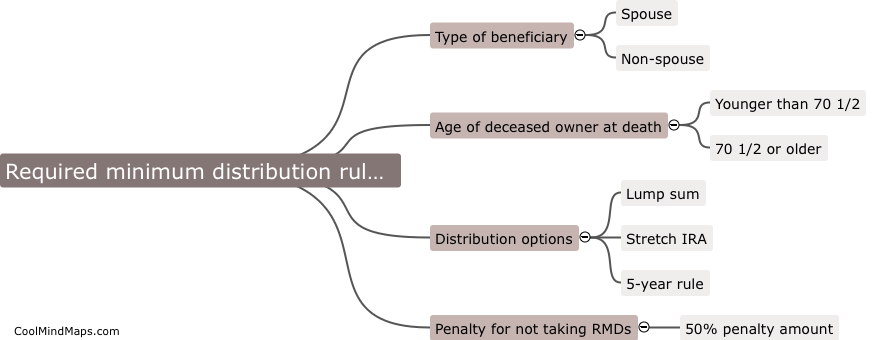

What are the required minimum distribution rules for inherited IRAs?

The required minimum distribution rules for inherited IRAs depend on the relationship of the beneficiary to the original account holder. Spouses who inherit an IRA have the option to treat it as their own and can delay distributions until they reach the age of 72. However, non-spouse beneficiaries must start taking required minimum distributions based on their life expectancy, or within 10 years of the original account holder's death under the SECURE Act. Failing to comply with these rules can result in penalties and taxes on the inherited IRA distributions.

This mind map was published on 31 July 2024 and has been viewed 68 times.