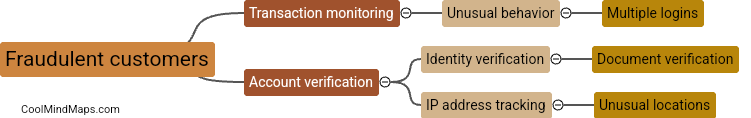

How can fraudulent customers be identified in electronic banking?

Fraudulent customers in electronic banking can be identified through various methods. One common approach is to monitor for suspicious activity, such as large or unusual transactions, frequent logins from different locations, or sudden changes in spending habits. Banks may also use advanced technological tools, like machine learning algorithms, to detect patterns of fraudulent behavior. Additionally, customers can be required to provide additional authentication methods, such as biometric data or one-time passwords, to verify their identity and prevent unauthorized access to their accounts. By employing a combination of these strategies, banks can effectively identify and prevent fraudulent activities in electronic banking.

This mind map was published on 8 November 2024 and has been viewed 26 times.