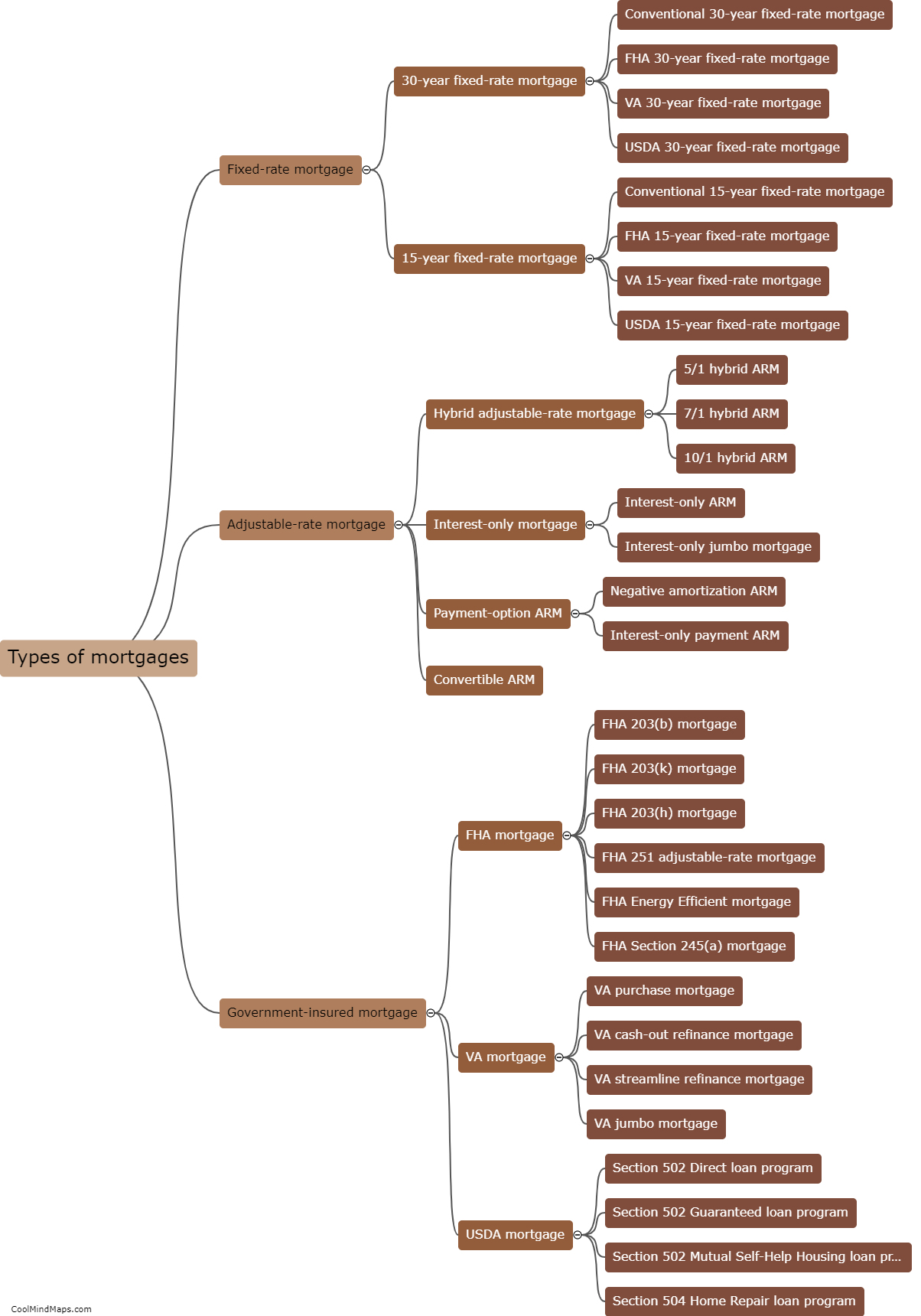

What are the different types of mortgages available?

There are several types of mortgages available to homebuyers, each with its own advantages and considerations. The most common type is a fixed-rate mortgage, where the interest rate remains constant throughout the loan term. This provides predictability in monthly payments but may have higher initial rates. Another option is an adjustable-rate mortgage, where the interest rate can change periodically based on market conditions. This type offers lower initial rates but can fluctuate over time. Government-backed mortgages, such as FHA loans, VA loans, and USDA loans, are designed for specific borrower profiles and often require lower down payments or have more flexible eligibility criteria. Additionally, there are jumbo loans for high-value properties, interest-only mortgages where borrowers only pay the interest for a set period, and reverse mortgages available to older homeowners. It's essential for individuals to carefully assess their financial situation and goals before choosing the most suitable mortgage option for their needs.

