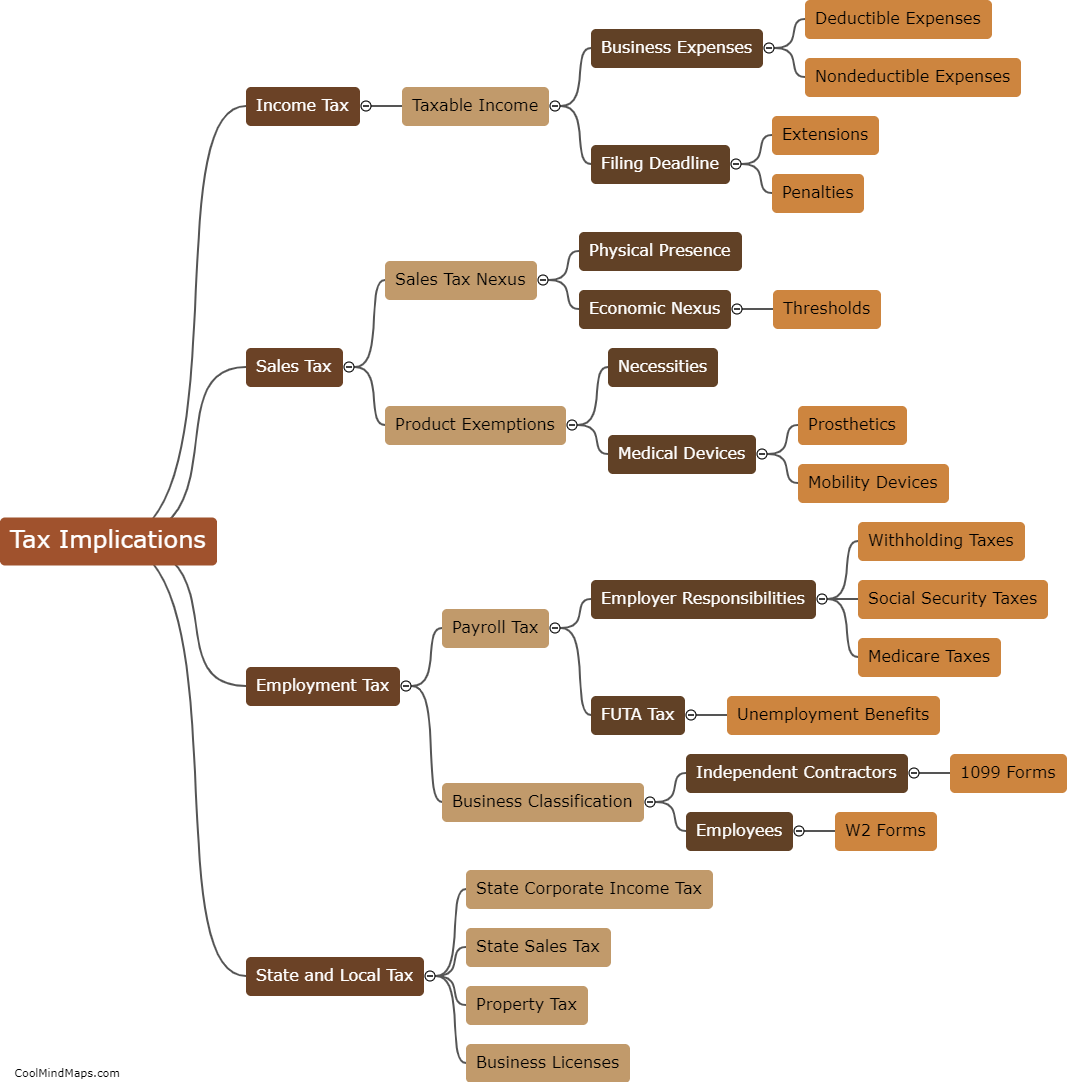

What are the tax implications for small businesses?

