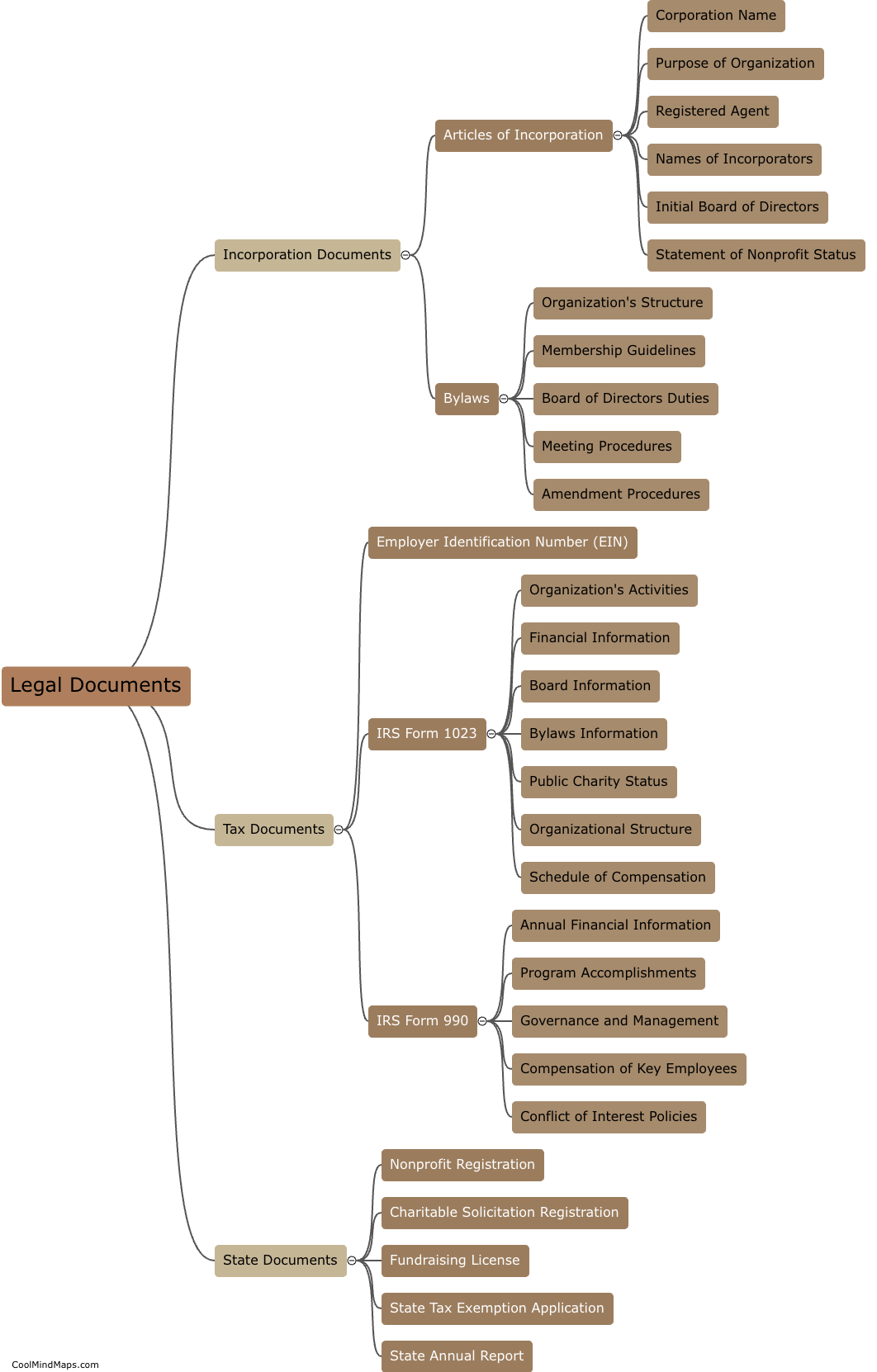

How can I apply for tax-exempt status?

