What are the basic principles of financial accounting?

Financial accounting is guided by several basic principles that help ensure accuracy, transparency, and consistency in reporting financial information. The first principle is the accounting entity concept, which states that a business's finances should be separate from its owner's personal finances. The second principle is the going concern concept, which assumes that a company will continue to operate in the foreseeable future. The third principle is the monetary unit concept, which states that financial transactions should be recorded and reported in a stable currency. The fourth principle is the historical cost concept, which requires assets and liabilities to be recorded at their original purchase price. The fifth principle is the matching principle, which states that expenses should be matched with revenues in the period they are incurred. Lastly, the principle of conservatism guides accountants to be cautious and objective, particularly in uncertain situations, ensuring that financial statements are not overstated. These basic principles provide a solid foundation for financial accounting practices.

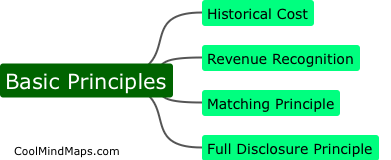

This mind map was published on 16 December 2023 and has been viewed 105 times.