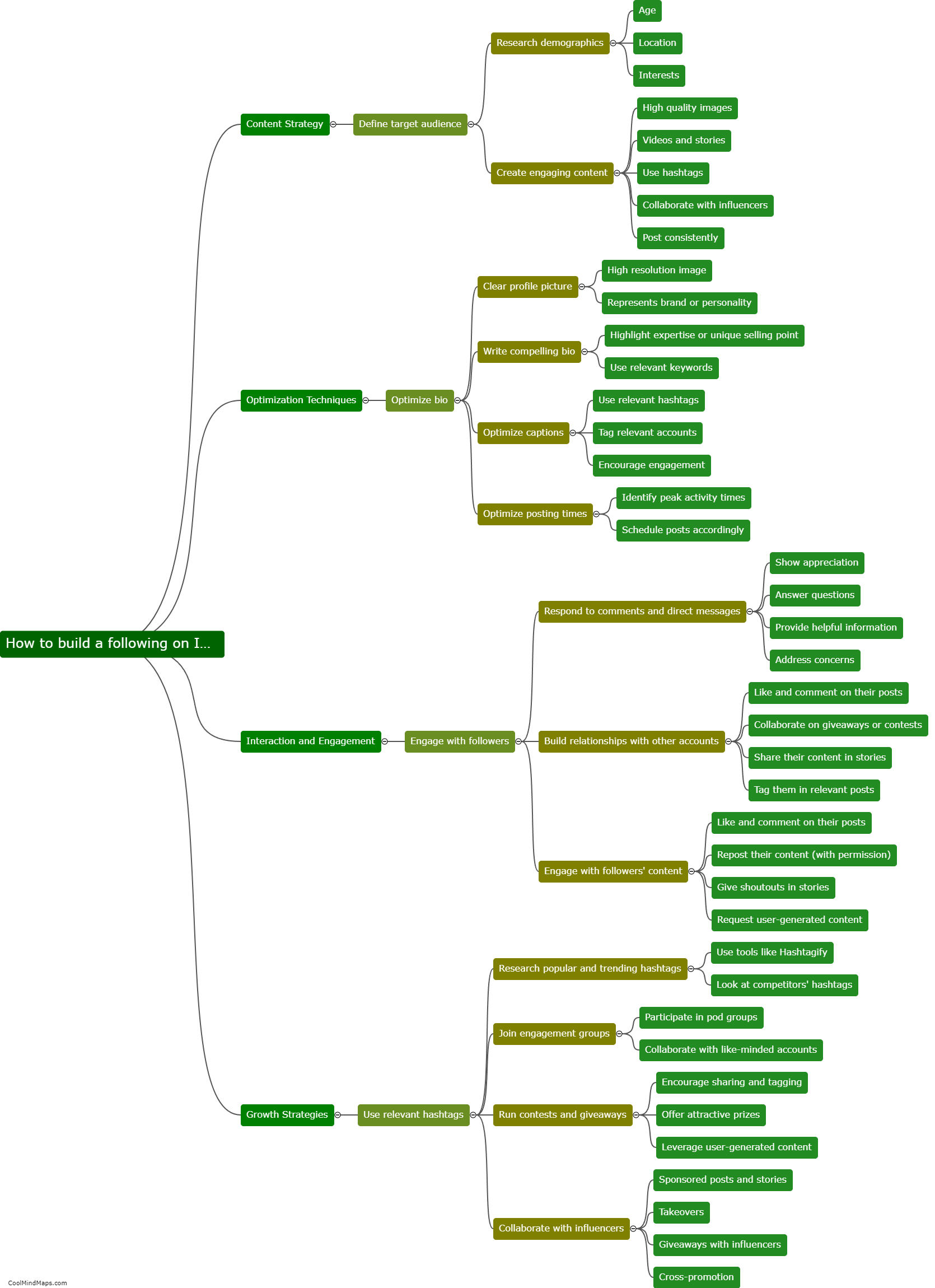

This mind map was published on 5 February 2024 and has been viewed 86 times.