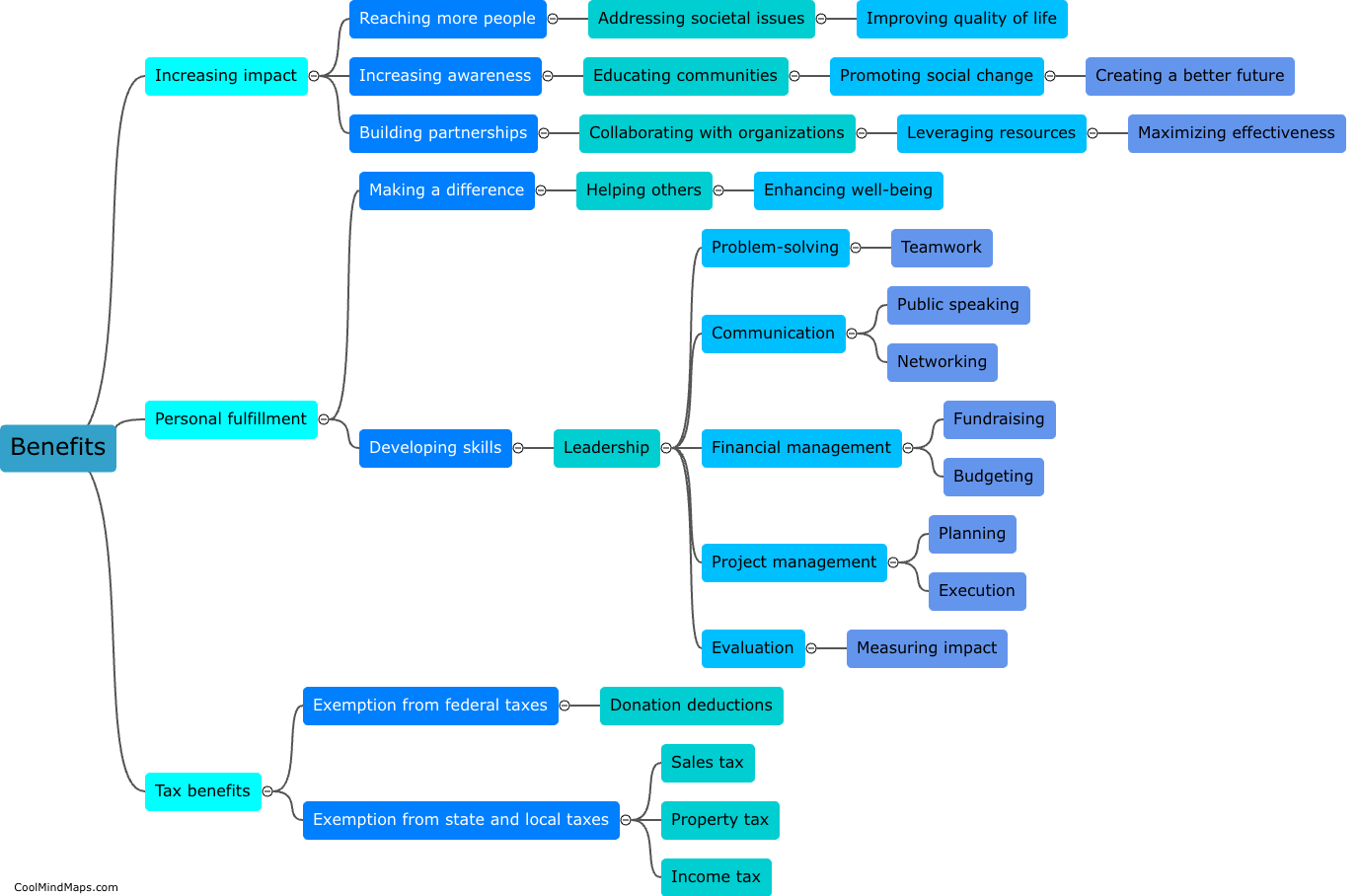

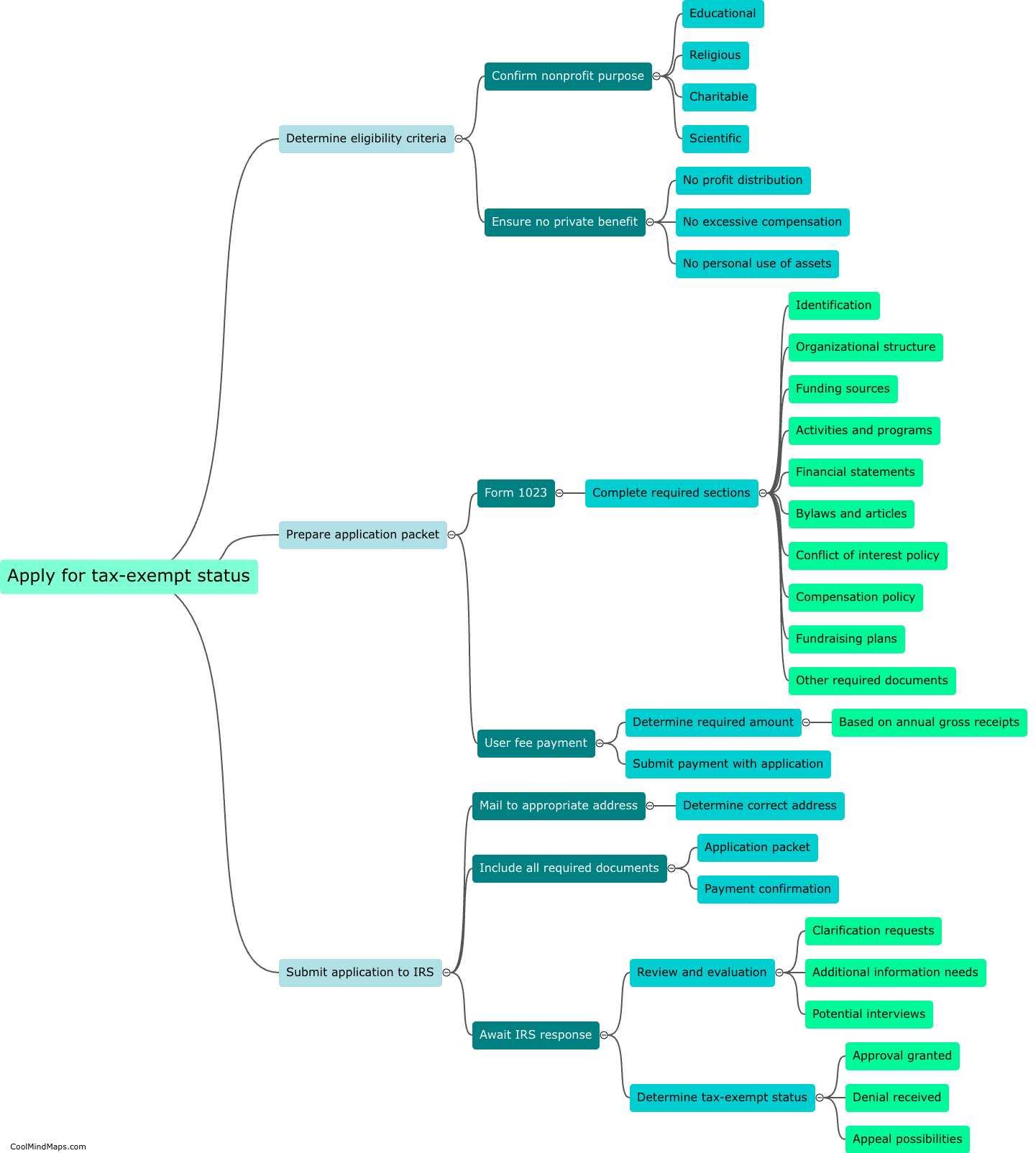

To apply for tax-exempt status, you will need to follow certain steps and meet certain requirements. Firstly, determine which type of tax-exempt organization you qualify for, such as a charitable, educational, or religious organization. Next, you will need to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). Then, you must fill out and submit Form 1023 or Form 1023-EZ, depending on your organization's size and income. These forms require you to provide detailed information about your organization's purpose, activities, finances, and governance. Additionally, you may need to attach supporting documents, such as bylaws, articles of incorporation, and financial statements. Once submitted, the IRS will review your application and may request additional information or clarification. If approved, you will receive a determination letter granting your tax-exempt status, allowing you to enjoy certain tax benefits and exemptions. It is advisable to consult with a tax professional or an attorney familiar with nonprofit tax laws to ensure you complete the application process accurately and efficiently.

This mind map was published on 19 August 2023 and has been viewed 97 times.