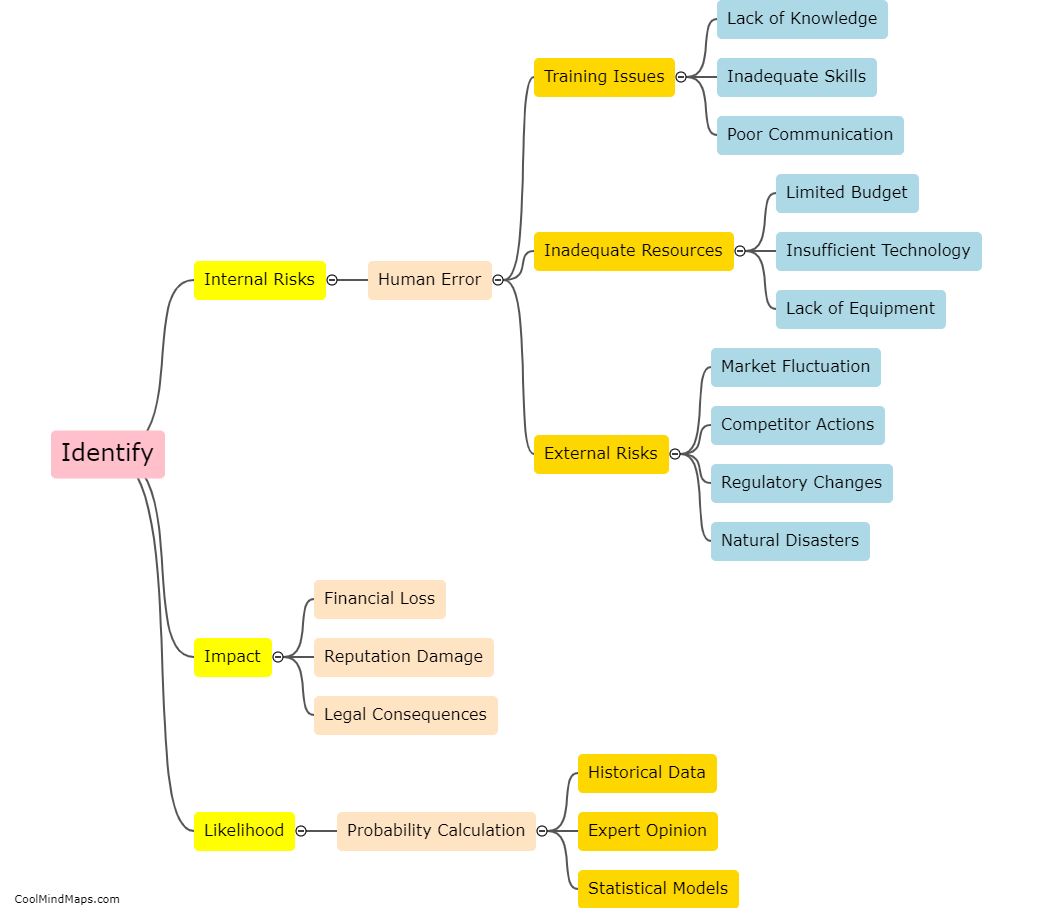

What are the different types of risks?

There are various types of risks that individuals, organizations, and societies face. One common category is financial risk, which includes factors like market volatility, interest rate fluctuations, and credit default. Operational risks refer to potential failures or disruptions in the daily operations of a business, such as equipment breakdowns or supply chain issues. Strategic risks involve the uncertainties and potential negative consequences associated with decision-making and business strategies, including competitive threats and changes in market conditions. Reputational risks pertain to threats that can damage an individual's or company's reputation, such as public scandals or negative customer reviews. Lastly, there are legal and compliance risks that involve potential violations of laws, regulations, or ethical standards, which can result in legal consequences or damage to an organization's integrity. Understanding the different types of risks is crucial for effective risk management and mitigation strategies.

This mind map was published on 30 January 2024 and has been viewed 118 times.