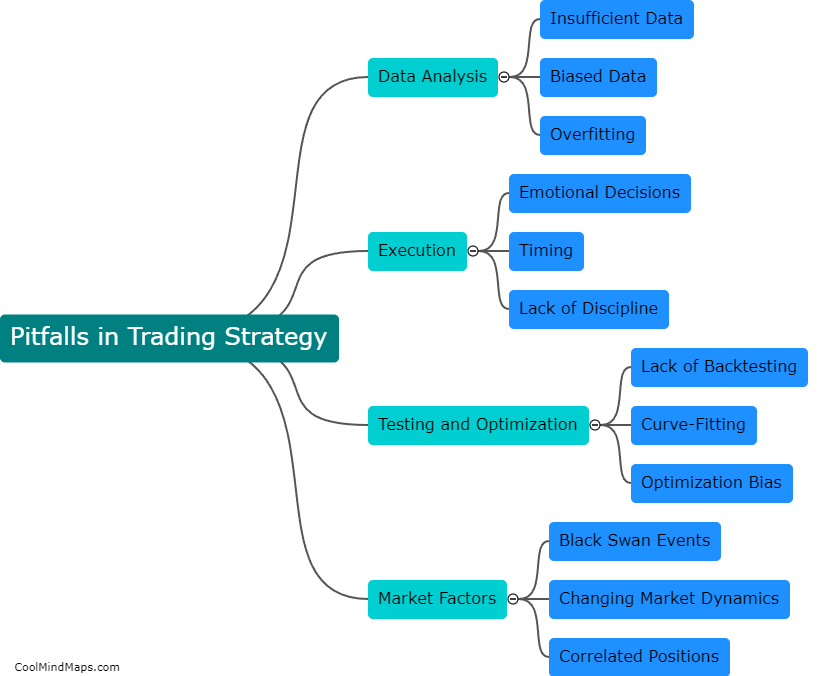

What are the common pitfalls in building a trading strategy?

When building a trading strategy, there are several common pitfalls to avoid. One pitfall is over-optimization, which occurs when a strategy is tailored too precisely to historical data, making it less likely to perform well in the future. Another pitfall is failing to consider risk management, which means the strategy may be profitable in the short term but lead to substantial losses in the long run. Additionally, not accounting for transaction costs and trading fees can result in lower profits or even losses. Finally, emotional decision-making and not adhering strictly to the strategy can make it difficult to assess its effectiveness. Overall, it is important to approach strategy building with caution, avoiding these common pitfalls and prioritizing risk management and a disciplined approach.

This mind map was published on 17 May 2023 and has been viewed 118 times.