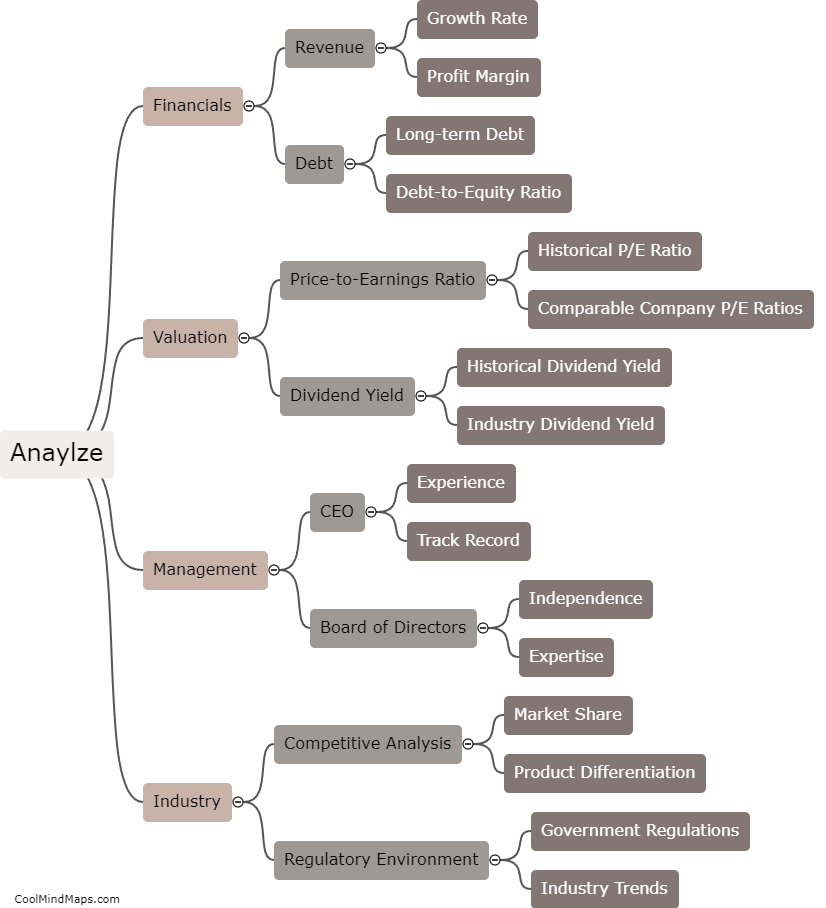

How do I analyze a stock before trading?

Analyzing a stock before trading is essential for making informed investment decisions. To begin with, it is crucial to evaluate the company's financial health by examining its financial statements, including the balance sheet, income statement, and cash flow statement. This helps identify the company's profitability, liquidity, and debt levels. Additionally, assessing the company's fundamentals such as revenue growth, earnings, and market share can provide insights into its competitiveness and potential for future growth. Furthermore, researching the industry and market trends can help determine the stock's overall potential. It is also important to consider the company's management team, their track record, and their strategic initiatives. Lastly, conducting a thorough analysis of the stock's valuation, such as price-to-earnings ratio, price-to-sales ratio, and dividend yield, among others, can help ensure that the stock is reasonably priced. By carefully evaluating these factors, investors can make more informed decisions when trading stocks.

This mind map was published on 14 September 2023 and has been viewed 97 times.