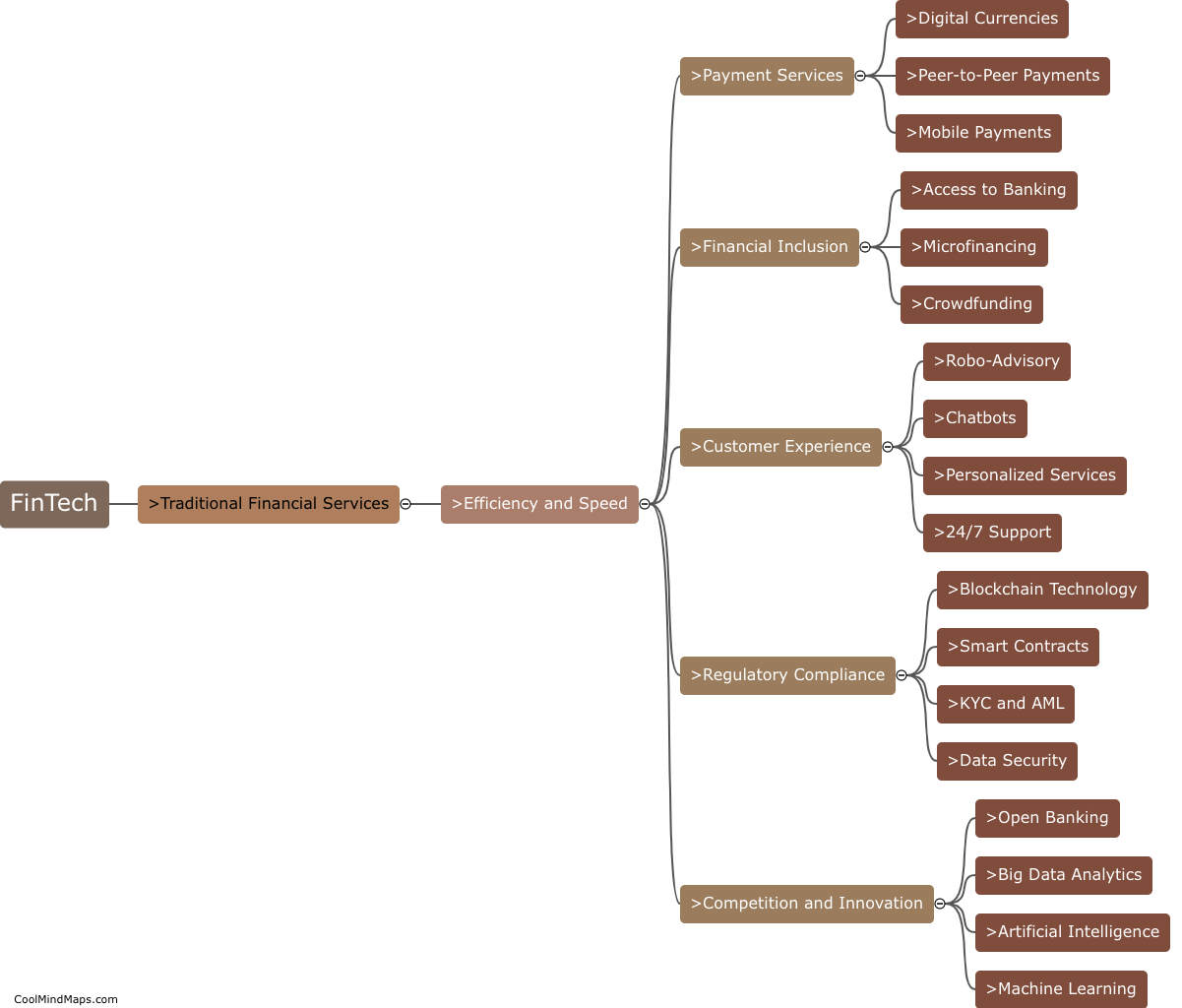

What are the different types of FinTech?

