What is the difference between stocks and mutual funds?

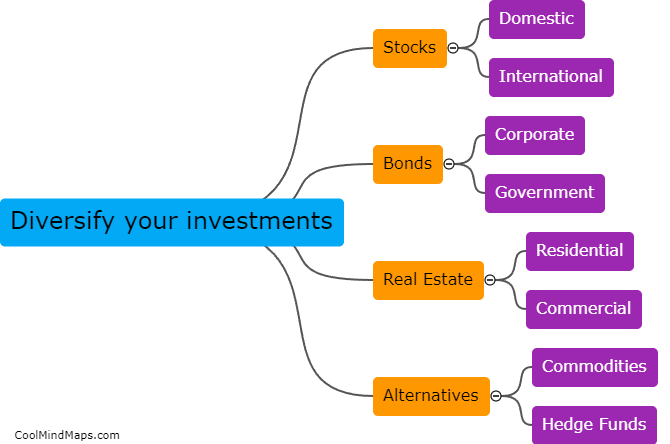

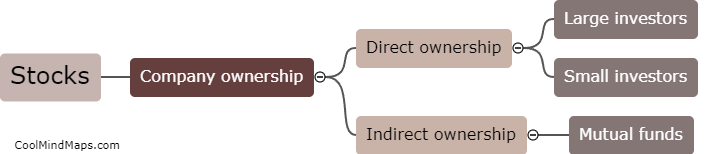

Stocks and mutual funds are both forms of investment assets. Stocks refer to ownership in a particular company, and the value of each share is determined by factors like earnings and market trends. On the other hand, a mutual fund is a collection of different stocks, bonds or other investments, typically managed by a professional fund manager. These funds are owned by multiple investors, and they share in any gains or losses based on the performance of the underlying assets. While stocks can offer higher returns, they also come with more risk due to their reliance on the success of a single company. Mutual funds, on the other hand, can provide a diversified portfolio and reduce risk while still allowing investors to participate in the stock market.

This mind map was published on 19 April 2023 and has been viewed 100 times.