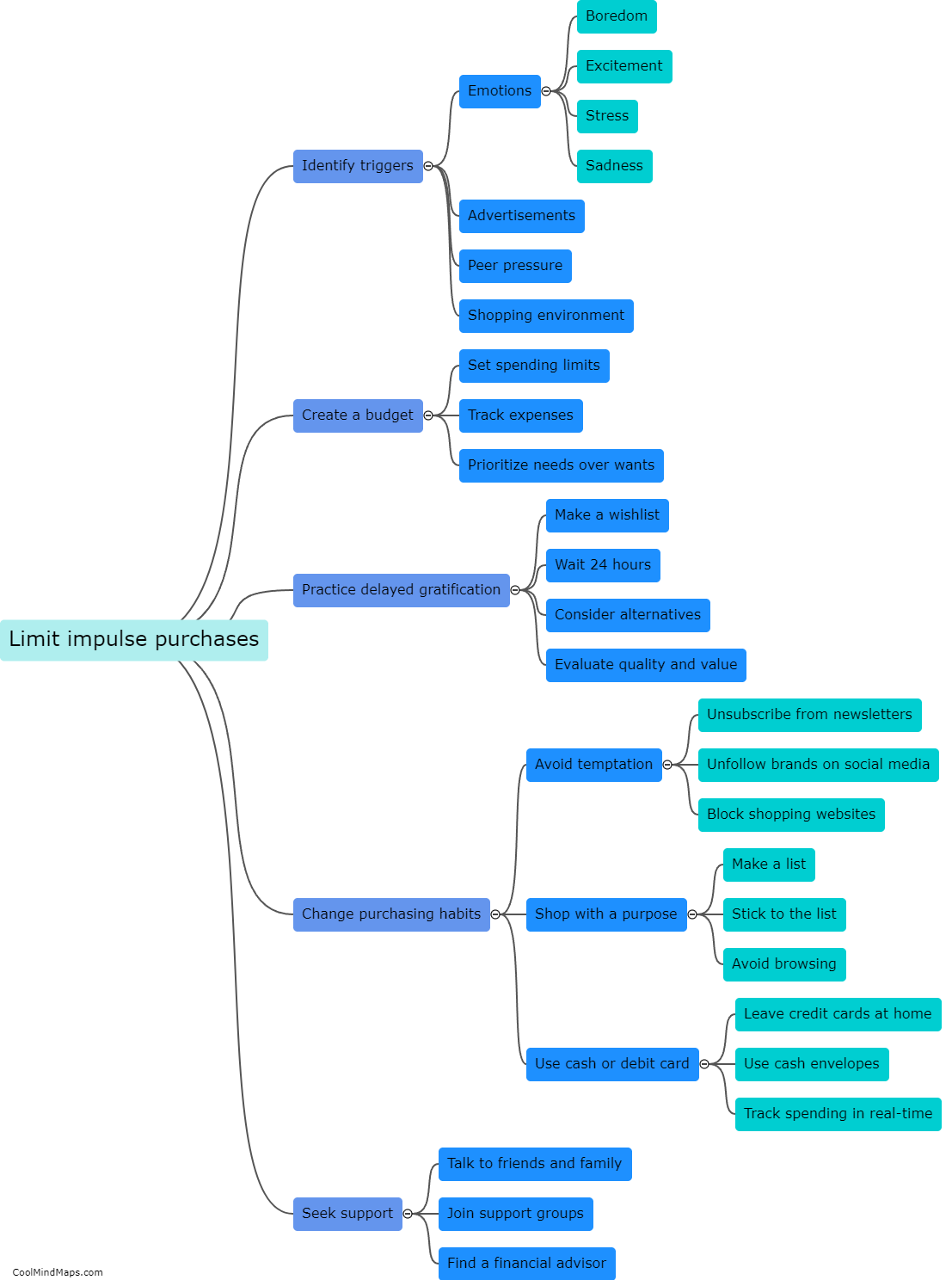

How to limit unnecessary impulse purchases?

Limiting unnecessary impulse purchases can be achieved by adopting several strategies. Firstly, creating a budget and sticking to it can prevent impulsive spending. By allocating a specific amount of money for non-essential items, individuals can have better control over their spending habits. Additionally, it can be helpful to avoid tempting situations. Unsubscribing from marketing emails, unfollowing tempting brands on social media, or even staying away from malls and shopping centers can reduce the exposure to impulsive triggers. Furthermore, taking time to consider the necessity and long-term value of a purchase can help differentiate between impulse buys and genuine needs. Waiting for at least 24 hours before making a purchase decision allows time for rational thinking and reflection. Lastly, self-discipline is key. Understanding personal triggers and finding alternative ways to cope with emotional or stress-related impulses can prevent impulsive spending. These strategies combined can help individuals take control of their spending habits and limit unnecessary impulse purchases.

This mind map was published on 29 November 2023 and has been viewed 97 times.