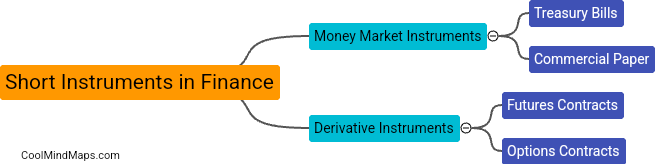

What are short instruments in finance?

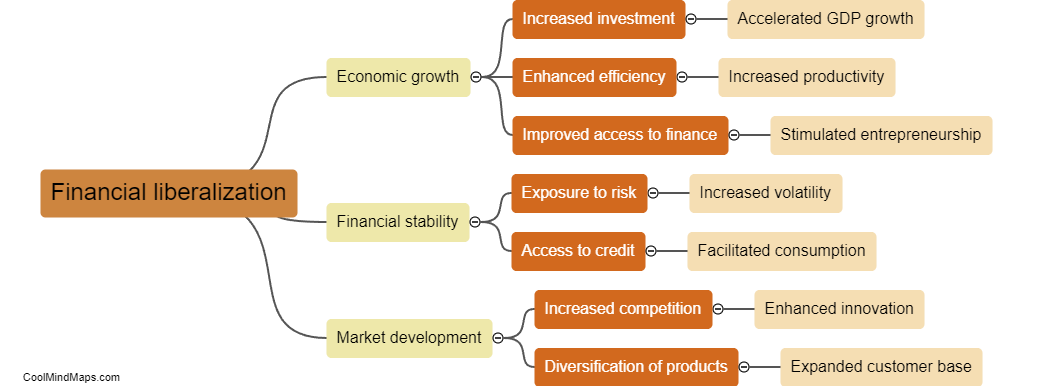

Short instruments in finance refer to investment vehicles that have a maturity period of less than one year. These instruments are used by investors to earn quick returns on their investments or to park funds temporarily while they assess other investment opportunities. Examples of short instruments include short-term treasury bills, commercial paper, and money market instruments. Short instruments offer a low risk profile compared to longer-term investments, but typically provide lower returns due to their short maturity period. Investors often use short instruments as a way to diversify their portfolio and maintain liquidity in their investments.

This mind map was published on 11 June 2024 and has been viewed 110 times.