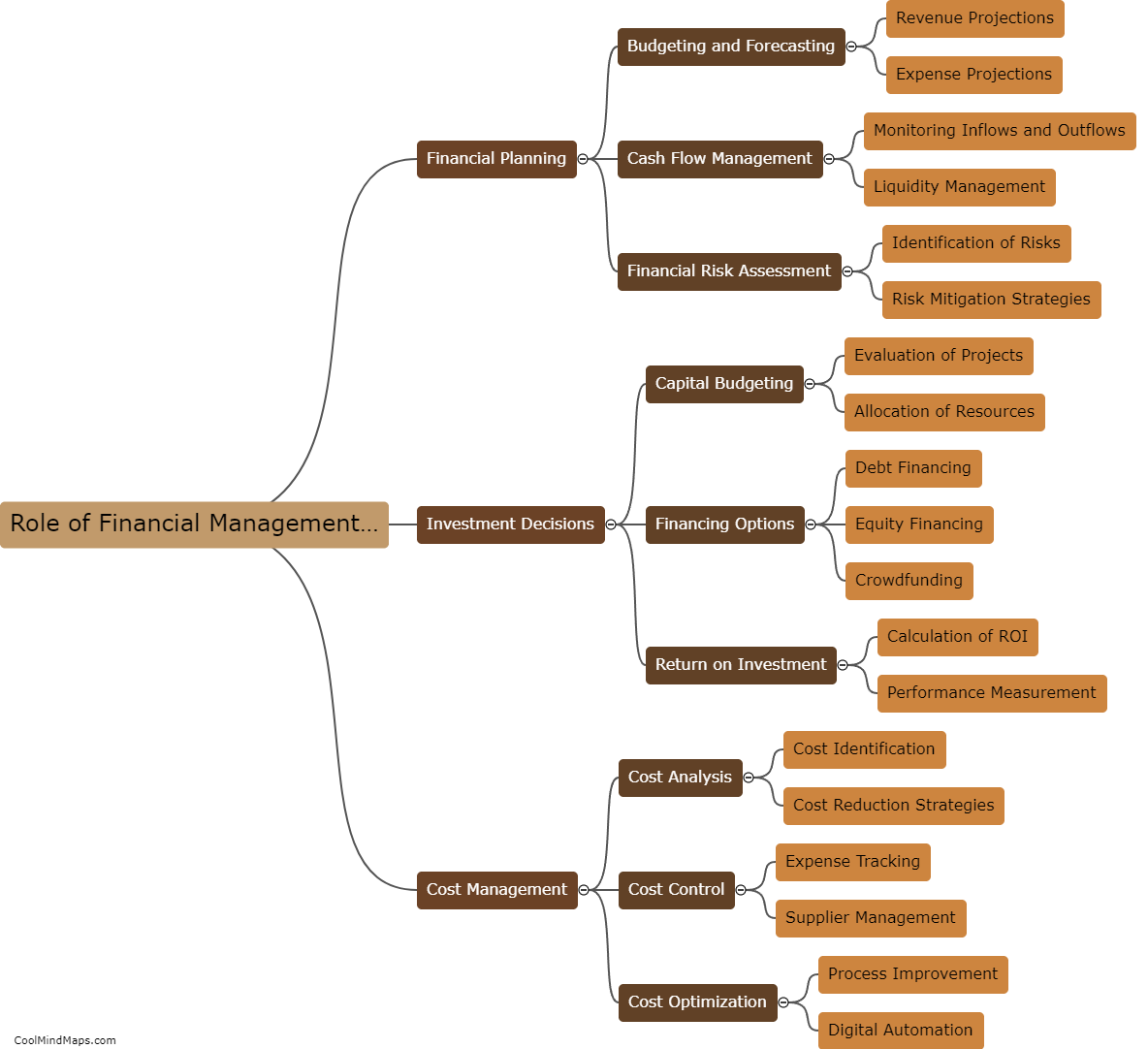

How can digital businesses effectively manage their finances?

