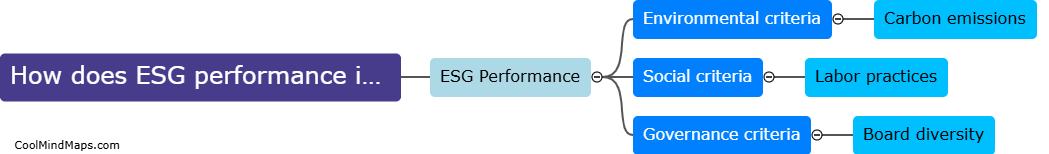

How does ESG performance impact financial distress?

Environmental, Social, and Governance (ESG) performance can significantly impact a company's financial distress. Companies with strong ESG practices tend to have better risk management, higher brand reputation, and improved relationships with their stakeholders. These factors can lead to reduced operational costs, increased revenues, and better access to capital, ultimately reducing the likelihood of financial distress. On the other hand, companies with poor ESG performance may face higher costs related to environmental fines, lawsuits, and regulatory compliance, as well as reputational damage that can negatively impact their financial stability. In summary, strong ESG performance can help mitigate financial distress, while weak ESG performance can exacerbate it.

This mind map was published on 25 October 2024 and has been viewed 26 times.