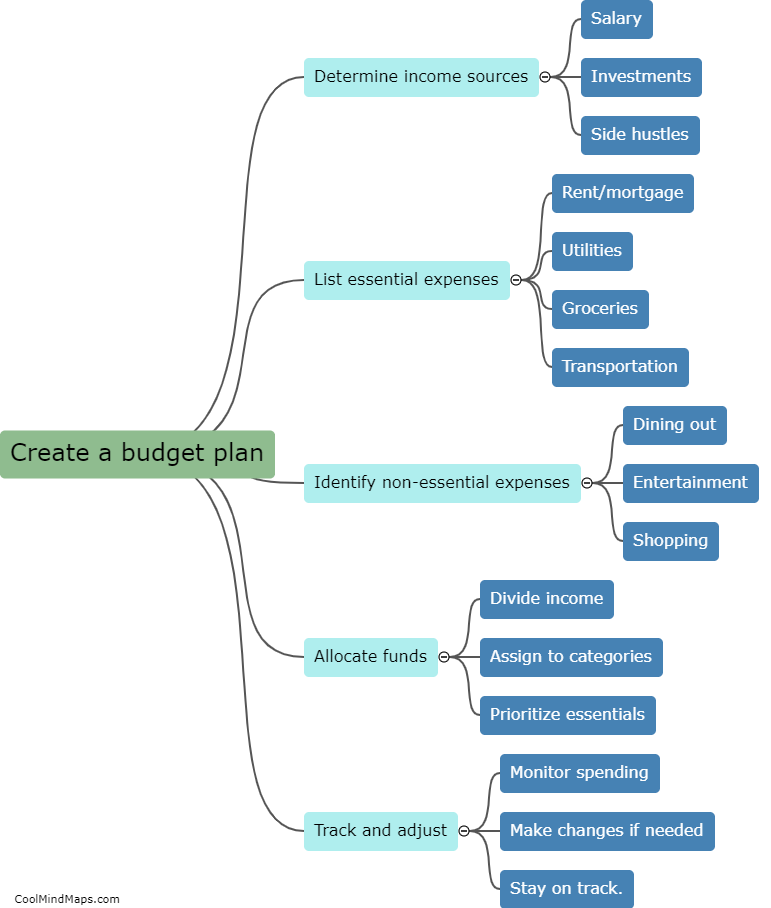

How to create a budget plan?

