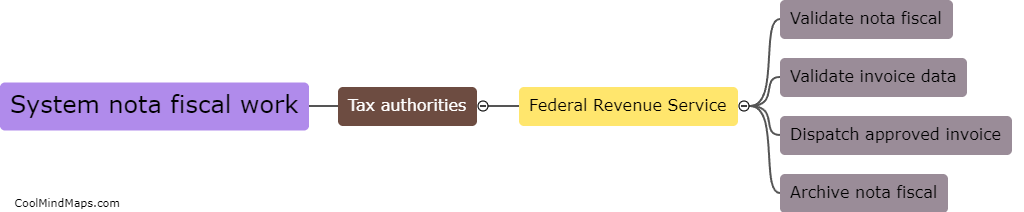

How does System nota fiscal work?

System Nota Fiscal is a digital invoicing system used in Brazil to document sales and services. It is mandatory for businesses to issue this electronic document for almost all transactions, ensuring transparency and reducing tax evasion. The process starts when a purchase is made, and the seller generates an electronic invoice with all the required information. This includes the buyer's tax identification number, the products or services purchased, and the applicable taxes. The invoice is then registered with the tax authorities, who validate the information before transmitting it to the buyer's tax account. The buyer can access their Nota Fiscal through an online platform and use it for accounting, claiming tax benefits, or resolving disputes. Overall, System Nota Fiscal streamlines the tax collection process, improves efficiency, and promotes a culture of compliance in business transactions.

This mind map was published on 7 September 2023 and has been viewed 98 times.