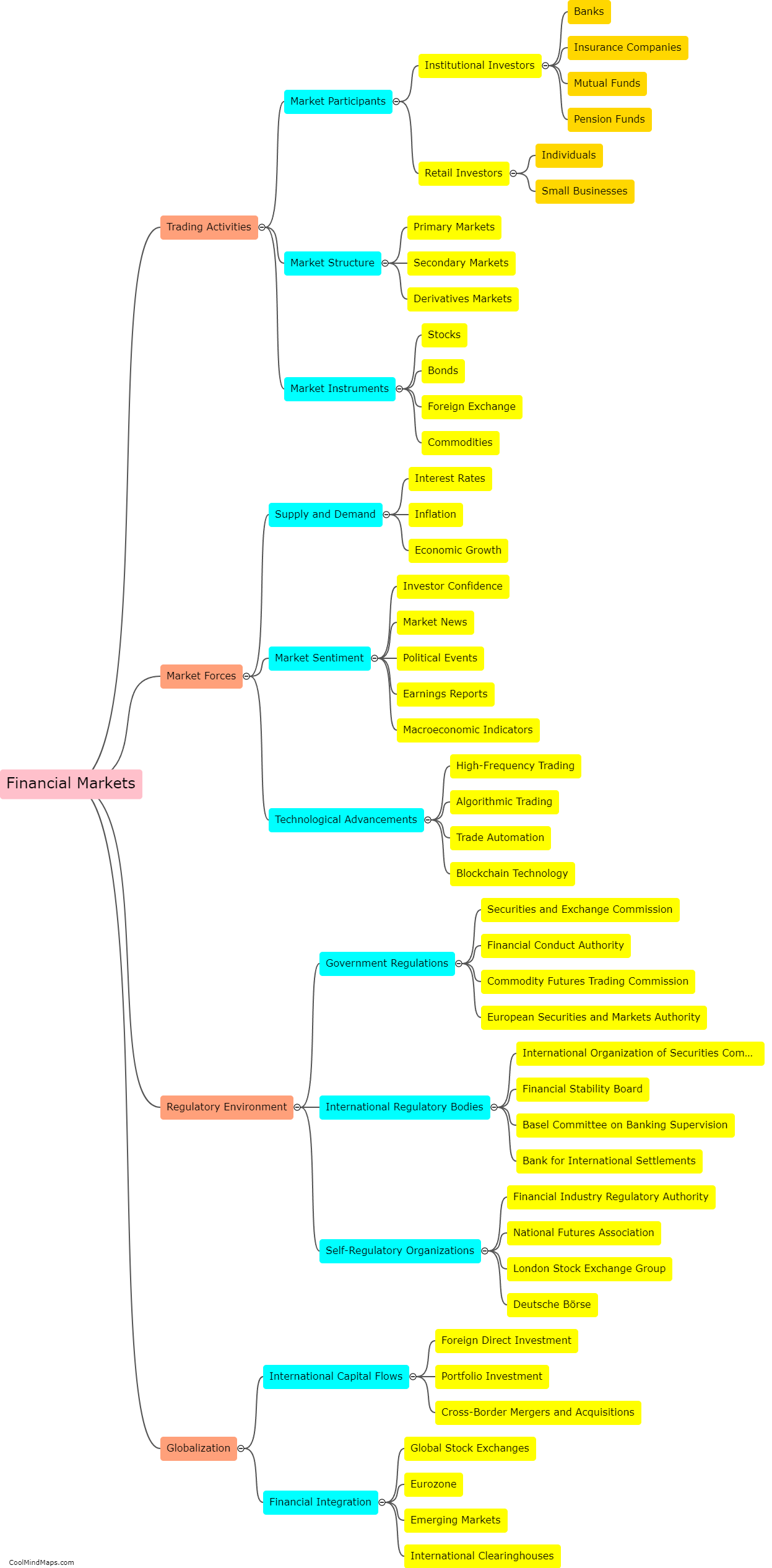

What are the implications of time-varying relationships for investors and traders?