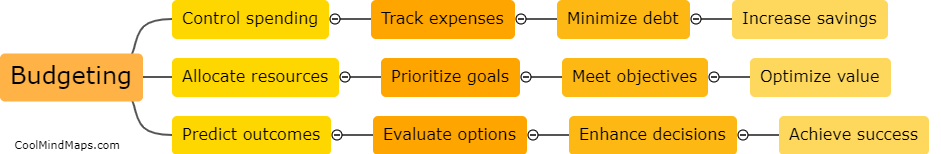

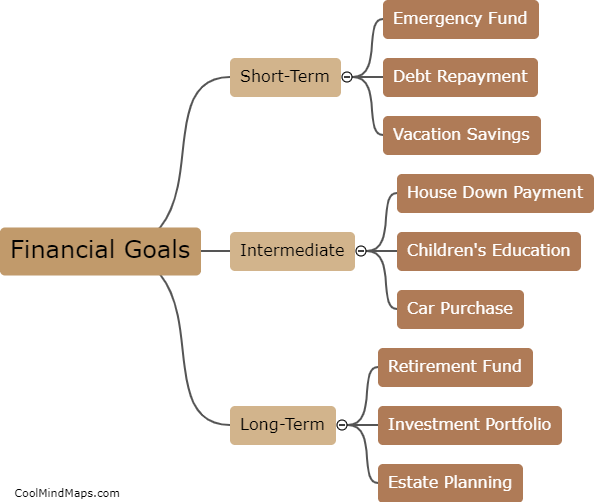

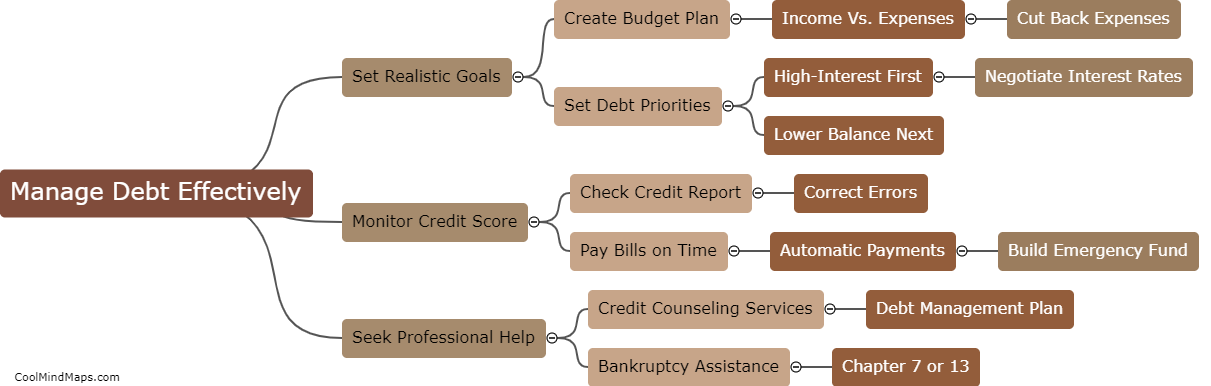

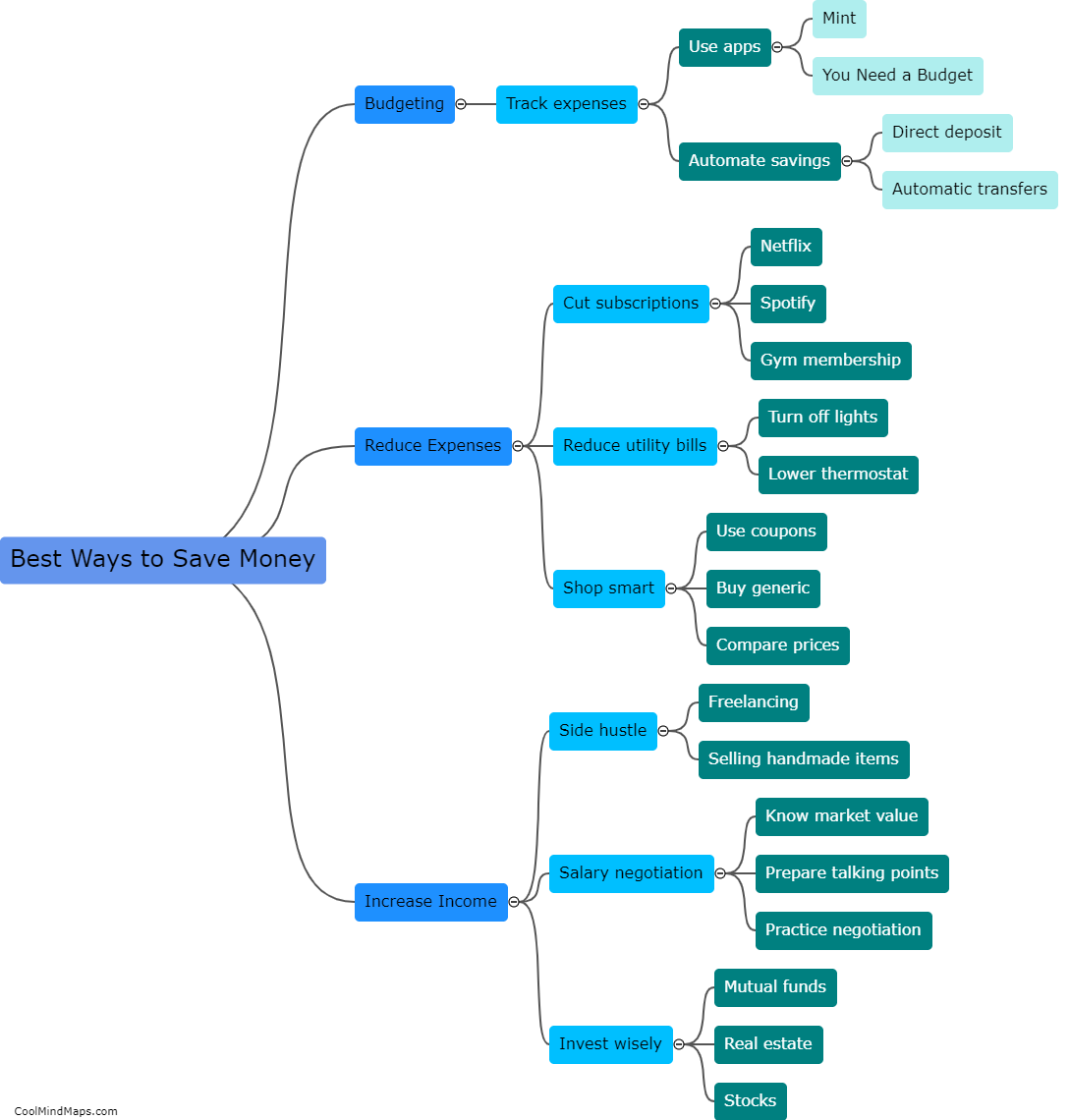

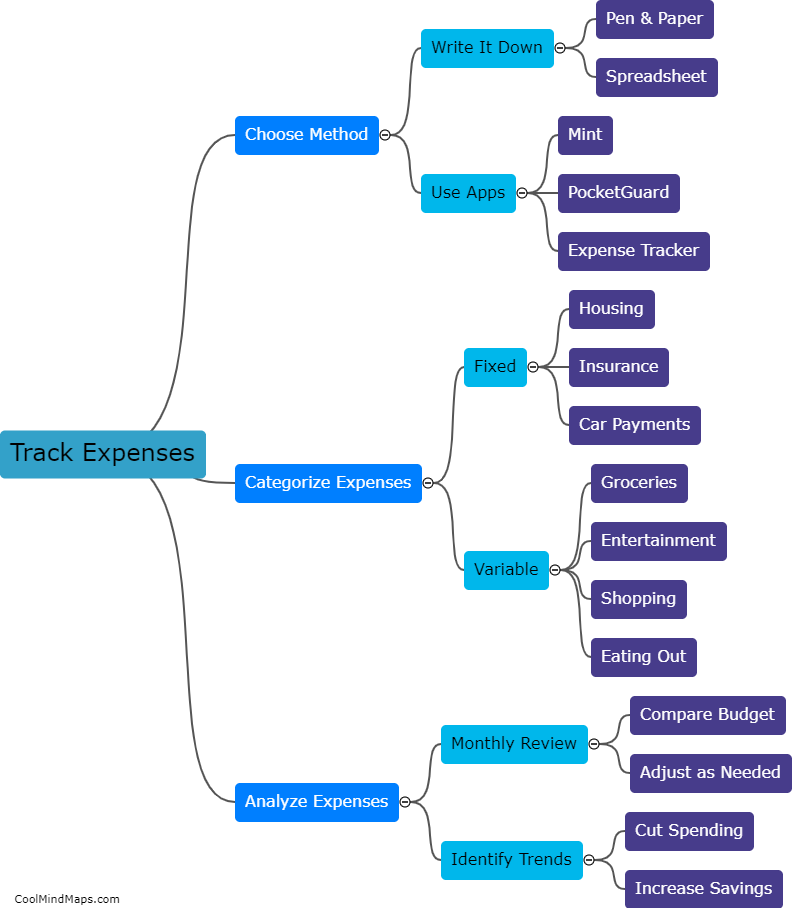

Creating a budget plan is an important task that helps individuals or households to manage their finances efficiently. The first step in creating a budget plan is to determine the monthly income and expenses. This includes tracking all sources of income, including salary, dividends, and bonuses. It is also important to track all monthly expenses, including rent, bills, groceries, entertainment, and other miscellaneous expenses. There are several budgeting tools available in the market that can help to create a budget plan, including spreadsheets, budgeting apps, or software. Once the monthly expenses and income are determined, it is essential to allocate the funds wisely and prioritize essential needs. It is also important to set financial goals, such as saving for an emergency fund, paying off debts, or saving for a vacation, and adjust the budget plan accordingly. Finally, it is essential to review and revise the budget plan regularly to ensure that it is still relevant and effective.

This mind map was published on 17 April 2023 and has been viewed 99 times.