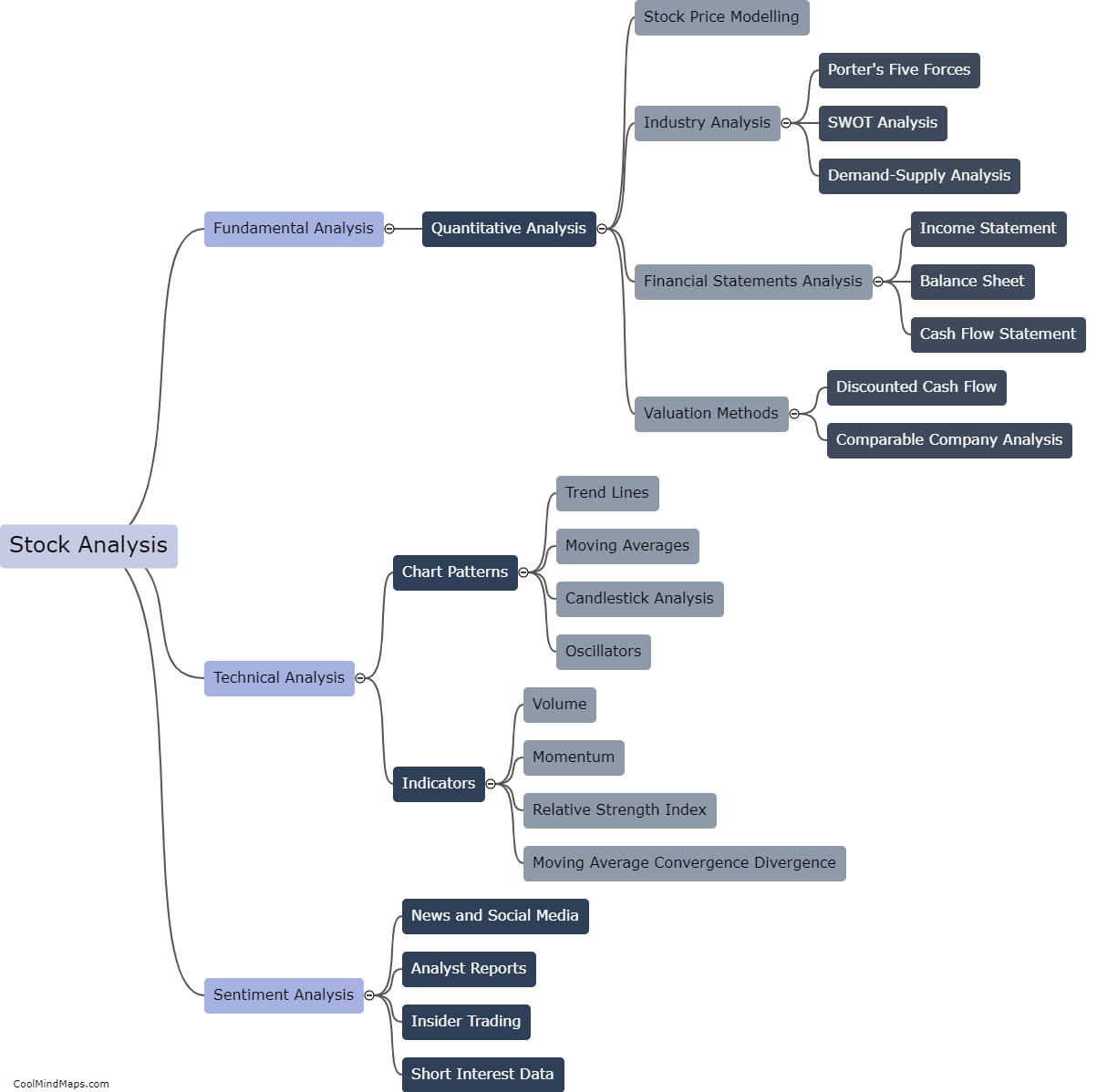

How can one analyze stocks for investment?

Analyzing stocks for investment requires careful research and consideration of various factors. First, investors should look at a company’s financial statements, including its balance sheet, income statement, and cash flow statement, to assess its financial health and profitability. Next, analysts should evaluate the market and industry performance of the company, considering factors such as competition, regulatory changes, and consumer trends. Additionally, investors should review a company’s management team, corporate governance, and overall business strategy to determine if it is likely to succeed in the long term. Finally, investors should consider the stock’s valuation, including its price-to-earnings ratio and other key financial metrics, to determine if it is undervalued or overvalued compared to its peers and the broader market. By taking a comprehensive and data-driven approach to stock analysis, investors can make informed decisions about which stocks to invest in for the long term.

This mind map was published on 18 May 2023 and has been viewed 112 times.