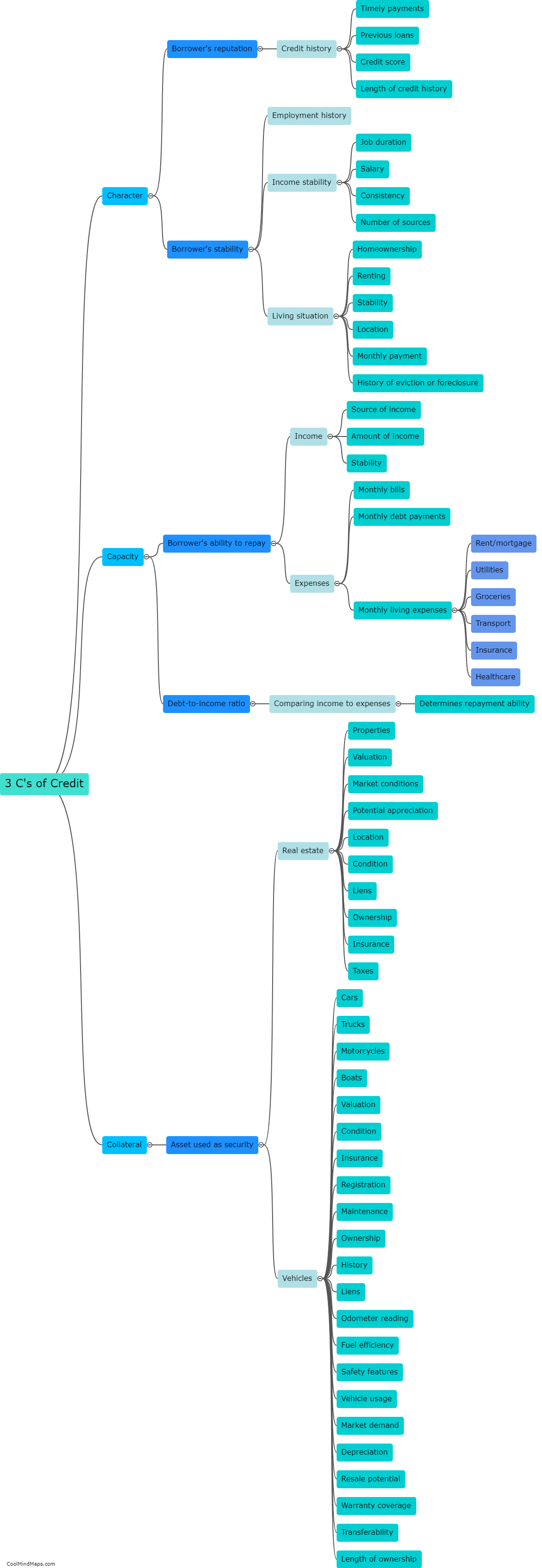

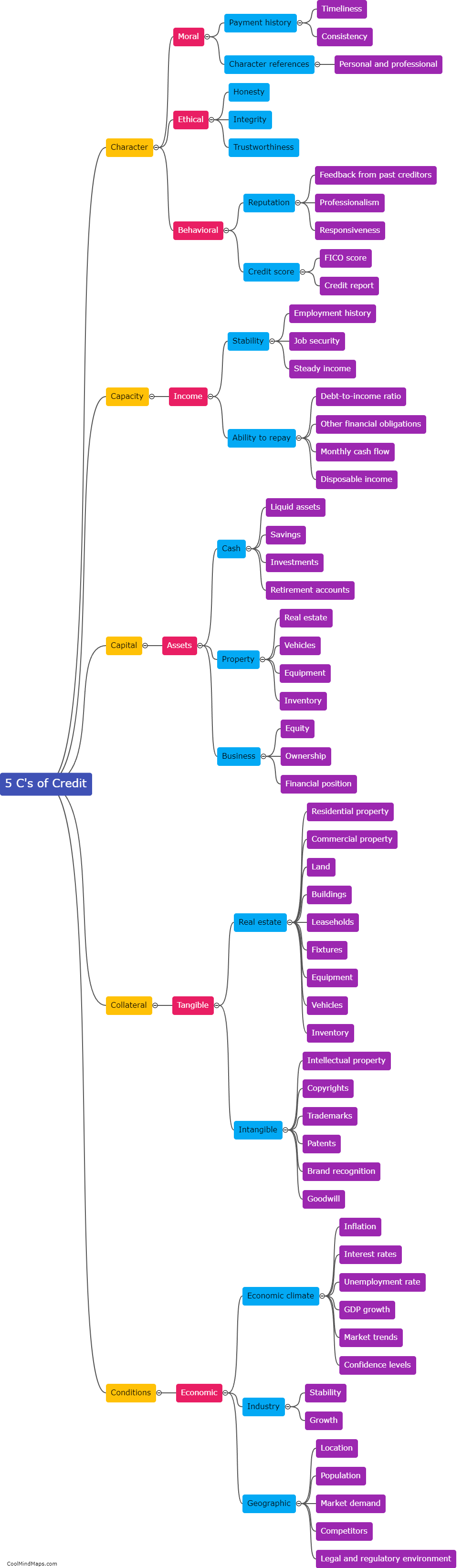

What are the 5 C's of credit?

The 5 C's of credit refer to the factors that lenders typically evaluate when determining a borrower's creditworthiness. These factors include character, capacity, capital, collateral, and conditions. Character assesses the borrower's reputation, integrity, and willingness to repay the loan. Capacity examines the borrower's ability to repay the debt by analyzing their income, expenses, and existing financial commitments. Capital refers to the borrower's financial reserves and investment in the business. Collateral involves the assets the borrower pledges to secure the loan. Finally, conditions refer to the external factors that could impact the borrower's ability to repay, such as the overall economic climate or industry-specific conditions. By considering these 5 C's, lenders can assess the risk associated with lending money and make informed decisions.

This mind map was published on 8 November 2023 and has been viewed 99 times.