How can start-ups in India make strategic financial decisions?

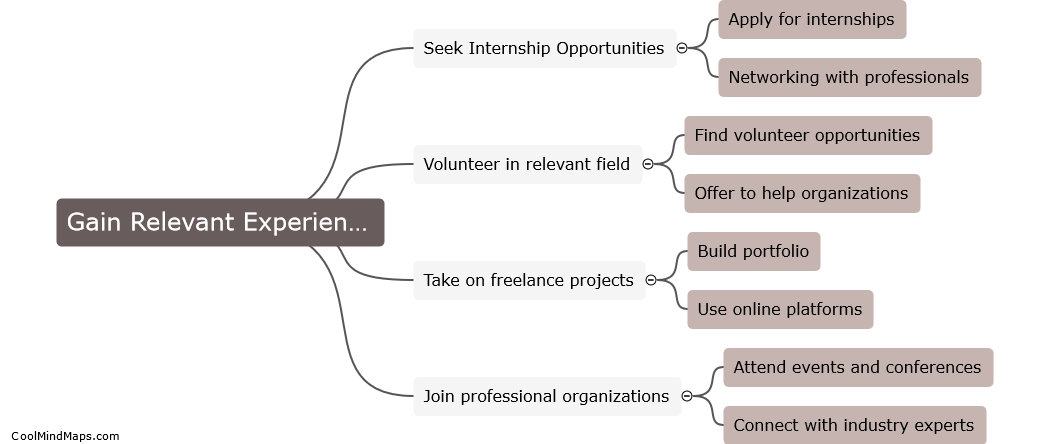

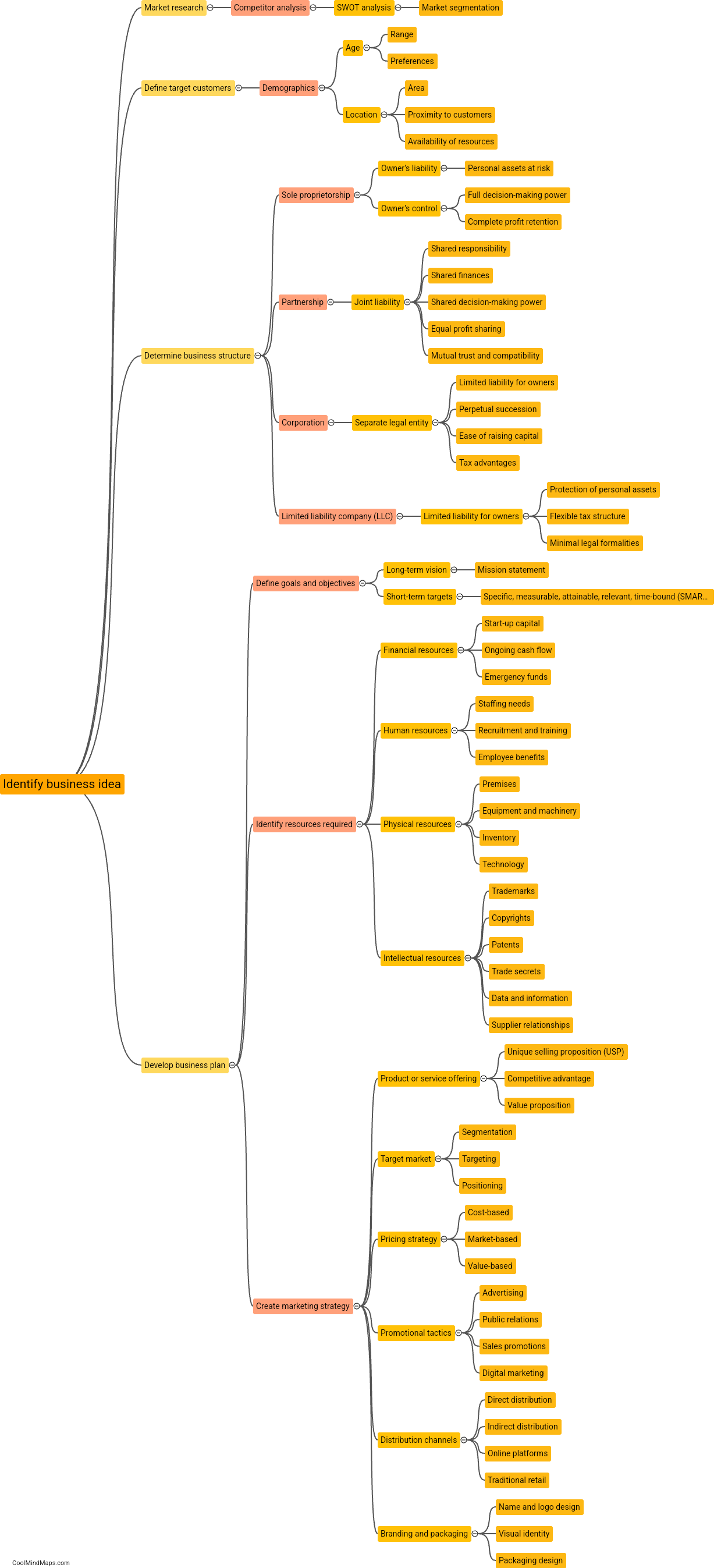

Start-ups in India can make strategic financial decisions by considering several key factors. Firstly, it is essential for start-ups to conduct thorough market research to assess the demand and competitive landscape of their industry. This knowledge allows them to identify potential revenue streams, pricing strategies, and growth opportunities. Secondly, start-ups should develop a comprehensive financial plan that outlines their budget, cash flow projections, and funding needs. This enables them to allocate their resources effectively and plan for any financial