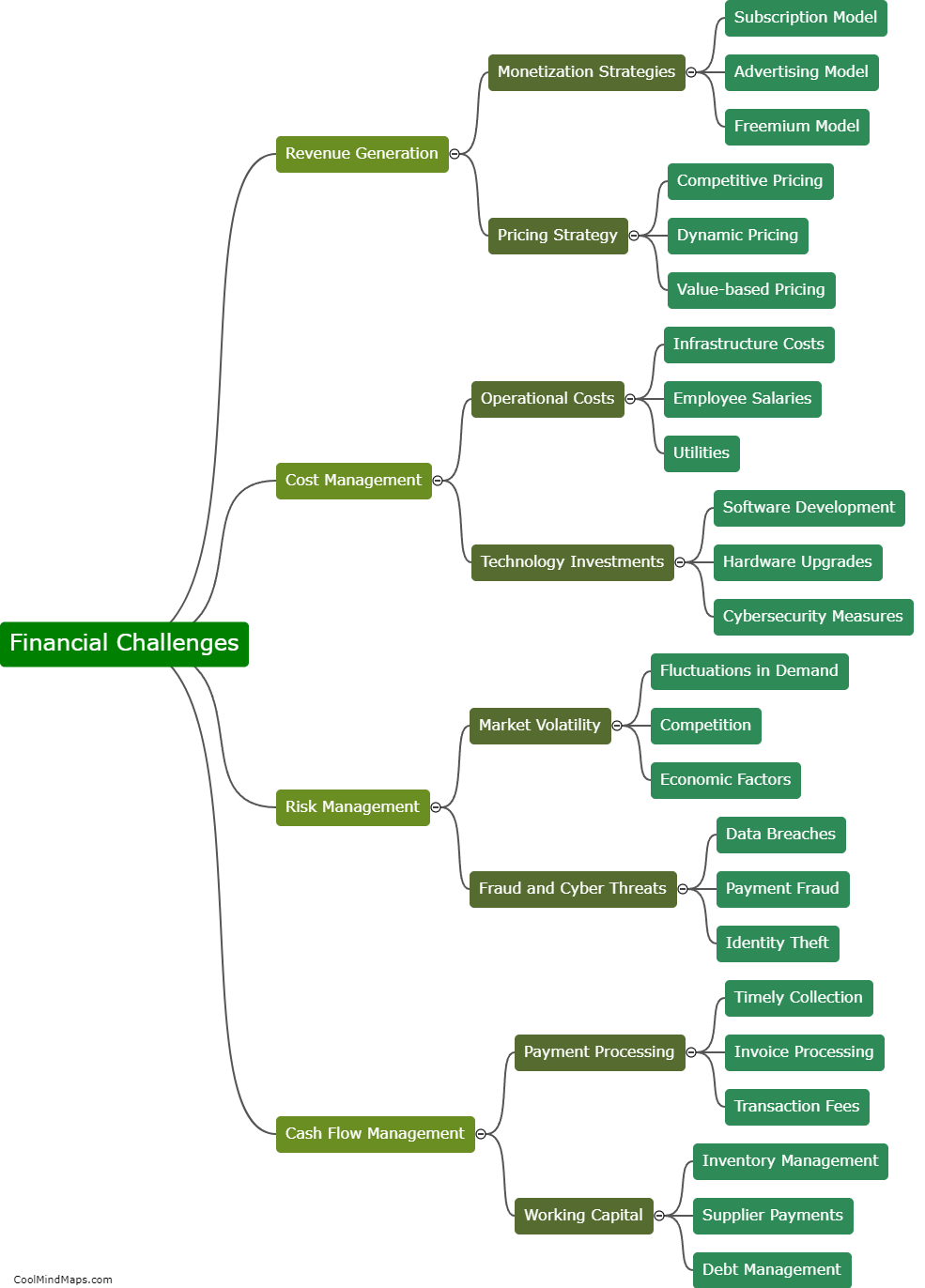

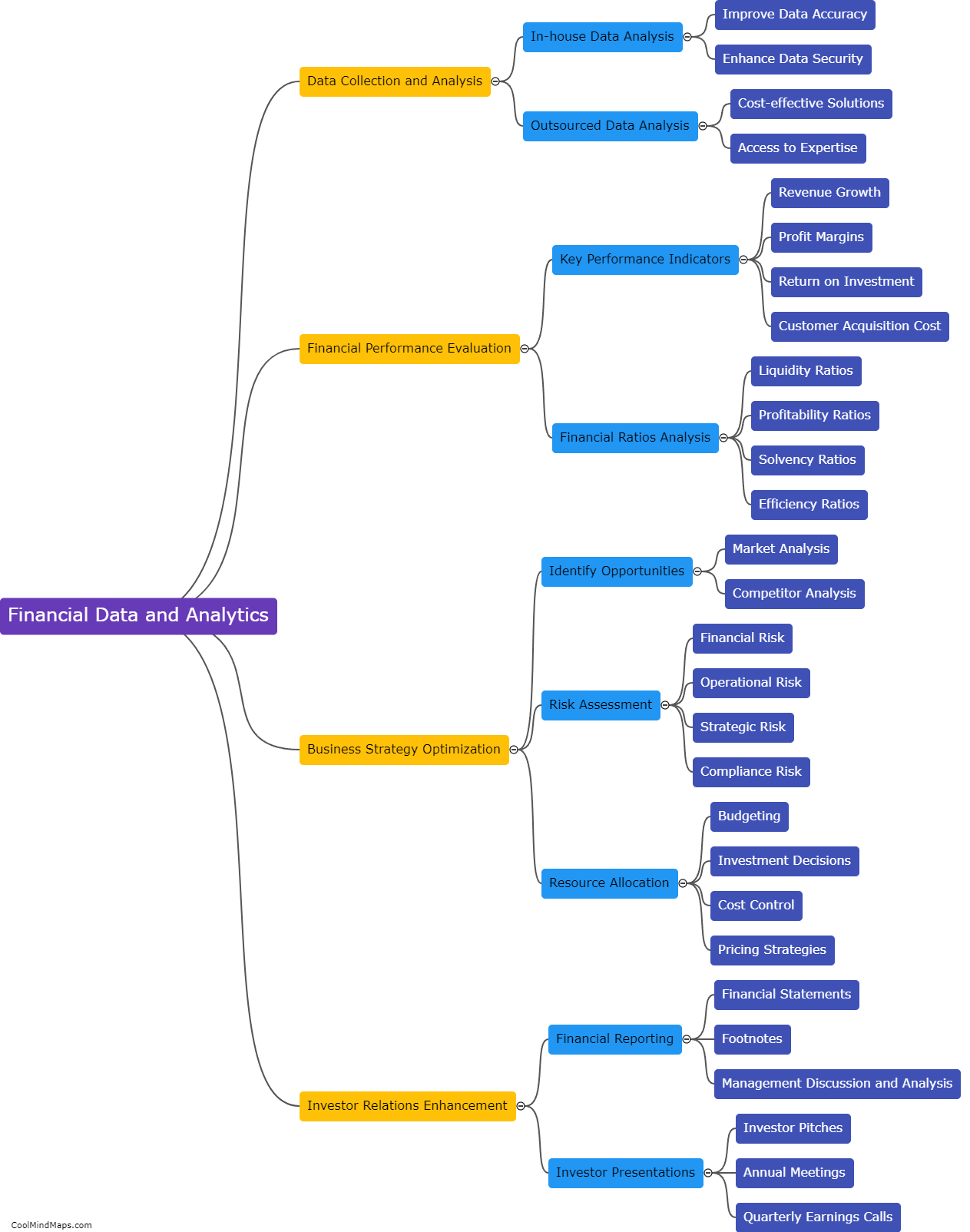

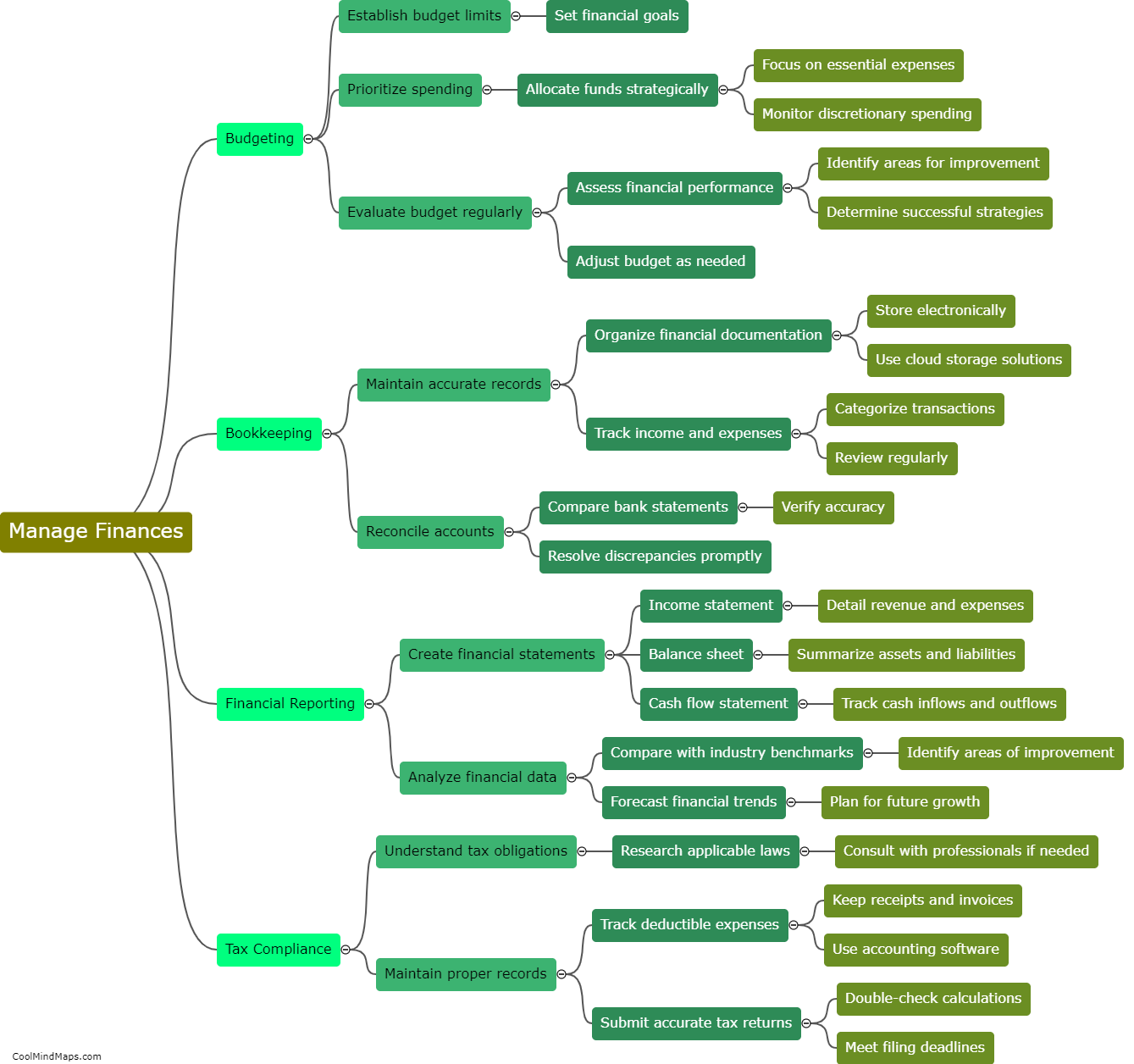

Digital businesses can effectively manage their finances by leveraging various tools and strategies. Firstly, implementing cloud-based accounting and financial management software allows for real-time tracking of income, expenses, and cash flow. This ensures accurate and up-to-date financial