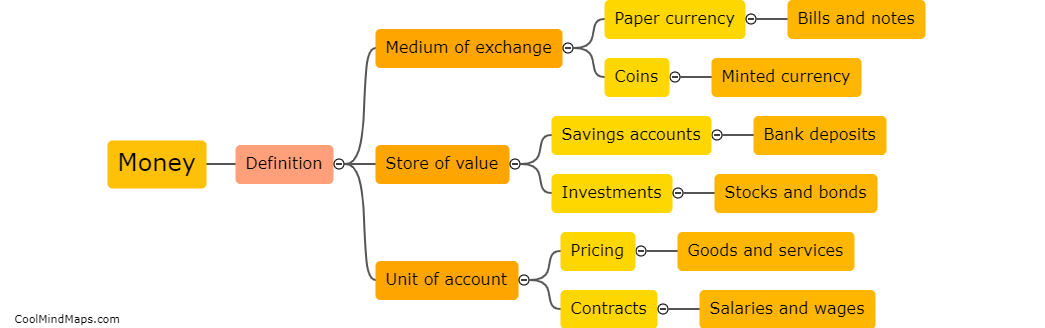

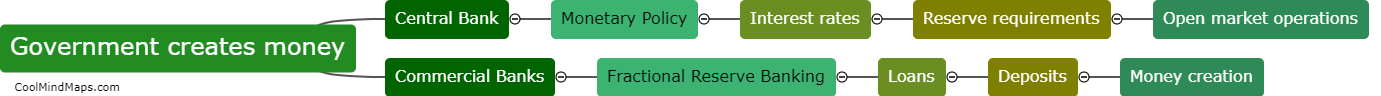

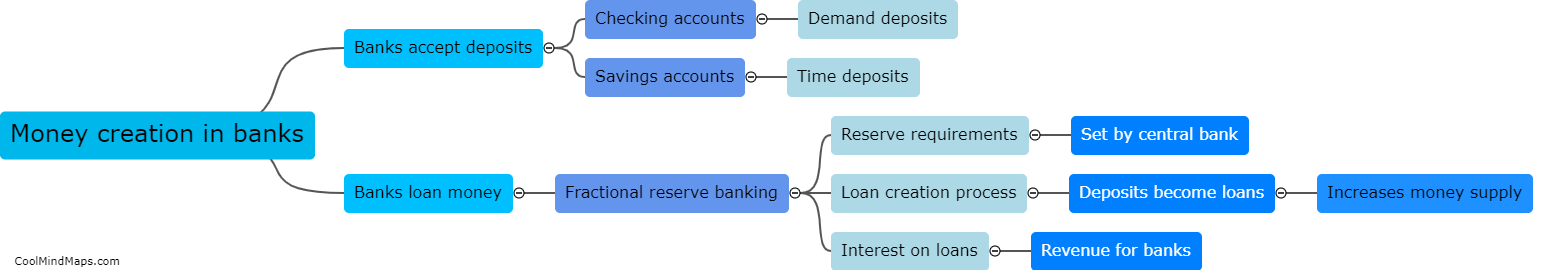

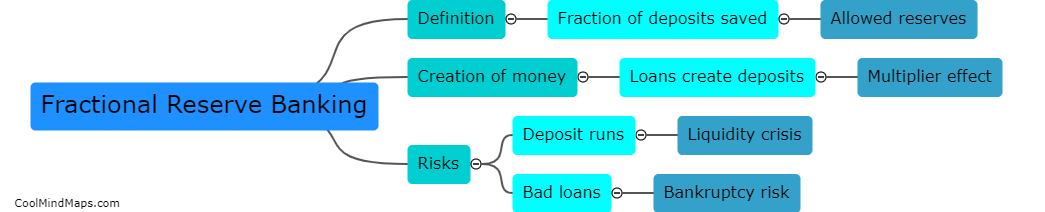

What is fractional reserve banking?

Fractional reserve banking is a banking system in which banks are required to keep a fraction of their deposited funds as reserves, while the rest can be used to lend to borrowers. This enables banks to create new money by issuing loans that are not backed by actual reserves. The reserve requirement is typically set by the central bank of a country to ensure the stability and safety of the banking system. However, this system also exposes banks to the risk of runs on deposits, as they may not have enough reserves to cover all depositors at once.

This mind map was published on 21 May 2023 and has been viewed 137 times.