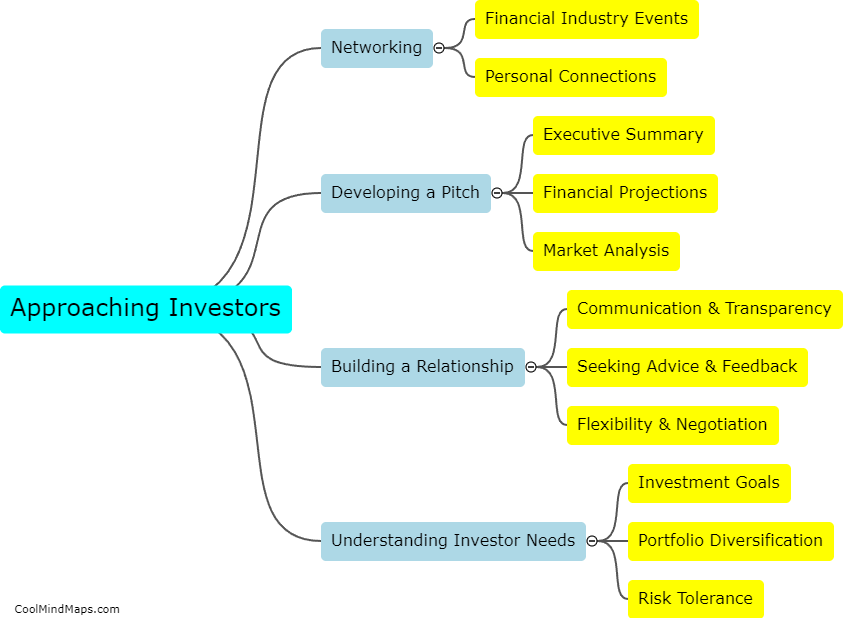

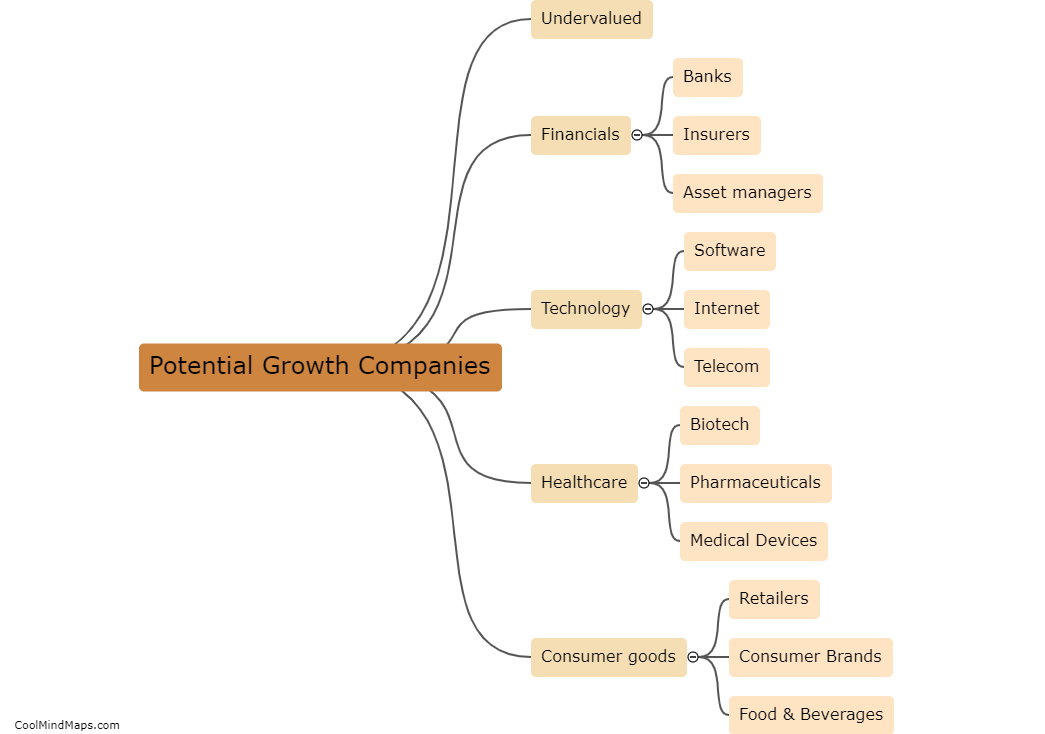

Which companies are undervalued and ripe for potential growth?

Determining which companies are undervalued and ripe for potential growth requires a deep understanding of the market, industry trends, financial metrics, and the company's inherent strengths and weaknesses. Some industries that show growth potential include technology, healthcare, and renewable energy. Focusing on companies with sustainable revenue growth, strong balance sheets, and reasonable valuations can provide a good starting point for identifying undervalued stocks. However, it is important to conduct thorough research and analysis before making investment decisions as the market is constantly evolving and unpredictable.

This mind map was published on 11 June 2023 and has been viewed 110 times.