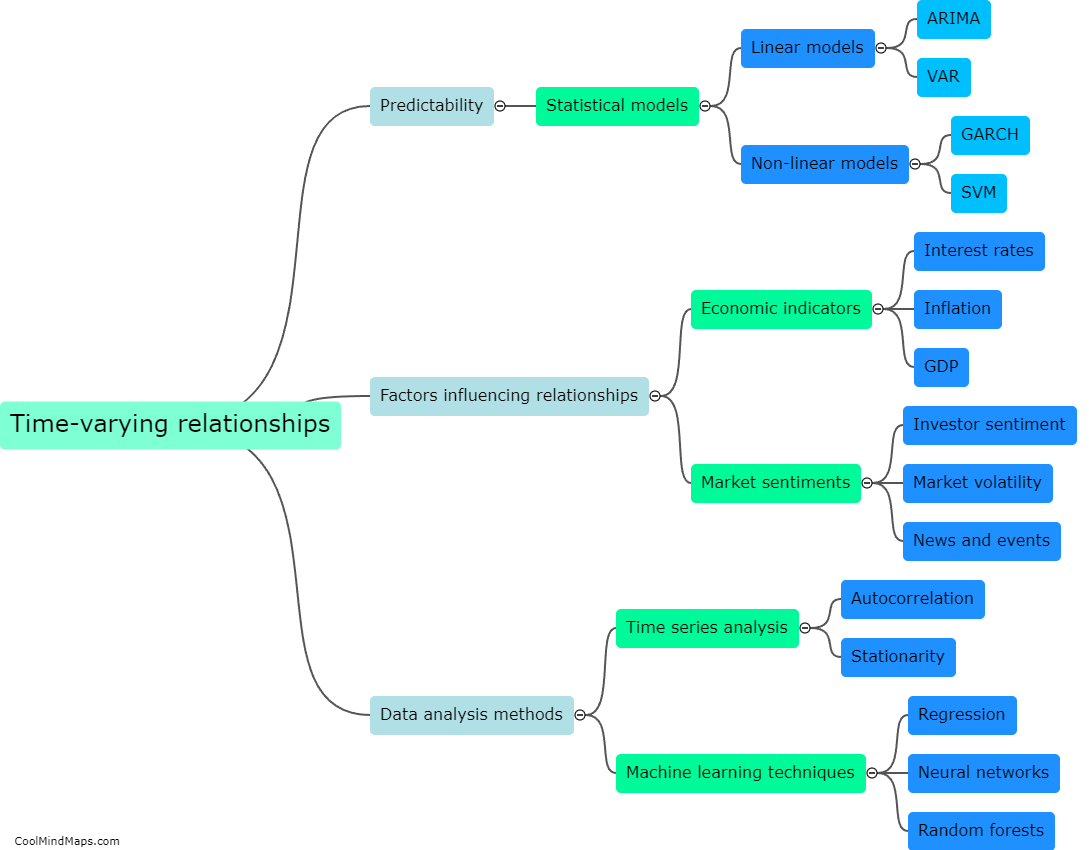

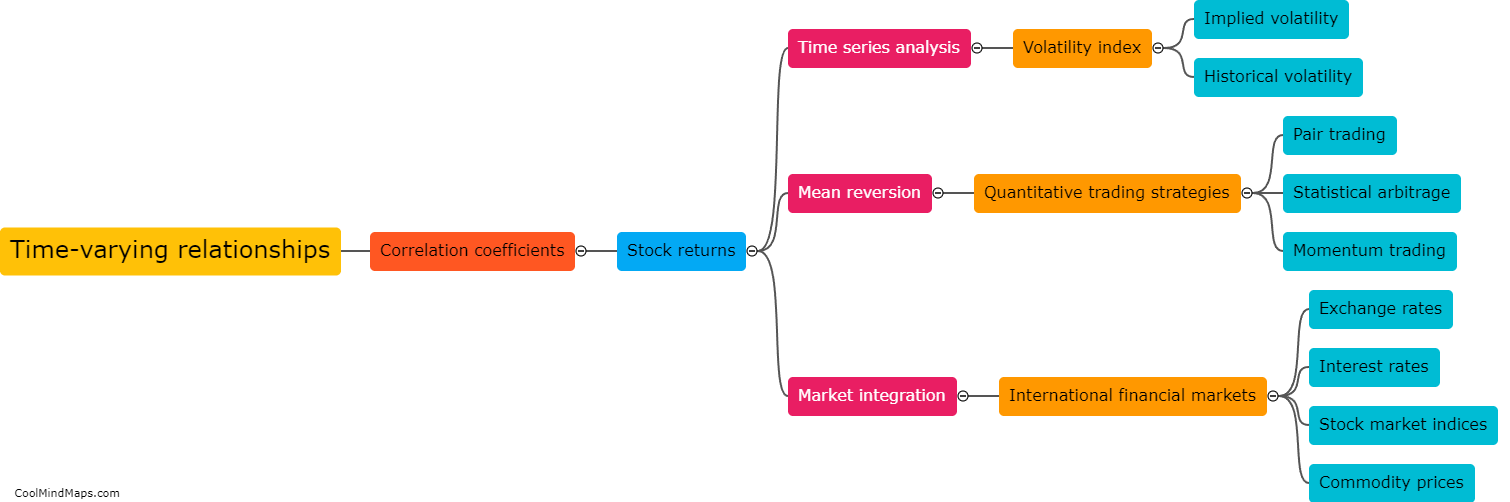

Time-varying relationships refer to the dynamic and changing nature of the relationships between different financial instruments or variables over time. These relationships can have significant implications for investors and traders. Firstly, it highlights the importance of recognizing and understanding the shifting correlations and dependencies among assets. This knowledge is crucial in building diversified portfolios and managing risk effectively. Moreover, time-varying relationships can provide opportunities for active traders to identify and capitalize on shifting market trends and anomalies. By continuously monitoring and adapting to changing relationships, investors and traders can enhance their decision-making process and potentially improve their returns. However, it also poses challenges as it requires constant analysis and adjustment strategies, making it essential for investors and traders to have access to timely, accurate, and reliable data and analytical tools.

This mind map was published on 22 December 2023 and has been viewed 100 times.