What are the benefits of algo trading?

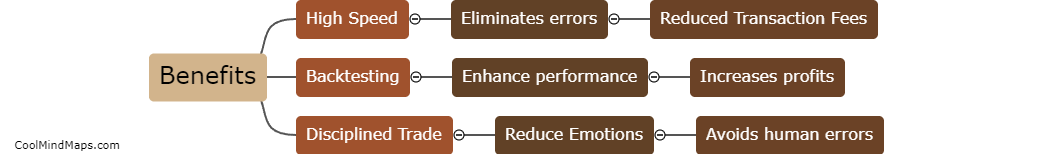

Algorithmic trading, or algo trading, involves the use of automated trading systems that execute orders based on pre-programmed instructions without the need for human intervention. The benefits of algo trading can be significant for traders and investors, including faster and more precise trade execution, reduced transaction costs, improved risk management, and increased trading volume. Additionally, algo trading can help eliminate emotional bias from trading decisions and potentially generate higher returns by exploiting market inefficiencies. Overall, the use of algo trading can provide a competitive edge in the fast-paced world of financial markets.

This mind map was published on 7 June 2023 and has been viewed 95 times.