information, enabling proactive decision-making. Additionally, adopting automated invoicing and payment processing systems streamlines the financial operations and minimizes human errors. Digital businesses should also establish a budgeting framework, setting clear financial goals and regularly monitoring performance against these targets. Monitoring key performance indicators (KPIs) such as revenue, customer acquisition costs, and lifetime value helps in identifying areas of improvement and growth opportunities. Lastly, collaborating with financial professionals, such as accountants or financial advisors, brings expertise and guidance to optimize taxation, manage risks, and plan for long-term financial sustainability.

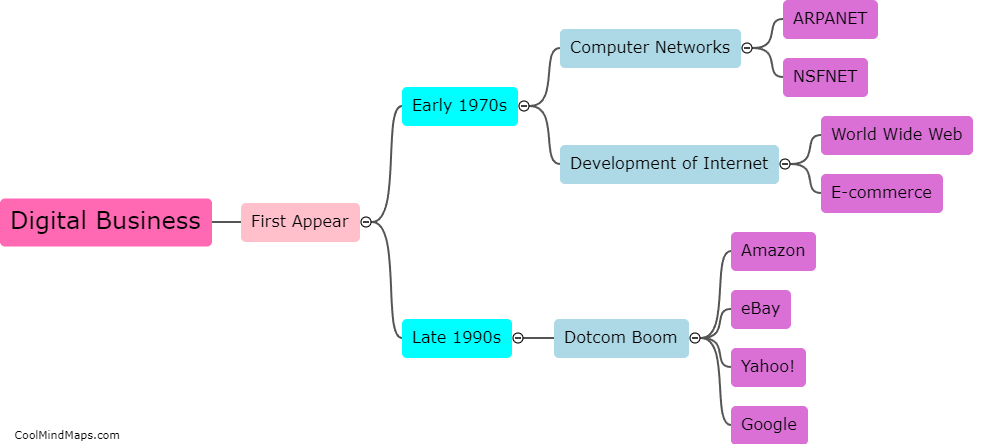

This mind map was published on 5 November 2023 and has been viewed 113 times.