challenges they may face. Additionally, start-ups can explore various sources of funding such as venture capital, angel investors, or government schemes specifically designed for supporting start-ups. Finally, it is crucial for start-ups to establish strong financial management practices, including regularly monitoring financial performance, optimizing costs, and employing sound risk management strategies. By incorporating these strategies into their decision-making processes, start-ups in India can enhance their ability to thrive and succeed in the competitive business ecosystem.

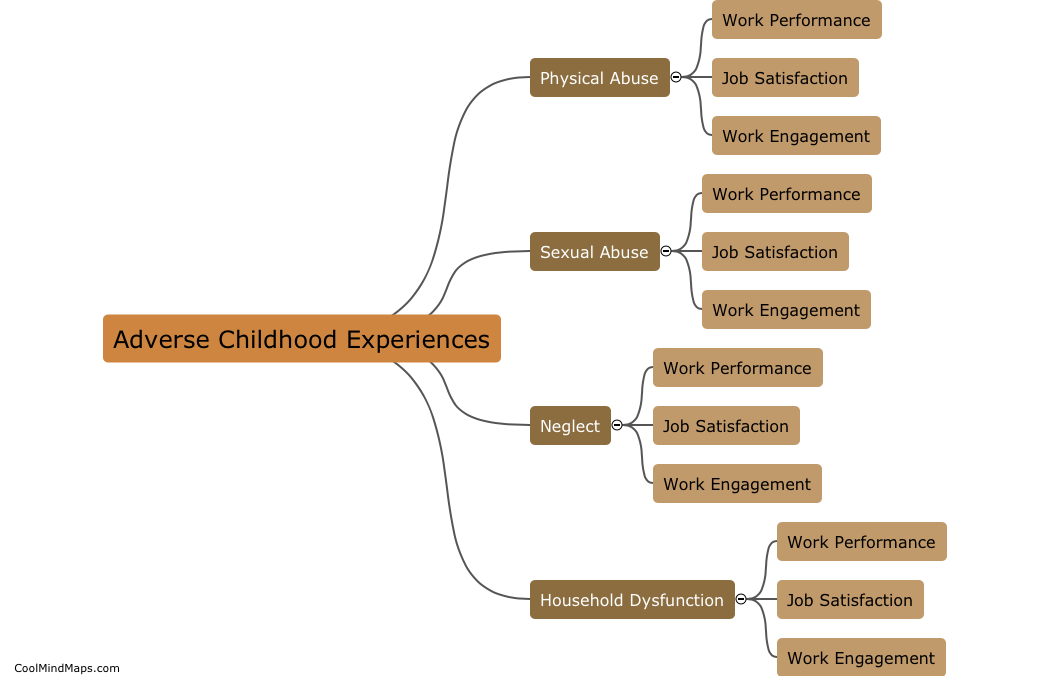

This mind map was published on 23 January 2024 and has been viewed 117 times.