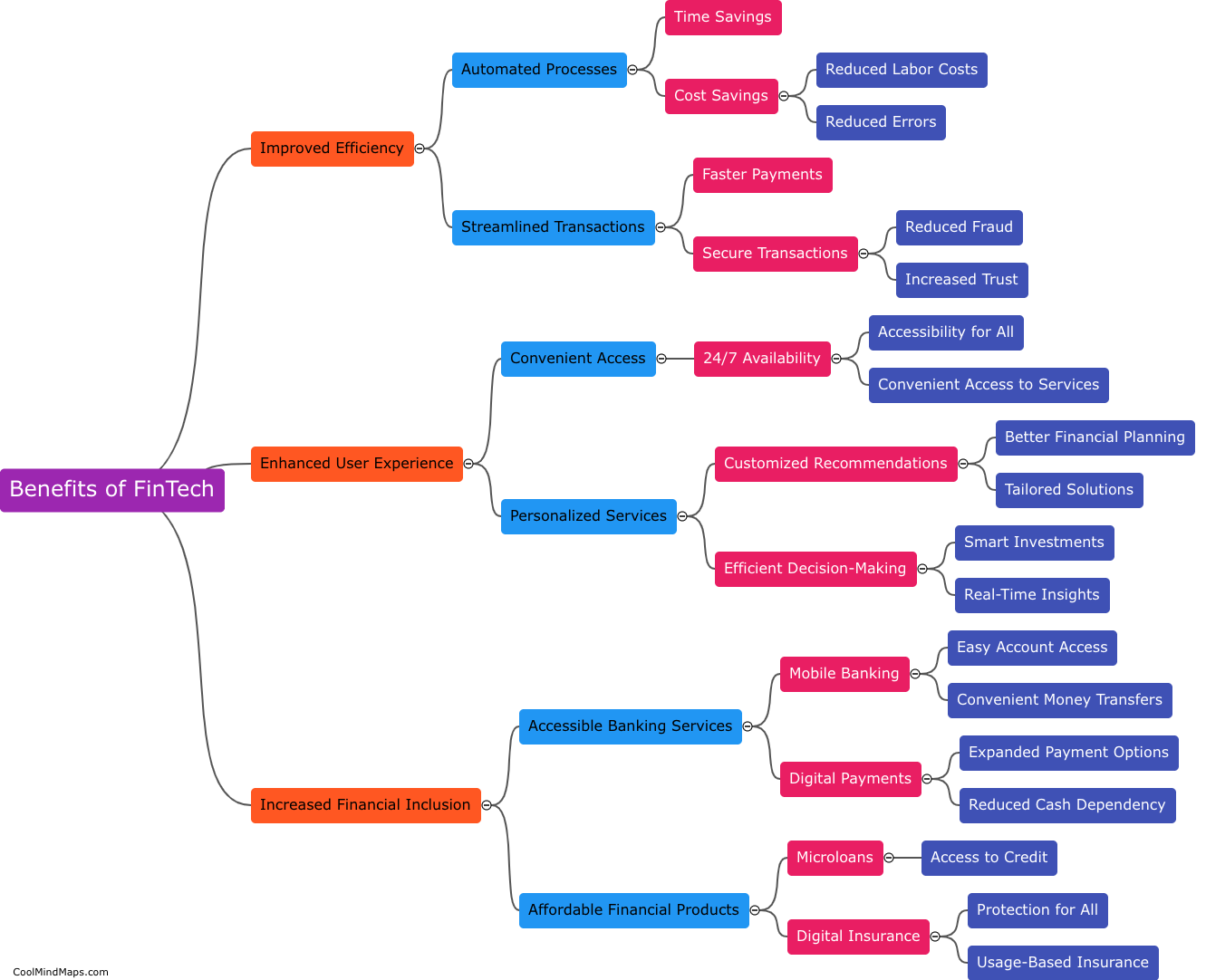

FinTech, short for Financial Technology, refers to the innovative use of technology to improve and enhance various financial activities. There are several types of FinTech that cater to different sectors within the financial industry. One prominent category is Payments and Money Transfer, which includes mobile wallets, peer-to-peer payments, and digital currencies. Another type is Personal Finance and Robo-Advisors, which comprise budgeting apps, robo-investment platforms, and automated financial advice services. Additionally, there are online lending platforms that streamline the lending process, crowdfunding platforms that enable fundraising for projects, and Insurtech platforms that use technology to simplify and enhance insurance processes. Moreover, RegTech services exist for regulatory compliance, data analytics and cybersecurity solutions, and blockchain technology finds its application in various financial sectors. These different types of FinTech innovations are transforming the financial landscape by making transactions more efficient, improving access to financial services, and enhancing customer experiences.

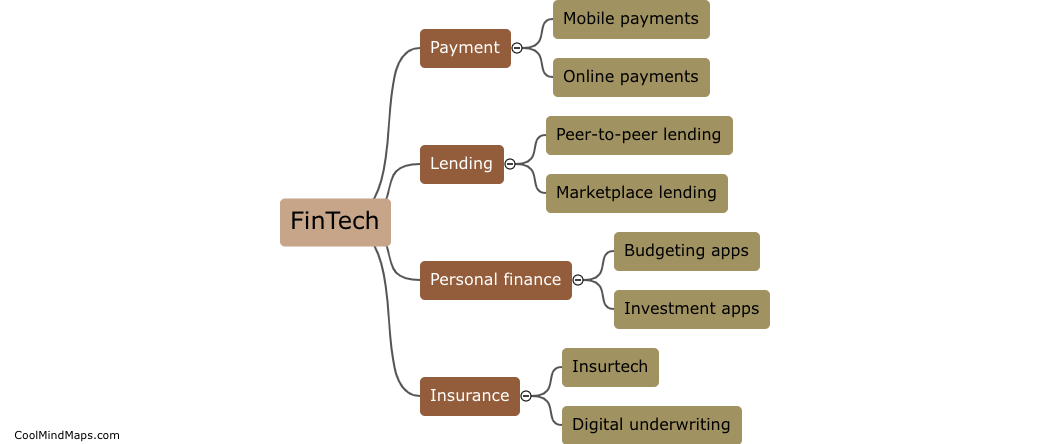

This mind map was published on 21 November 2023 and has been viewed 90 times.