How do too big to fail banks impact the economy?

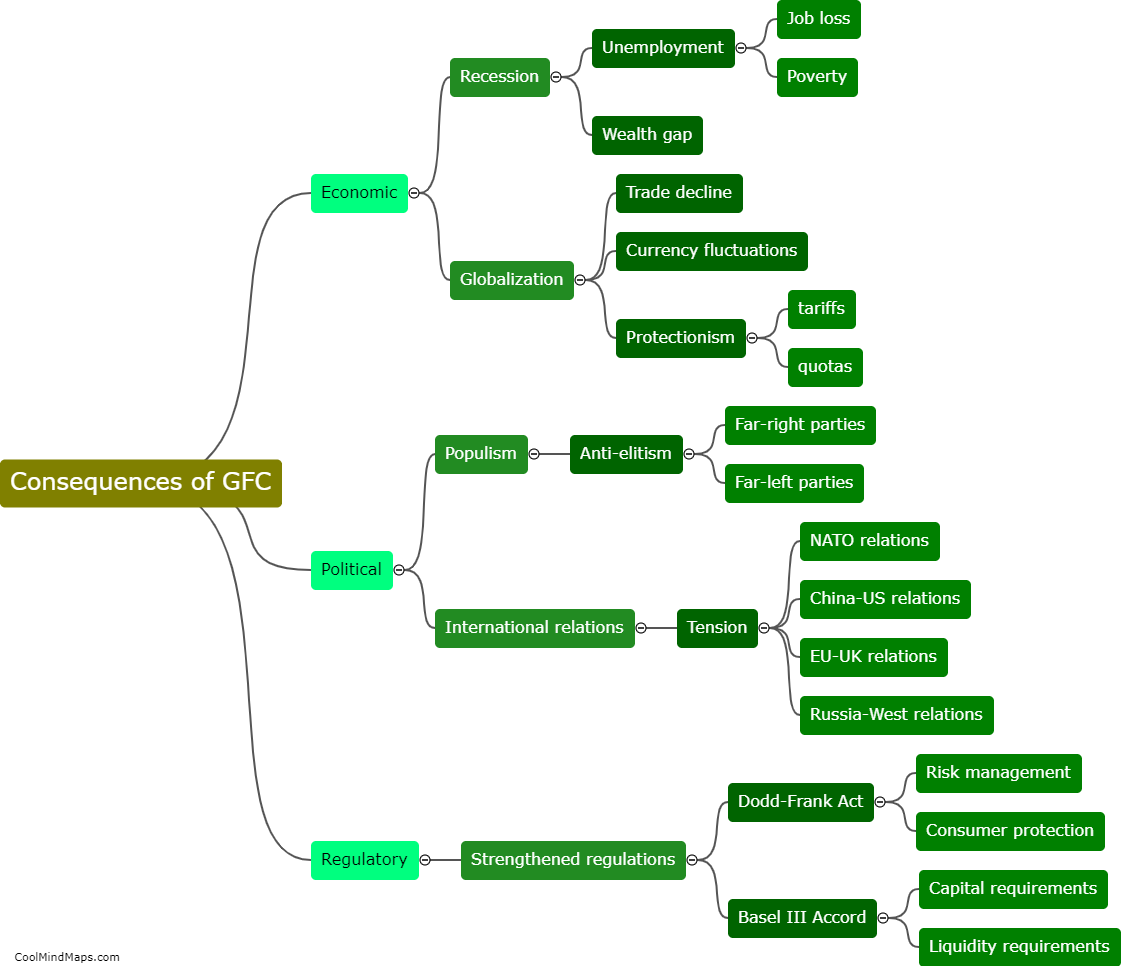

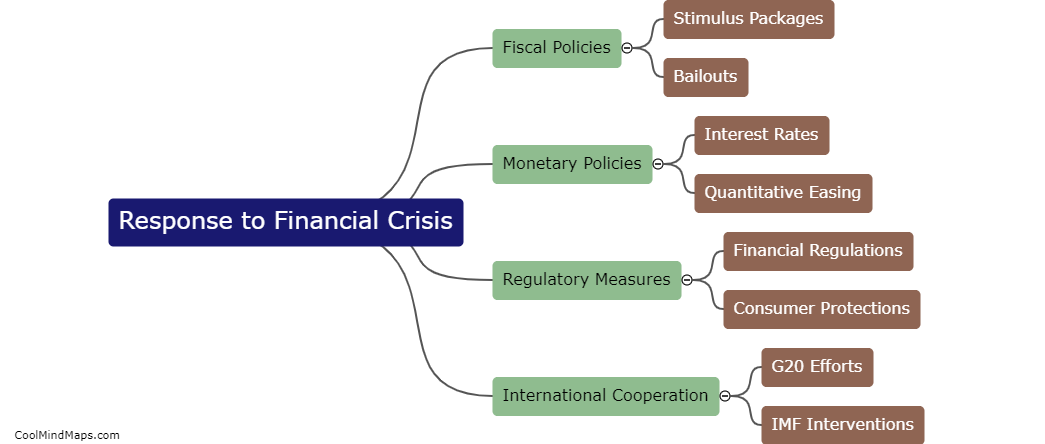

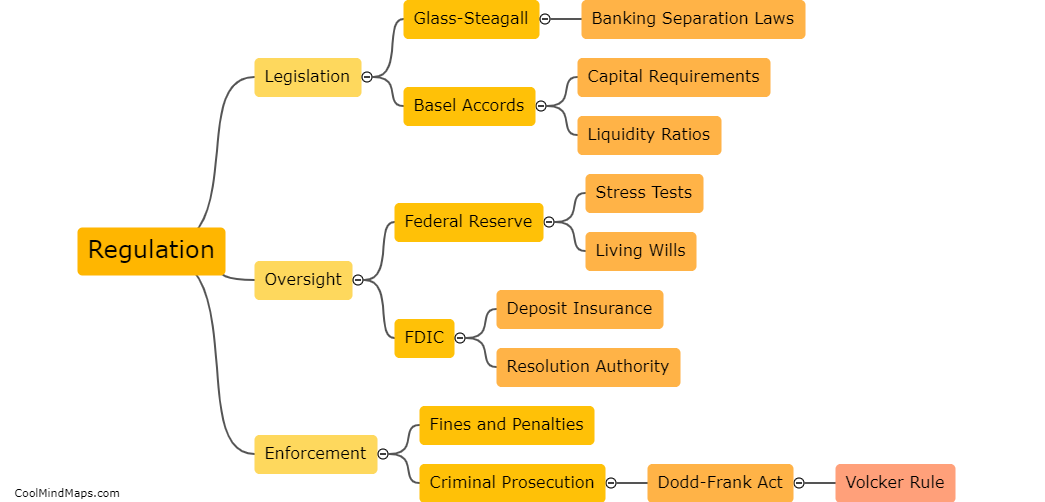

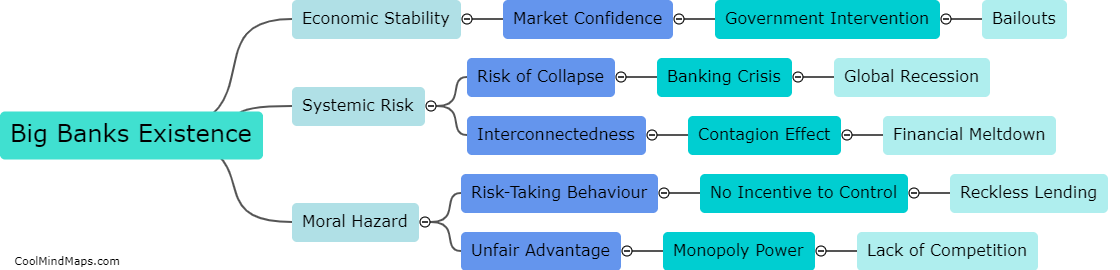

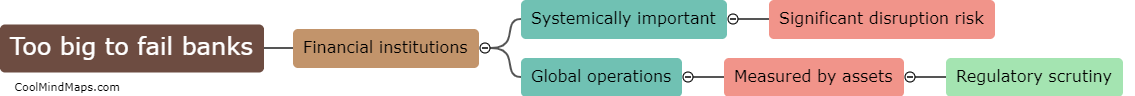

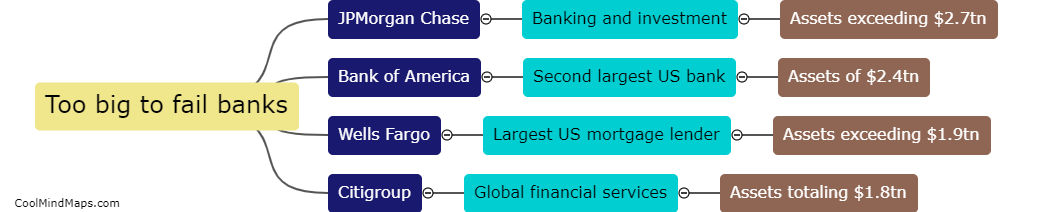

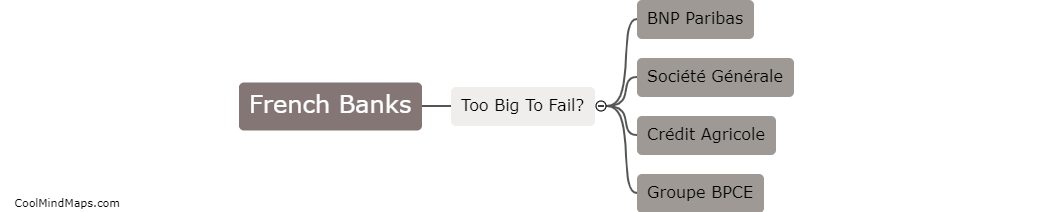

Too big to fail banks refer to large financial institutions whose collapse could have a catastrophic impact on the economy. The failure of such banks can lead to a domino-effect of defaults and bankruptcies in the financial system, causing a recession or even a depression. In order to avoid such a scenario, the government often provides bailouts or subsidies to these banks, which can distort market incentives and lead to a moral hazard wherein banks feel less accountable for their actions and may take on more risk. Additionally, these banks may have a larger influence on government policies and regulations, leading to a concentration of power in the financial sector. Overall, the existence of too big to fail banks can have negative consequences on the economy, including increased risk-taking and reduced competition, which can hinder innovation and growth.

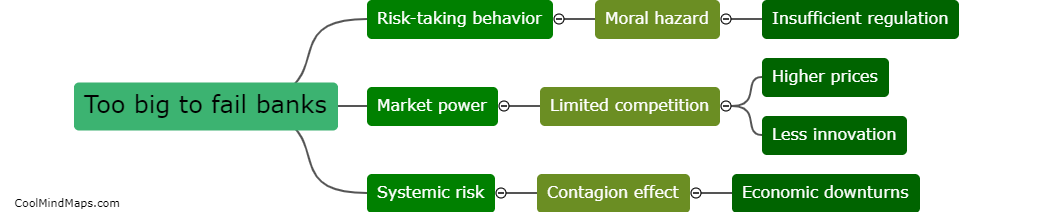

This mind map was published on 23 May 2023 and has been viewed 109 times.