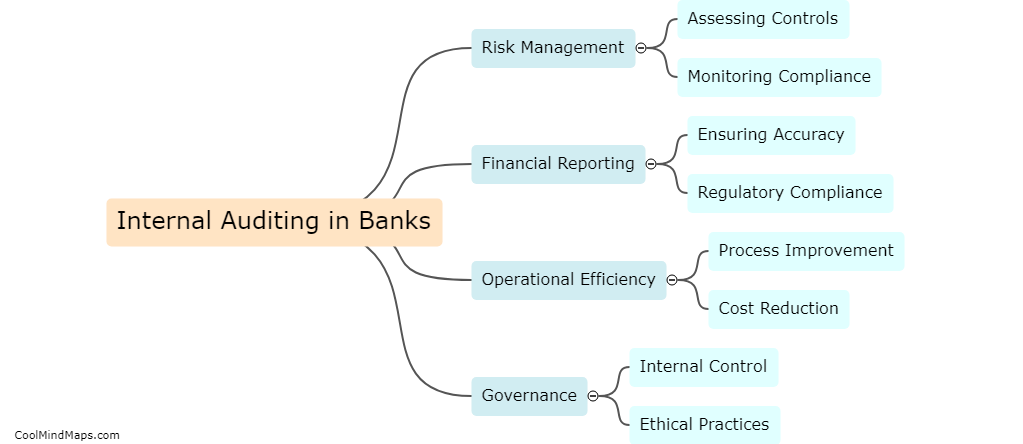

What are the common risks in bank internal auditing?

Common risks in bank internal auditing include misstatements in financial statements, fraudulent activities, errors in regulatory compliance, inadequate internal controls, and lack of independence in the auditing process. These risks can result in financial losses, damage to the bank's reputation, and regulatory penalties. It is essential for bank internal auditors to identify and mitigate these risks to ensure the accuracy, reliability, and transparency of financial reporting and operations.

This mind map was published on 13 March 2024 and has been viewed 86 times.