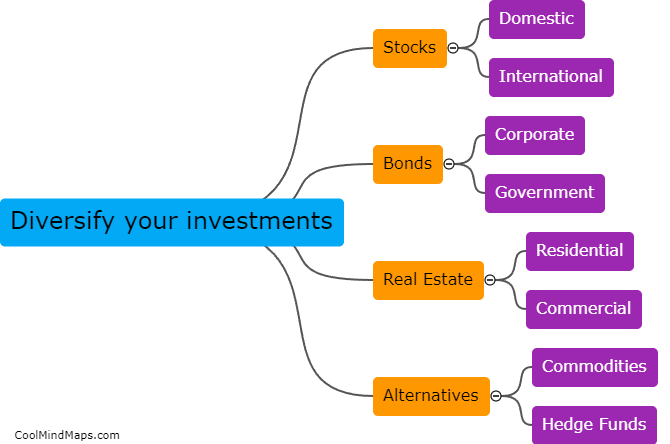

How do you diversify your investments?

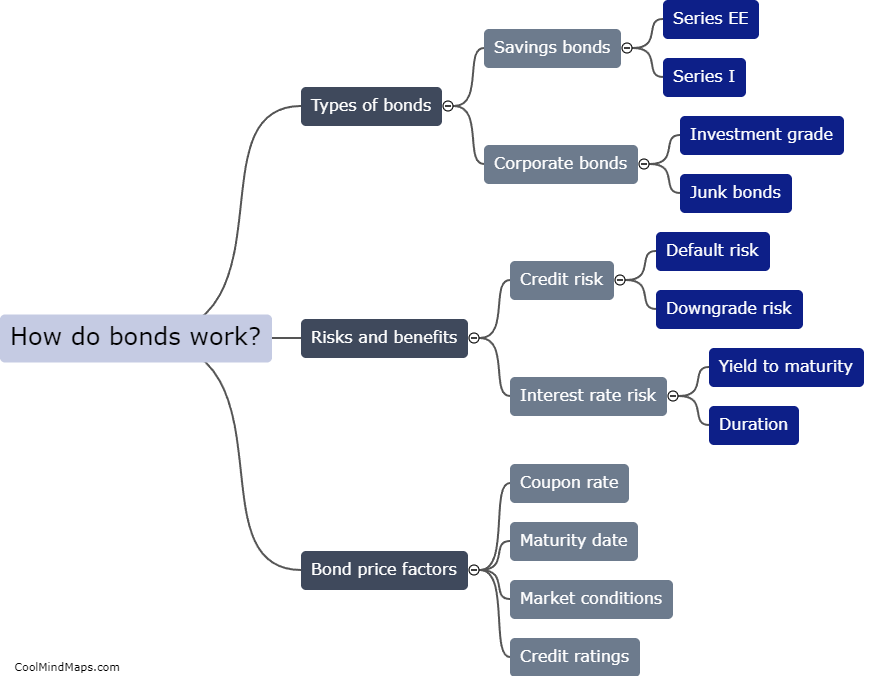

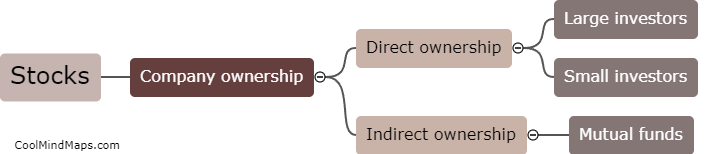

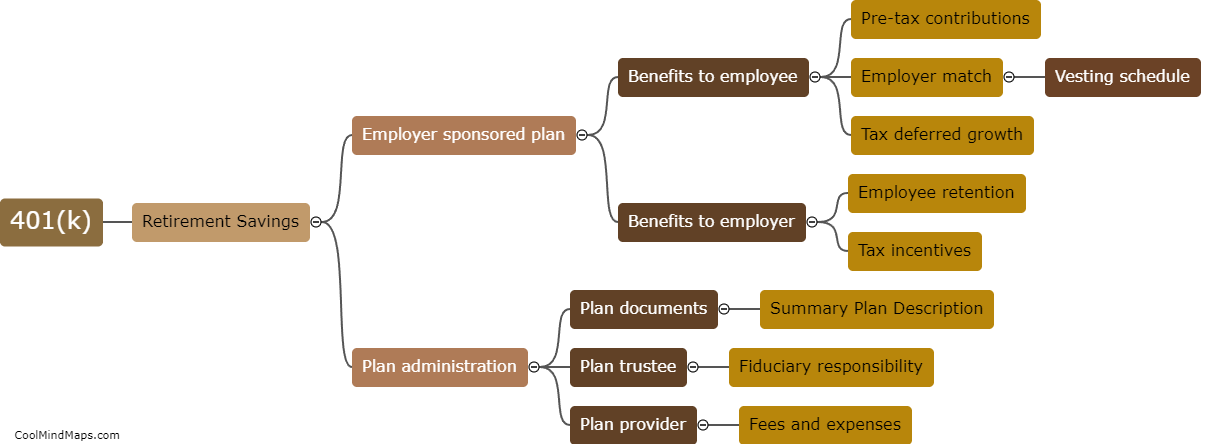

Diversifying your investments means spreading your money across different asset classes and investments, rather than putting all your eggs in one basket. This helps to reduce risk and increase potential returns. To diversify your investments, you can consider investing in stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate, commodities, and alternative investments such as hedge funds or private equity. It's important to research and select investments that align with your financial goals and risk tolerance. Regularly review your portfolio and make adjustments as necessary to maintain diversification and meet your financial objectives.

This mind map was published on 19 April 2023 and has been viewed 126 times.