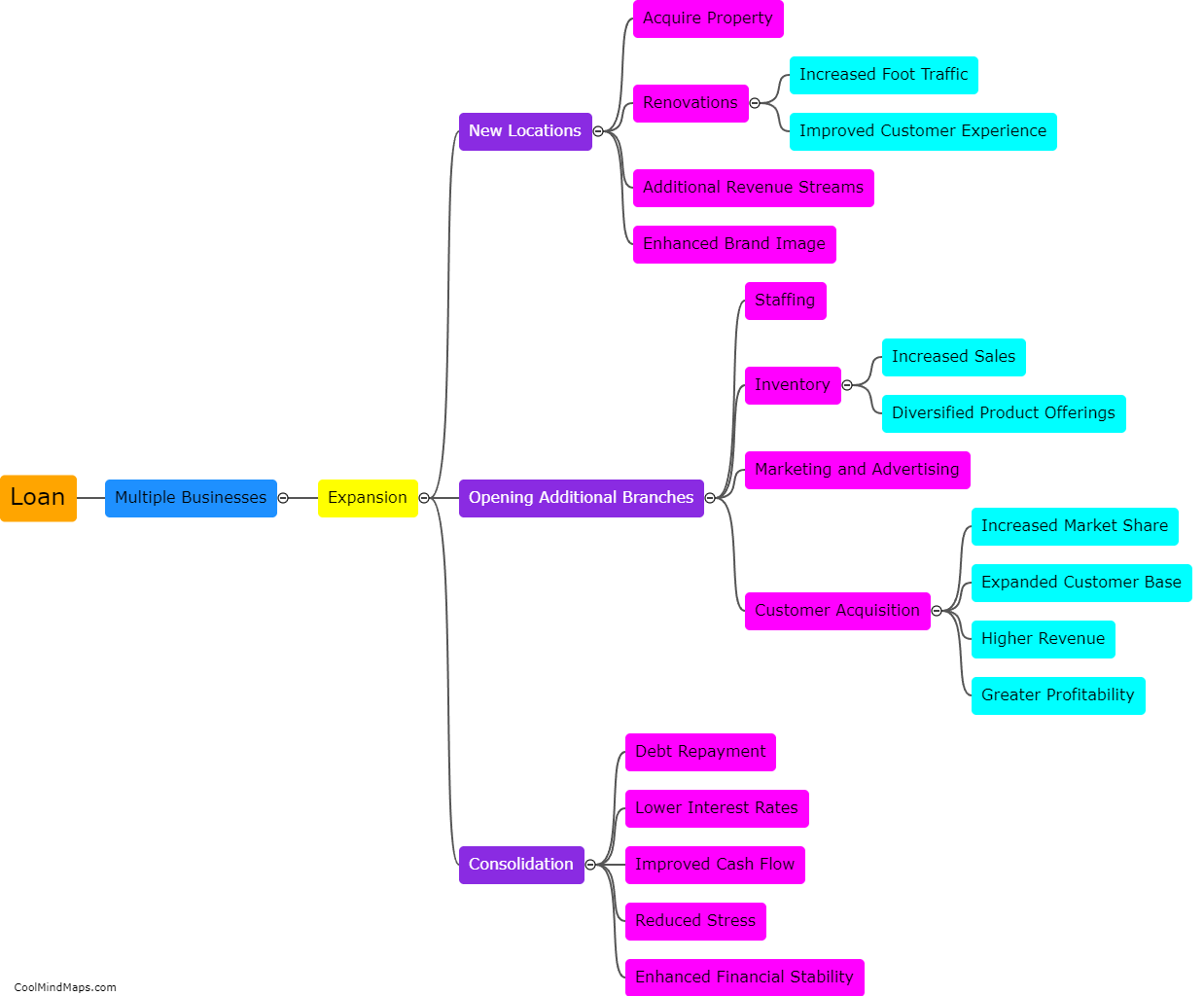

How can a loan be used to finance multiple businesses?

A loan can be used to finance multiple businesses by providing funds that can be distributed among different business ventures or projects. This approach allows an entrepreneur or investor to diversify their investments and minimize risk by allocating funds to different business opportunities. By securing a loan, they can access the necessary capital to start or expand multiple businesses simultaneously. This allows for more efficient use of funds and greater potential for profitability. However, it is crucial to assess the feasibility and profitability of each business venture before deciding how to allocate the loan proceeds in order to ensure that each business has the potential to generate sufficient revenue to repay the loan.

This mind map was published on 5 October 2023 and has been viewed 94 times.