How do financial ratios affect the valuation of a stock?

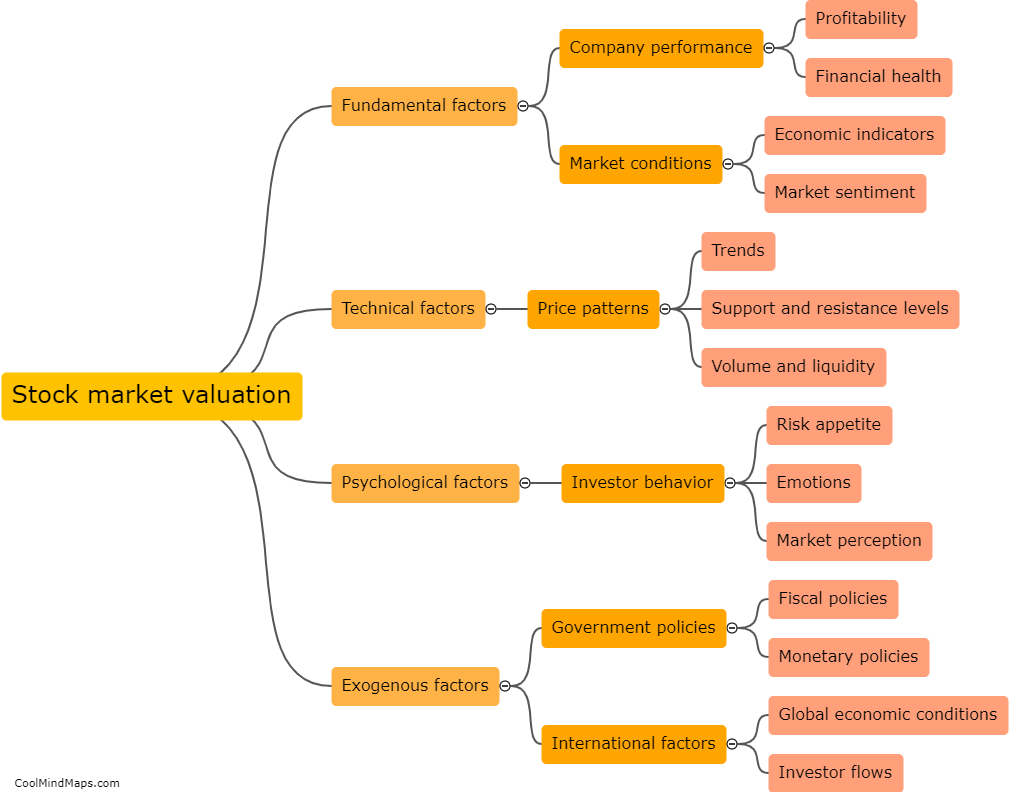

Financial ratios play a critical role in determining the valuation of a stock. These ratios provide valuable insights into a company's financial health and performance, allowing investors to assess its value and potential for future growth. Ratios such as price-to-earnings (P/E), price-to-sales (P/S), and price-to-book (P/B) are commonly used to compare a company's stock price to its financial metrics. Higher ratios indicate a positive outlook, as investors are willing to pay a higher price for each unit of earnings, sales, or book value. Conversely, lower ratios may suggest undervaluation, potentially attracting value-oriented investors. Thus, financial ratios act as a vital tool for investors in making decisions about buying or selling a stock, as they provide a snapshot of a company's financial performance and prospects.

This mind map was published on 11 February 2024 and has been viewed 94 times.