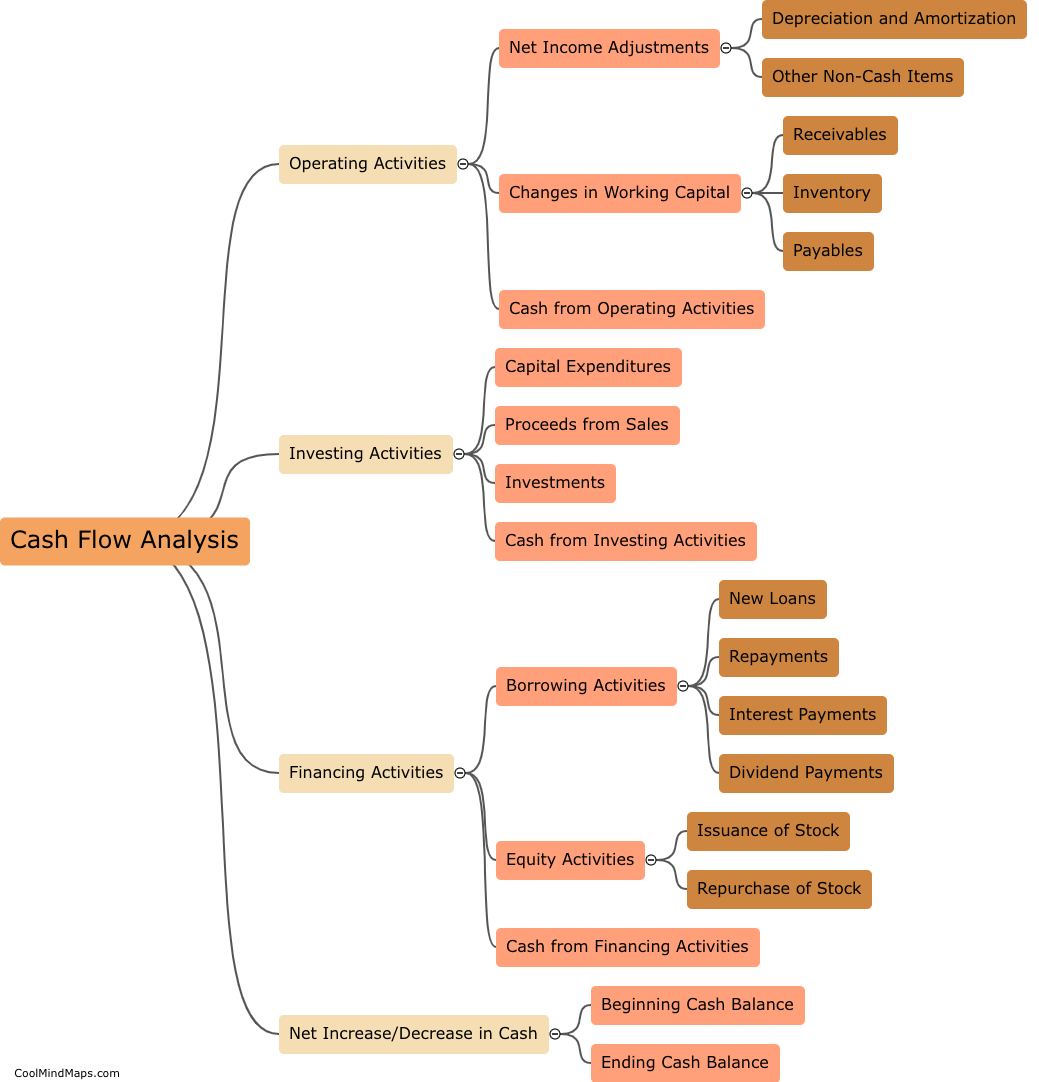

What are the different sections of a cash flow statement?

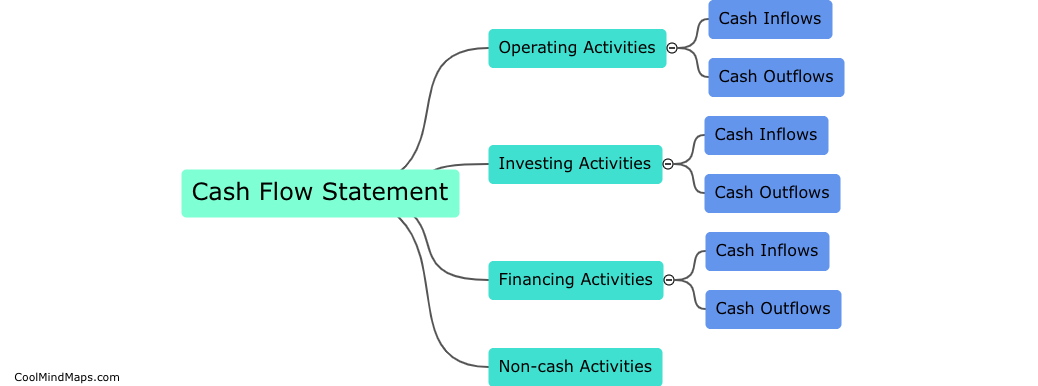

A cash flow statement is a financial statement that presents a company's cash inflows and outflows over a given period. It is typically divided into three main sections: operating activities, investing activities, and financing activities. The operating activities section includes cash inflows and outflows related to the core business operations of the company. The investing activities section details cash flows related to investments in long-term assets or divestitures of those assets. The financing activities section outlines cash flows related to financing the company's operations, such as issuing or repurchasing stock, borrowing or repaying debt, and paying dividends to shareholders. The overall purpose of a cash flow statement is to provide investors and analysts with a glimpse into a company's financial health by showing how much cash is generated or consumed in each of these areas during a given period.

This mind map was published on 24 April 2023 and has been viewed 102 times.