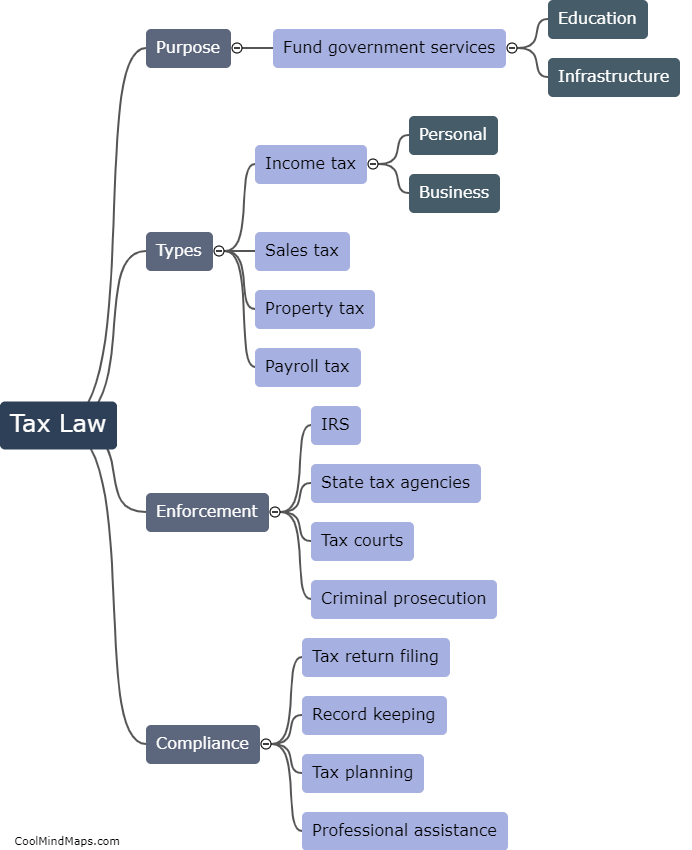

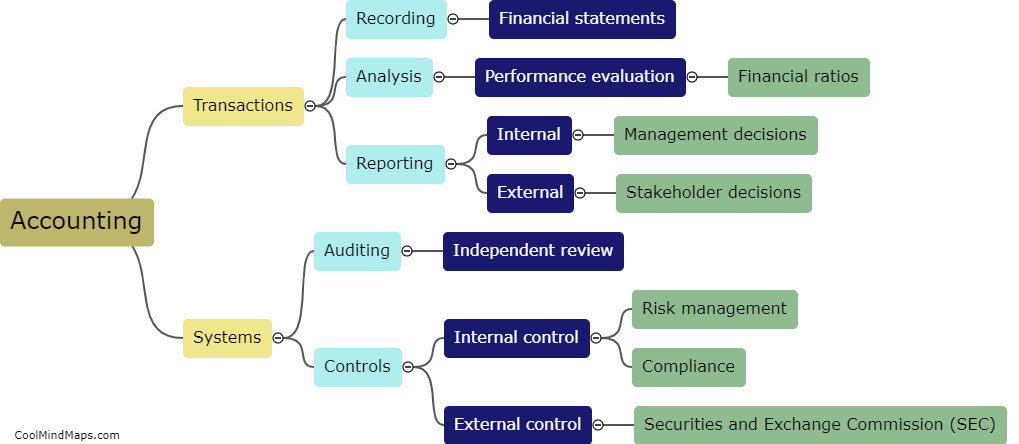

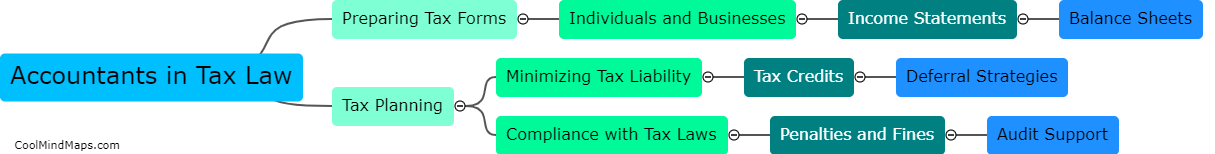

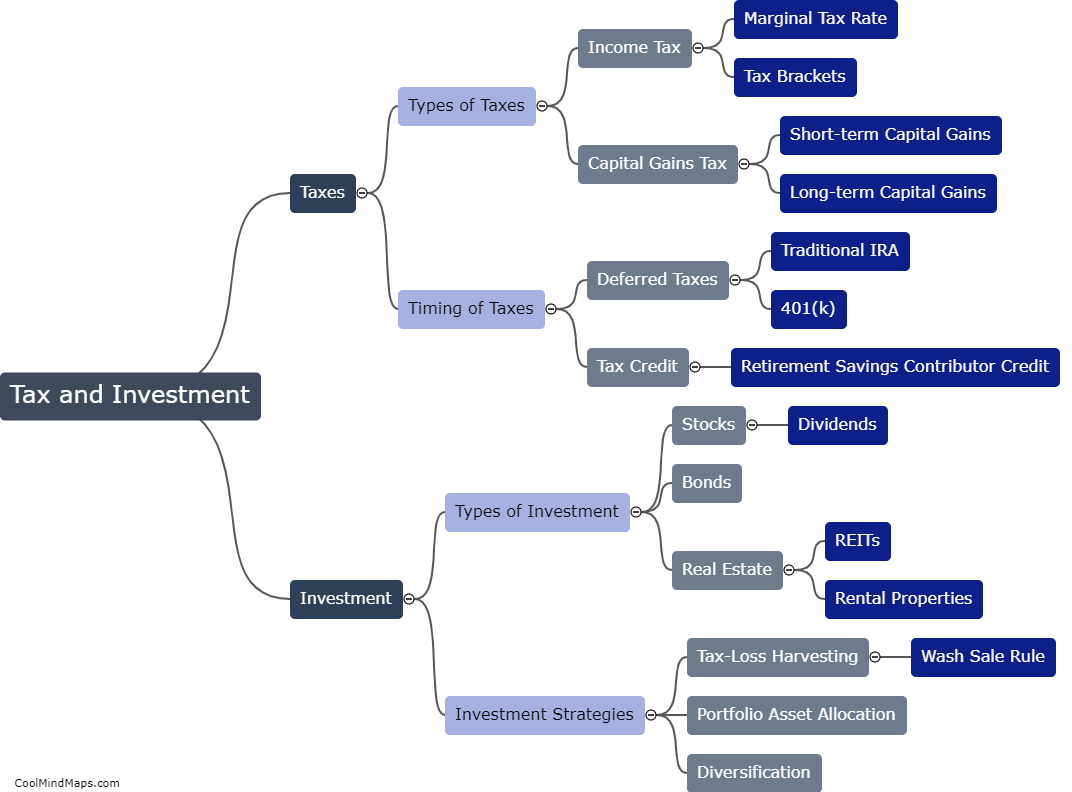

Small businesses are subject to various taxes, including income tax, payroll tax, sales tax, and property tax. The taxes that a small business is required to pay depend on several factors, such as its business structure, the type of goods or services it provides, and its location. There are also various deductions and credits available to small businesses, such as the home office deduction and startup expenses deduction. It is important for small business owners to understand their tax obligations and to keep accurate records of their income and expenses to avoid any potential penalties or fines.

This mind map was published on 18 April 2023 and has been viewed 98 times.