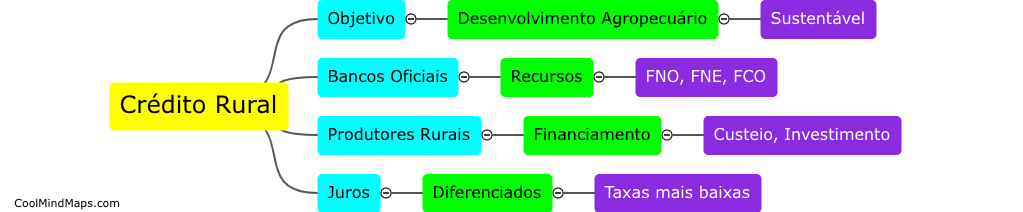

What is crédito rural?

Crédito rural is a financial mechanism designed to provide banking facilities and credit services to rural communities and individuals engaged in agricultural activities. It aims to improve the financial inclusion of farmers, landowners, and other rural groups by providing them with financial resources to sustain their agricultural production, marketing, and other business activities. Crédito rural often involves lending programs from government support agencies or agricultural banks, offering lower interest rates and longer repayment periods to make credit accessible for rural borrowers. Its main objective is to enhance rural livelihoods and foster sustainable agriculture development, by providing credit services to underserved rural communities.

This mind map was published on 21 April 2023 and has been viewed 305 times.