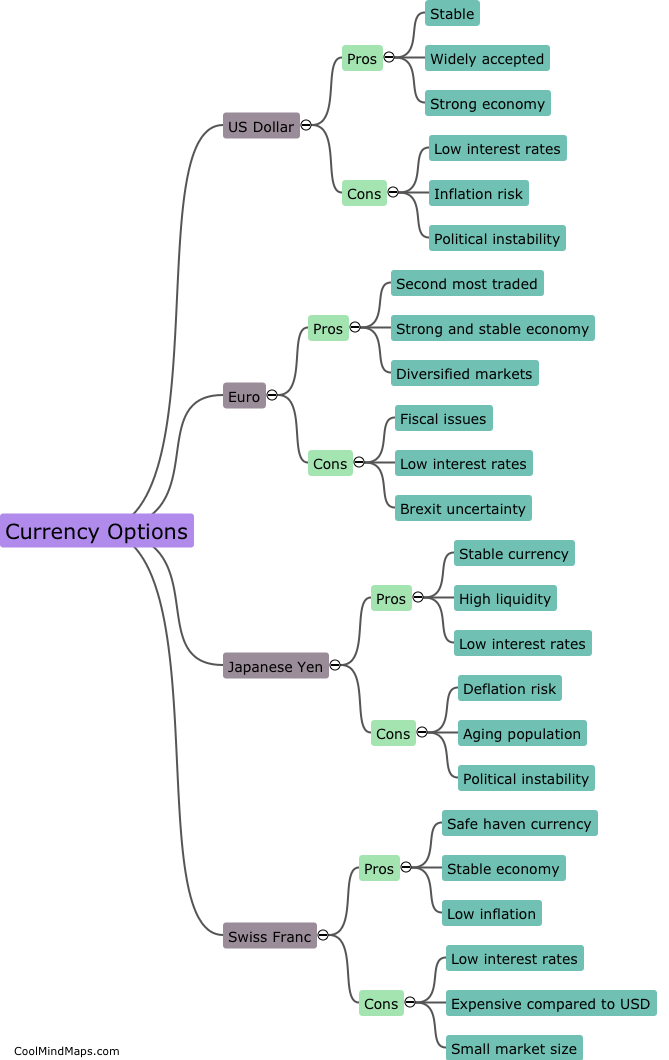

Comparison of different currencies for investment

When investing in different currencies, it's crucial to compare their performance in terms of stability, growth potential, and volatility. Currency prices fluctuate significantly based on economic and political events, which can affect the return on investment. It's also vital to consider the interest rates, inflation rates and overall economic health of the country before investing in a particular currency. One currency may have higher interest rates, which may offer a better return on investment than others with lower interest rates. Investors can use a range of metrics and analysis to evaluate the potential of different currencies and consider diversifying their portfolio across various currencies. Ultimately, the choice of the right currency for investment depends on the individual's risk tolerance and investment goals.

This mind map was published on 1 May 2023 and has been viewed 103 times.