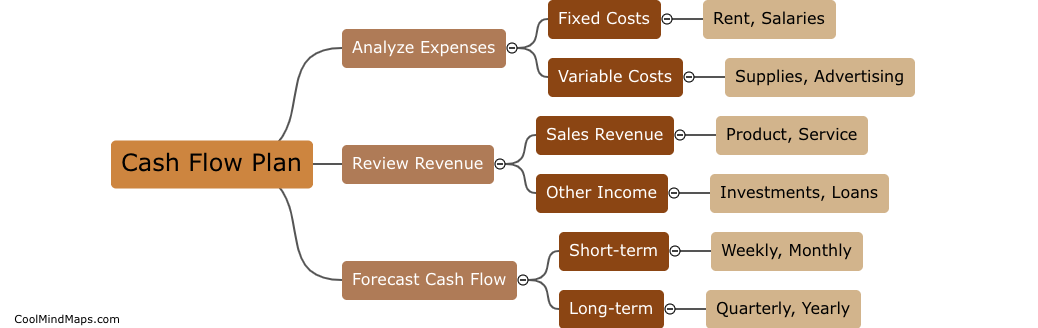

Why is cash flow planning important?

Cash flow planning is a crucial element to the financial success of any business. Without an accurate understanding of incoming and outgoing finances, businesses run the risk of running into cash flow problems. By planning cash flow, businesses can prepare for upcoming expenses, ensure they have enough cash on hand to meet financial obligations, and avoid being caught off guard by unexpected expenses. Additionally, cash flow planning provides insight into where money is being spent and can help identify areas where costs can be reduced. Overall, cash flow planning is essential for businesses to remain financially stable and avoid potential financial crises.

This mind map was published on 24 April 2023 and has been viewed 105 times.