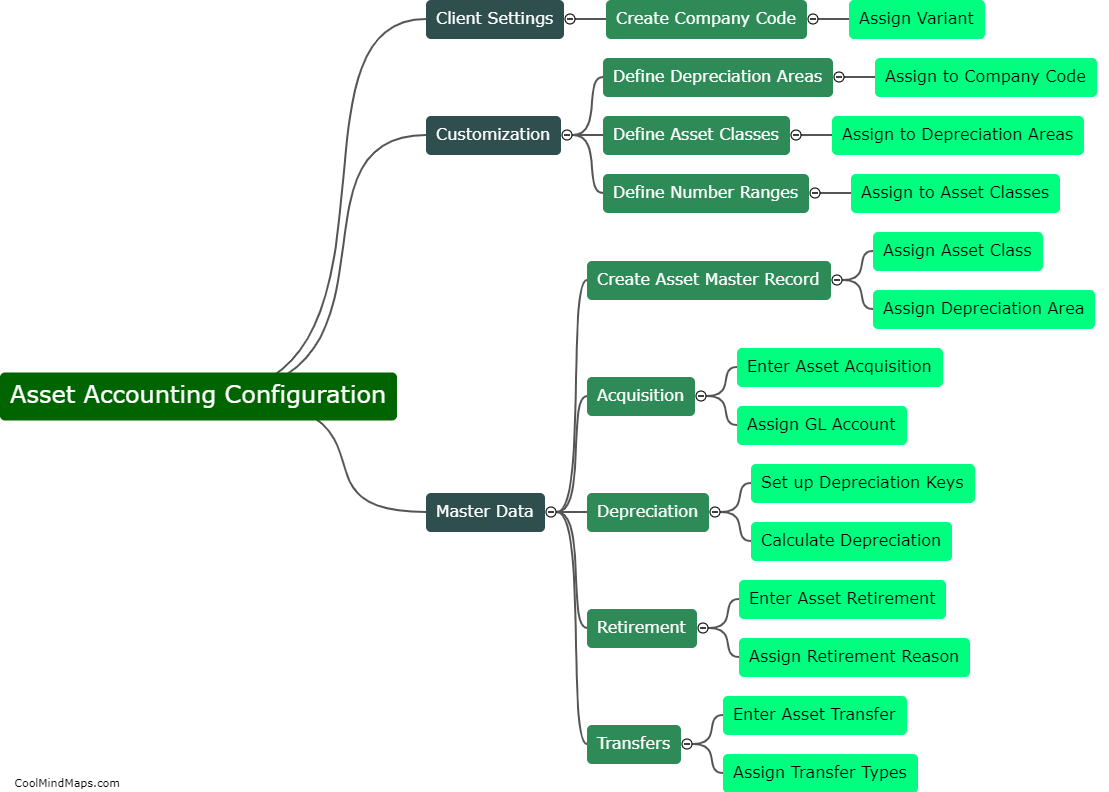

How to configure asset accounting in SAP?

To configure asset accounting in SAP, follow these steps: first, create an asset class in AO90 transaction with the required depreciation key, account determination, and screen layout. Then, assign the asset class to company code in OAYZ transaction. Next, create number ranges for assets in AS08 transaction. Afterwards, define the depreciation area in OADB transaction, specifying the relevant valuation methods and periods. Then, assign the depreciation area to the respective company code in OADB transaction. Lastly, define the chart of depreciation and assign it to the company code in SSAIMG transaction. Proper configuration of asset accounting in SAP enables you to record fixed asset transactions and track asset values, ensuring accurate financial reporting and compliance with regulatory requirements.

This mind map was published on 20 June 2023 and has been viewed 252 times.