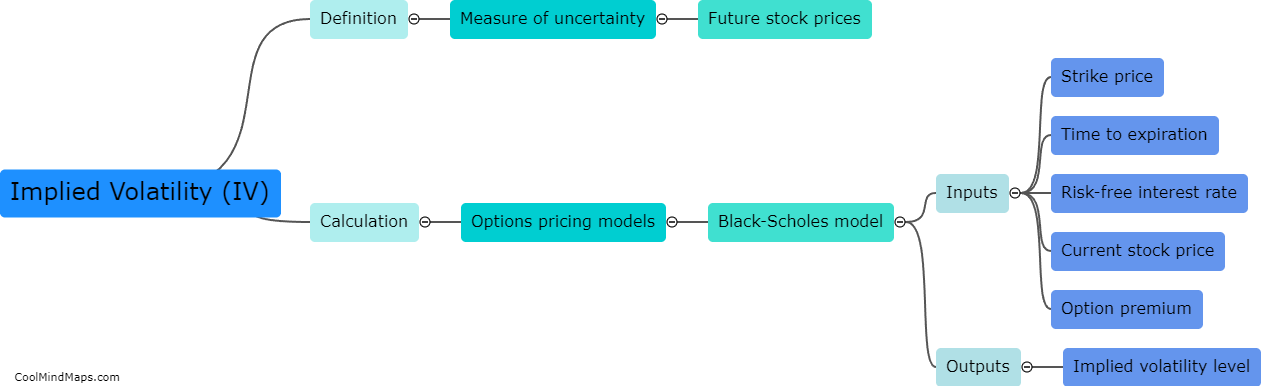

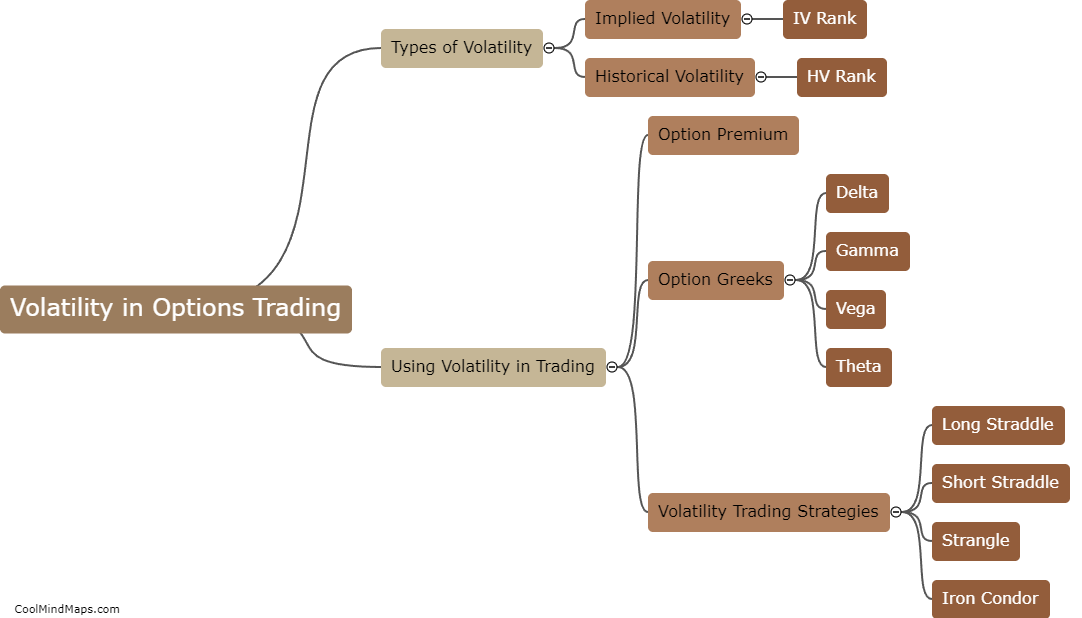

How to use Volatility in Options Trading?

Volatility is a crucial factor in options trading since it can significantly impact the price of an option. To use volatility effectively, traders need to analyze both historical and implied volatility measures. Historical volatility shows how much the underlying asset's price has fluctuated over a specific time period and can be used to estimate the potential range of future price movements. Implied volatility reflects the market's expectation of future price movements and can help traders identify attractive options trading opportunities. Options traders can use volatility to make informed decisions about buying or selling options, adjusting their positions, and managing risk.

This mind map was published on 28 May 2023 and has been viewed 88 times.