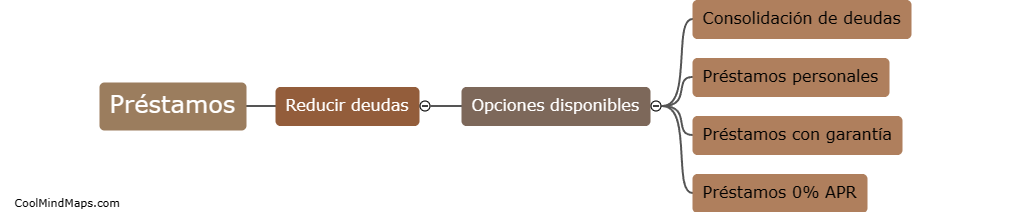

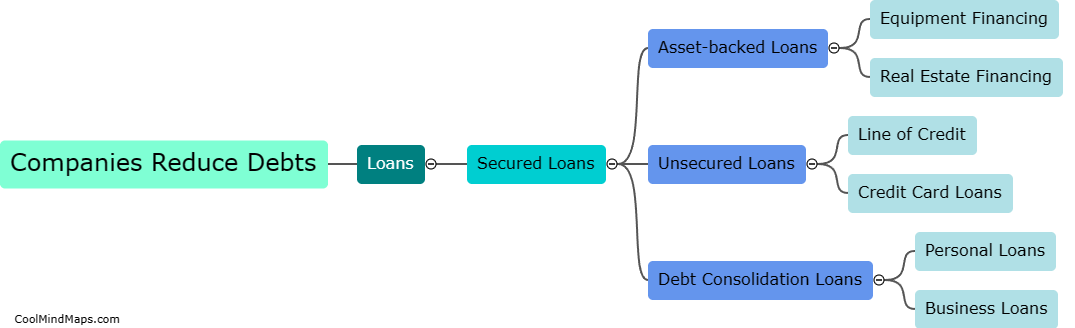

How do companies reduce debts through loans?

Companies often reduce their debts through loans by taking advantage of lower interest rates or more favorable terms offered by lenders. They can refinance existing debt by obtaining a new loan at a lower rate, allowing them to replace high-interest debt with more affordable options. Additionally, companies sometimes consolidate multiple debts into a single loan, reducing administrative burdens and potentially securing better terms. Loans can also enable businesses to generate immediate cash flow, which can be used to pay off outstanding debts. By strategically leveraging loans, companies can effectively manage and reduce their debts, providing a pathway towards financial stability and growth.

This mind map was published on 3 July 2023 and has been viewed 190 times.