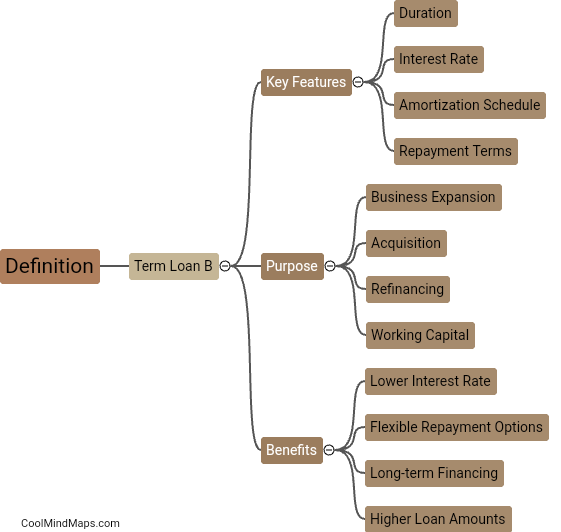

What is the definition of term loan b?

A term loan B is a type of loan typically provided by institutional investors, such as banks or private equity firms, to finance large-scale corporate transactions, such as mergers and acquisitions. It falls under the category of leveraged loans, meaning that it is granted to a borrower with a higher level of existing debt or a lower credit rating. Term loan B usually has a fixed interest rate, a maturity period of around five to seven years, and is structured as a senior secured debt. It is considered riskier than traditional bank loans due to its higher interest rates and subordinate position in the creditor hierarchy, but it is also attractive to borrowers as it provides access to significant amounts of capital for strategic business activities.

This mind map was published on 19 January 2024 and has been viewed 113 times.